In this article, our focus zeroes in on a specific case study: the 1-month at-the-money (ATM) call option linked to Tesla (TSLA), a company that’s been a magnet for market enthusiasts. Rewinding the clock to 2017, we’re on a mission to uncover a simple yet pivotal question – how profitable was this call option historically? By scrutinizing its performance over a 25-day trading period leading to expiration, we’re aiming to not only quantify the profitability but also decipher how frequently and significantly it rewarded traders. Through a systematic examination of three different methods, we’re seeking to demystify whether past performance can illuminate a pathway to option strategies.

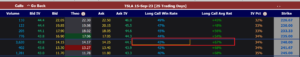

To conduct the historical backtest on the ATM option, we initially chose the ATM option with a 1-month expiration from the option chain. Subsequently, we performed a historical backtest on this option, generating performance statistics by comparing it with similar options from the past.

TSLA Option Chain Backtest Analysis

Methodology and Historical Perspective

Looking back to 2017, we examined the performance of a 1-month ATM call option on TSLA over a 25-day trading period until expiration using the below 3 different methods of trading.

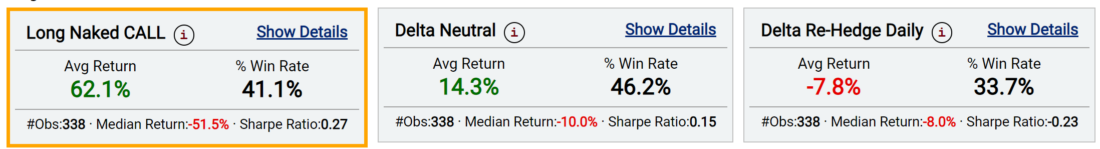

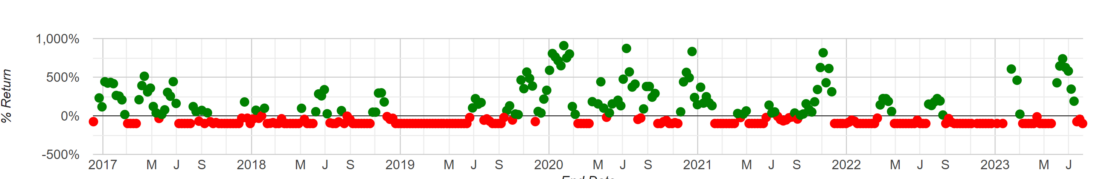

Method 1: Buy and Hold

The initial method involved buying the ATM call and holding it until expiration. The results were striking: while the option was profitable in just 41.1% of cases by expiration, the average return was a staggering 62.1%. This outcome might seem paradoxical at first glance, as the maximum loss on a call option is theoretically 100%. However, the analysis revealed instances where the call option yielded returns of over 500%, significantly elevating the average return.

Method 2: Initial Delta Hedging

In the second approach, the initial delta of the call was hedged, and the position was held until expiration. This method demonstrated a slightly higher win frequency of 46.2%, but the average return dipped to +14.3%. This intriguing finding implies that despite an increase in the frequency of wins, simply holding the call without mitigating the directional risk often yielded more substantial returns.

Method 3: Delta Neutral Hedging

The final method centered around delta-neutral hedging, which involved adjusting the hedge at the end of each trading day to trade the daily volatility of the stock. Surprisingly, this approach displayed the lowest win rate at 33.7%, and an average loss of -7.8%. The results suggest that the option’s implied volatility tended to overestimate the actual daily volatility of the underlying stock.

Conclusion and Insights

The performance of the ATM call option strategy on TSLA revealed a nuanced picture, with outcomes highly dependent on the chosen method. Historically, merely buying the call and waiting yielded higher returns. The substantial gains in percentage terms balanced out the more frequent losses, resulting in noteworthy average profits.

This study underscores the importance of understanding the nuances of different trading strategies. The dynamic interplay between implied and actual volatility, as well as the implications of hedging, unveils valuable insights that traders can leverage to make informed decisions. As the market continues to evolve, historical analyses like these shed light on the potential outcomes of various approaches, empowering traders with the knowledge they need to navigate the complex world of options trading.

—

Originally Posted August 11, 2023 – Profitability Analysis of TSLA’s 1-Month At-the-Money Call Option

Disclaimer: The information presented in this article is intended for educational and informational purposes only. It does not constitute financial advice, trading recommendations, or investment strategies. The analysis and findings are based on historical data and past performance, which may not necessarily predict future outcomes. Trading and investing in financial markets involve inherent risks, and individuals should conduct thorough research, seek professional guidance, and consider their risk tolerance before making any trading or investment decisions. The author and the platform assume no responsibility for any financial losses or decisions made based on the content of this article.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.