Options Market is Expectations for Nvidia Earnings

I don’t think I’m prone to hyperbole, but I must admit that this afternoon’s Nvidia (NVDA) earnings report is the most consequential that I can recall for quite some time.

To be frank, this stock has been truly spectacular. It is up over 50% since it reported in May, when its stellar guidance ratified and turbocharged investors’ enthusiasm for artificial intelligence (AI). While that fervor, like the overall market, has cooled somewhat, it remains a key driver of the mega-cap tech stocks that dominate our main equity indices. We got a reminder of this phenomenon on Monday, when NVDA rose nearly 8.5%. It is highly unusual to see a stock rally so dramatically just ahead of earnings, but NVDA is a highly unusual case.

NVDA is by no means a cheap stock, but by some measures it is not unreasonably expensive – as long as it meets the expectations that were ratcheted drastically higher last quarter. It has an eye-watering trailing P/E of 226, but its forward P/E of 57, which is still quite robust, implies earnings growth of nearly 4x in the coming year. That gives the stock a PEG ratio of 1.1, which is hardly outlandish – again, only if it meets the lofty expectations.

For this quarter, EPS is expected to nearly quadruple to $2.07 from last year’s $0.52, which revenues are expected to nearly double at $11.04 billion vs $6.70 billiion. Data center revenues, which are perceived to be the key beneficiary of corporate AI spending, are expected at $7.98 billion, more than double last year’s $3.81 billion.

The heady combination of high expectations and stellar recent performance raises the stakes for today’s report, both for NVDA itself, but also for the numerous stocks that have followed NVDA’s lead in embracing AI. Remember, NVDA took investors on a wild ride not that long-ago when it was a key beneficiary of cryptocurrency enthusiasm. Bear in mind that computer scientists and others have been working on artificial intelligence for years, if not decades. The emergence of ChatGPT brought AI into the mainstream, but the challenge remains as to whether the current wave of corporate adoption is persistent or somewhat faddish.

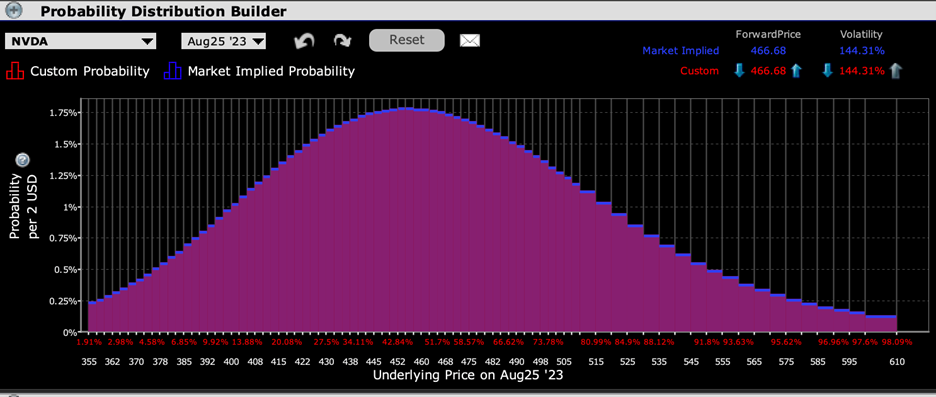

Regarding the options market’s views, we can start with the IBKR Probability Lab. With the stock trading around $467, the peak probability expressed by options expiring on Friday is in the $460 region. That is not particularly surprising, considering those were at-money options just yesterday:

