AT A GLANCE

- In October, more than 270,000 equity options contracts traded per day outside of U.S. hours at CME Group

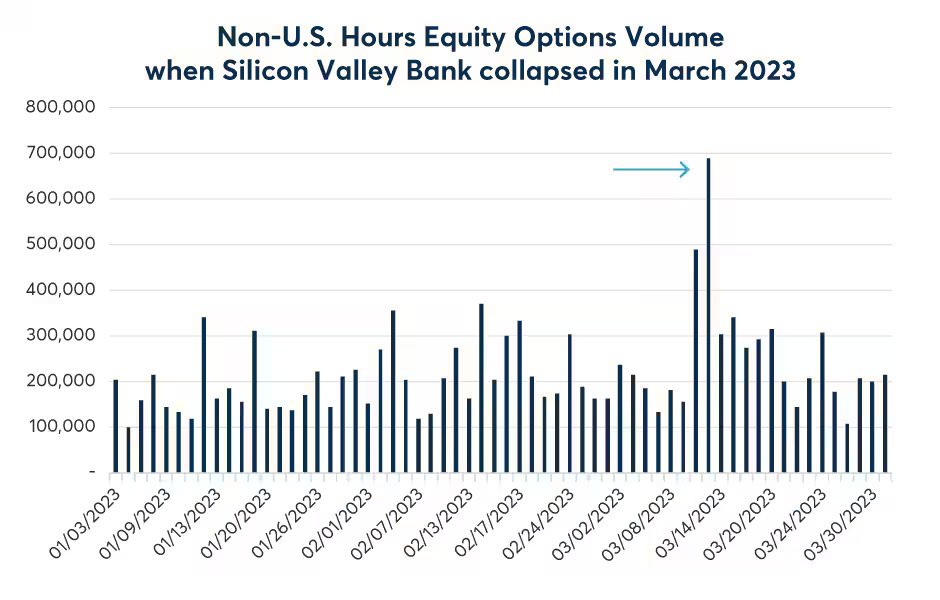

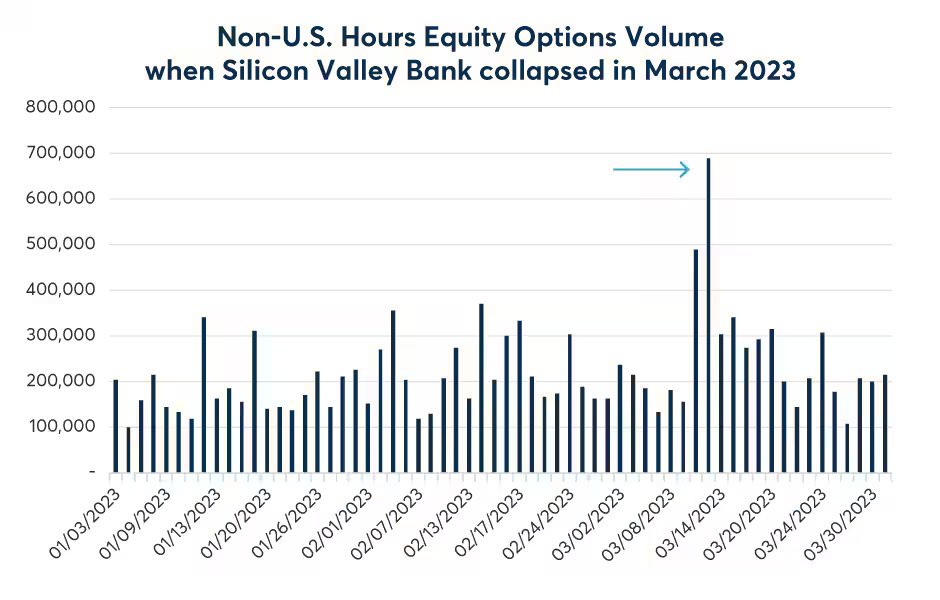

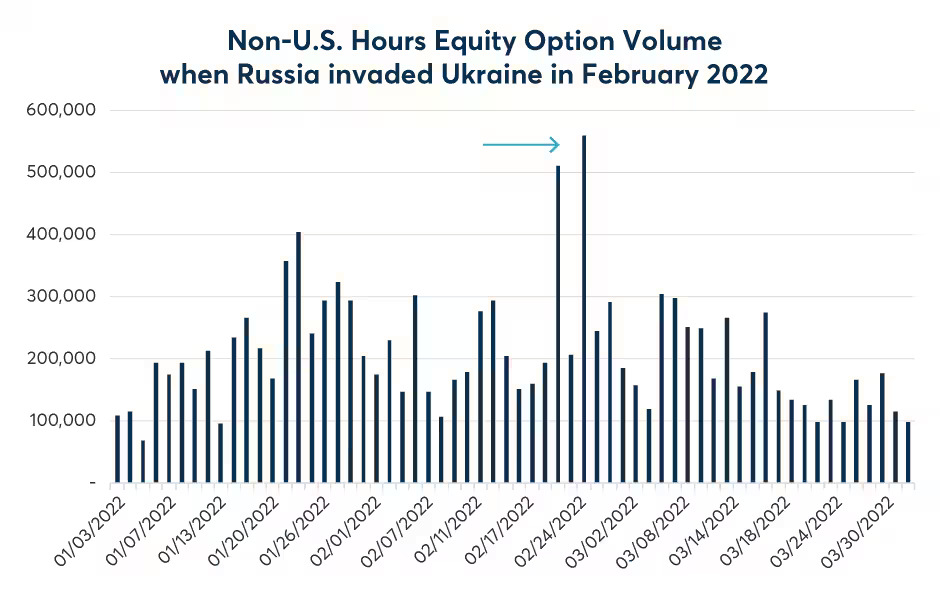

- Trading volumes in equity options spiked during non-U.S. hours after the retail banking crisis and Russia’s invasion of Ukraine

Since the pandemic, investors have gone through a variety of unprecedented market moving events. Geopolitical turmoil, banking industry crisis, constant recession fears amidst high inflation and the Fed tightening cycle have all underscored the value of risk management in an era of uncertainty.

Hedging in real time and accessing a sufficient liquidity pool when it is needed have become more important than ever. CME Group offers deep liquidity across both E-mini equity index options and E-mini futures outside of traditional U.S. cash market hours, to help investors around the world respond to the market-moving events and news in their own time zones.

