In a recent study, we conducted an in-depth analysis of option straddles in S&P 500 stocks, uncovering a remarkable performer over the past 12 weeks—Procter & Gamble (PG). In this blog post, we’ll share the fascinating insights gleaned from this study and explore how these findings can empower you to make informed trading decisions.

Analyzing the Data:

Our study involved examining the performance of option straddles placed on Mondays at 10 am, with daily delta hedging at the end of each trading day. We evaluated the performance based on the closing prices on Fridays, providing a comprehensive snapshot of the weekly gains. The study was performed on S&P 500 stocks.

Option Straddle Performance- Delta Hedging

Consistency in Profits:

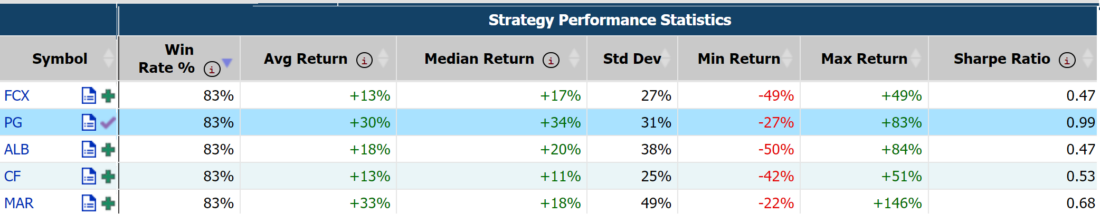

Among the various S&P 500 stocks, we identified five top straddle performers that showcased remarkable consistency in profitability, boasting an impressive 83% win rate over the last 12 weeks. Procter & Gamble emerged as the star performer within this elite group.

Impressive Returns:

Over the 12-week period, Procter & Gamble demonstrated exceptional returns, averaging an impressive 30% gain per week. The median return for PG stood at +34%, highlighting the consistent profitability of the selected option straddle strategy.

Exploring the Range of Returns:

In addition to analyzing the average returns, we also compared the best and worst returns recorded by Procter & Gamble over the 12-week timeframe. The results revealed a remarkable best return of 83%, showcasing the potential for significant gains. However, it’s essential to acknowledge that even successful strategies can experience downturns, as evidenced by the worst return of -27% for PG during this period.

Reward-Risk Ratio:

Assessing the risk-reward profile of Procter & Gamble’s option straddle strategy, we examined the ratio of average returns to standard deviations. The data indicated that PG exhibited a compelling reward-risk ratio, approaching a value of 1. This finding suggests that the strategy generated attractive returns while maintaining relatively low levels of volatility.

Implied Volatility and Gamma Trading:

Furthermore, our analysis revealed that Procter & Gamble’s implied volatility tended to be priced relatively low, making it an intriguing candidate for delta-neutral gamma trading strategies. While past performance does not guarantee future results, these findings provide valuable insights and raise intriguing possibilities for traders seeking potential opportunities in the market.

Conclusion:

The Market Chameleon tool has allowed us to screen and conduct a comprehensive analysis of option straddle performance, with Procter & Gamble emerging as the top performer in S&P 500 stocks over the past 12 weeks. Its high success rate, impressive average returns, favorable reward-risk ratio, and suitability for delta-neutral gamma trading strategies make it an intriguing stock to watch. Remember, trading always carries inherent risks, and it’s crucial to exercise caution and conduct thorough research before making any investment decisions.

—

Originally Posted July 12, 2023 – Options Straddles Strategies: Analyzing the Top Performer in S&P 500 Stocks

Disclaimer: The information provided in this blog post is based on historical data and does not guarantee future performance. Options trading involves risks, and individuals should consult with a financial advisor before engaging in such activities.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Thanks for the great information!!!

You’re welcome, William! Thank you for reading Traders’ Insight.