IBKR Probability Lab for NVDA Options Expiring August 25th

Source: Interactive Brokers

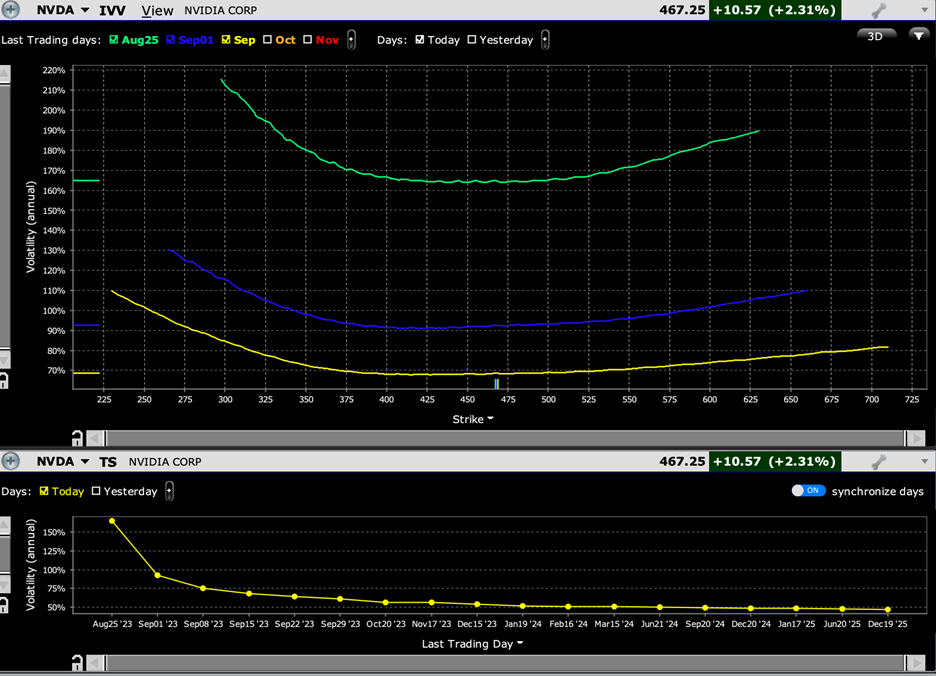

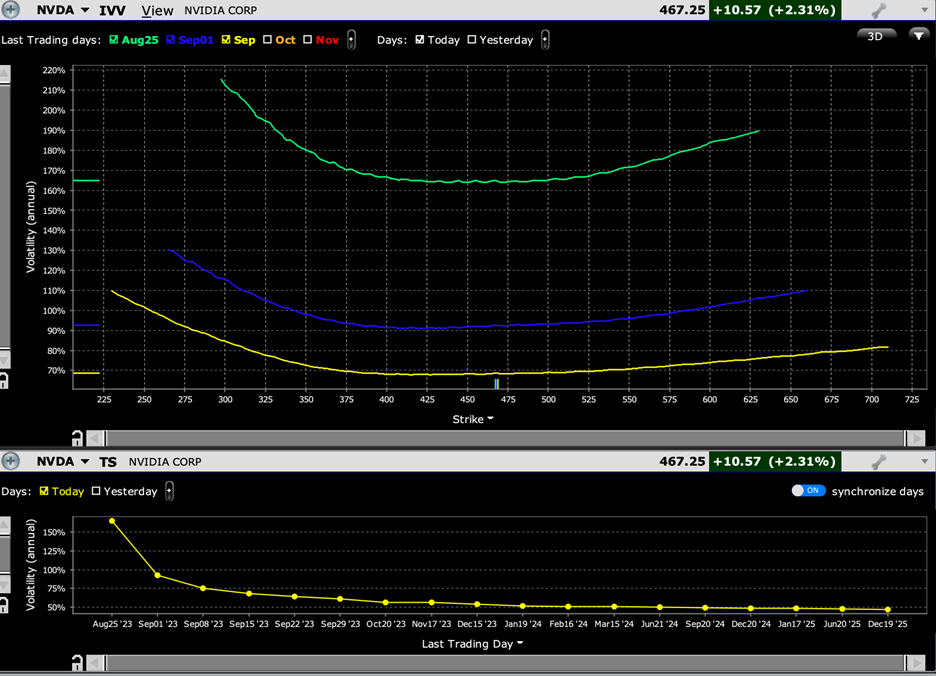

When we look at skews, via the IBKR Implied Volatility Viewer, and the term structure of volatility, we see that options are pricing in a roughly 10% daily move for the rest of the week, and that skews are very flat in throughout a wide range of outcomes, from about $400 through $525.

NVDA – Implied Volatility Viewer for Options Expiring August 25th (green, top graph), September 1st (blue, top), September 15th (yellow, top); Term Structure of Implied Volatility (yellow, bottom)

Source: Interactive Brokers

Considering that the past two post-earnings moves for NVDA have been +24% and +14%, a 10% move seems rather tame. But the question for later today and tomorrow is whether the already lofty expectations are correct. After the recent upswings it seems as though investors expect some incremental boost beyond the already stellar guidance offered by the company. Quite frankly, will a reaffirmation of guidance, or simply meeting the expectations listed above, be enough for investors enamored with the promise of AI riches. We’ll find out soon enough.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Hi, how did you use IBKR Implied Volatility Viewer, and the term structure of volatility and determine the 10% expected move?

Hello Shaheen, thank you for your question. Please review our user guide page on the Implied Volatility Viewer for more insight: https://www.ibkrguides.com/tws/impviewertop.htm

Very insightful. Would you please point to the PD and other tools mentioned on the IBKR site?

Hello Shailendra, thank you for commenting. You can find our tools by searching our website or user guide: https://www.ibkrguides.com/tws/home.htm. For instance, here is more information about the Implied Volatility Viewer: https://www.ibkrguides.com/tws/impviewertop.htm and Probability Lab: https://www.ibkrguides.com/tws/usersguidebook/mosaic/probabilitylab.htm