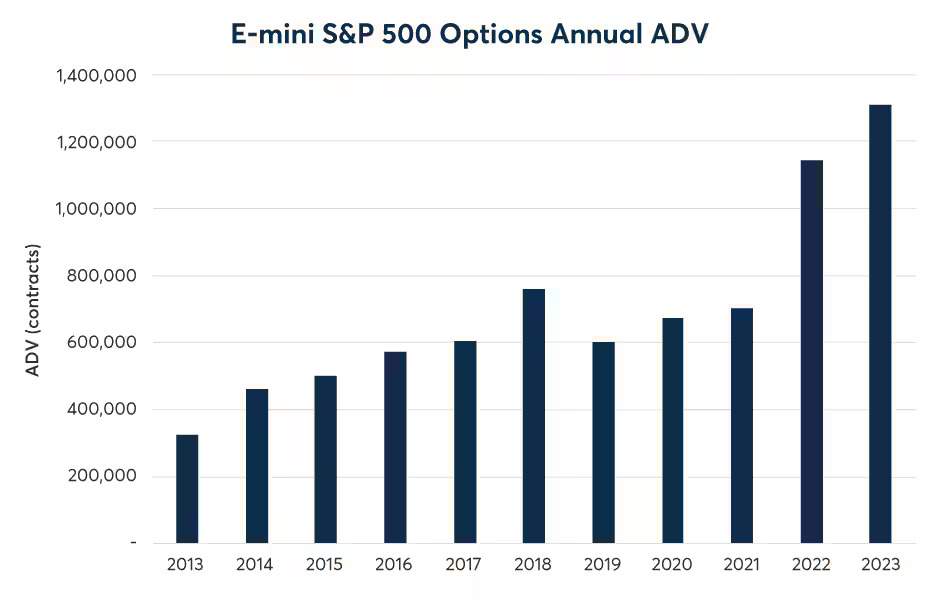

Source:CME Group

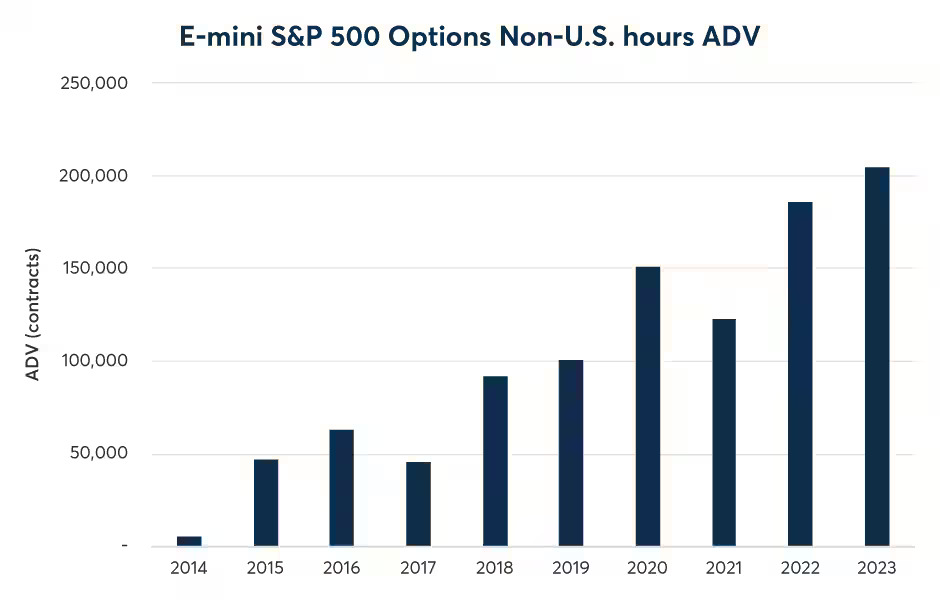

Source:CME Group

Actionable Liquidity Around the Clock

In many cases, investors in Asia and Europe have worldwide allocations of their assets. The substantial liquidity pool of U.S. equity index products in their time zones allows market participants to effectively manage unexpected market risk. For investors based in the U.S., having significant liquidity outside of cash hours provides an ability to hedge any overnight risk or take advantage of new opportunities when news breaks.

For example, during the retail banking crisis in March, more than 686,000 E-mini S&P 500 options contracts were traded in non-U.S. trading hours (5 pm – 8 am central time) at CME Group as markets reacted to the news around Silicon Valley Bank and the emergency measures announced by U.S regulators overnight. Similarly, on the night that Russia invaded Ukraine in February 2022, nearly 560,000 E-mini S&P 500 options contracts traded before the U.S. cash equity market opened.

Source:CME Group

Source:CME Group

E-mini S&P 500 options average daily volume (ADV) during non-U.S. hours has grown more than 300% since 2017. The liquidity pool spanning from zero-day options out to five years on the curve does not disappear after the U.S. market close, and this continuity makes CME Group a unique place to trade listed S&P 500 options.

Buy-Side Use Cases

A fine grid of options expirations provides flexibility to structure trades to fit the need as required. This becomes more attractive when there is sufficient liquidity across the curve and round the clock.

Non-U.S. hours volume at CME Group has significantly grown in recent years tracking approximately 16-18% of total volume. Below are four use cases of how some buy-side market participants could employ static or dynamic hedging strategies using E-mini S&P 500 options in their time zones.

1. Rebalancing Portfolios

Portfolio managers in Europe and Asia often have a conditional rebalancing mandate for their global asset allocation, typically between equity and fixed income investments. If the ratio between the two departs from their desired mix, the managers will have to restore the ratio through rebalancing which can be tactically achieved by using E-mini S&P 500 options for the U.S. equity component. For instance, they may consider to write strangles – selling call options at higher strike and selling put options at lower strike that have the same expiration – at any time of the day, either through Request for Quote (RFQ) or a bilaterally negotiated block at CME Group to minimize any slippage risk.

2. Minimum Distribution Guarantees

Some pensions in Europe and Asia have a minimum distribution guarantee in their products. If this includes U.S. equities, they can run a dynamic hedging program with a tail risk overlay using E-mini S&P 500 options. They may also choose to execute a complex series of puts and calls, and execute any required delta hedging whenever the market moves, all of which can be easily accomplished by CME Group’s near 24-hour liquidity offering.

3. Guaranteed Schemes

Insurance companies can also consider using options to manage a guaranteed scheme embedded in their products such as a variable annuity. They can layer in options at any time of the day, rather than hedging with a linear product which only manages the delta.

4. Structured Products

The strong non-U.S. hours liquidity plays a vital role to the large structured product market in Asia and in Europe, such as auto-callable notes. These notes typically help investors receive high yield if the underlying indices are above the coupon strike on any observation date, usually every 6 months, or receive the principal if the note is knocked out early or at maturity so long as the underlying indices have never touched the knock-in barrier.

They are highly popular in Japan (Uridashi) and Korea (ELS) providing an opportunity to retail and institutional investors to receive a high yield. The S&P 500 index is one of the major indices often employed in the note construction, alongside local benchmark equity indices such as Nikkei225 and KOSPI200. E-mini S&P 500 options are responding to the issuers’ needs with an unmatched liquidity pool, when the issuers seek to hedge their positions using the corresponding futures and options in their time zone.

In today’s complex, highly uncertain yet interconnected global markets, the ability to manage risk in real time has become critically important. E-mini S&P 500 options, can help investors to tailor their investment strategies and effectively manage risk regardless of time zone.

Read the full report on S&P 500 options trading outside U.S. hours.

—

Originally Posted December 8, 2023 – Options Trading Grows During Non-U.S. Hours

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.