Options are known for their versatility. This is partly due to options contracts’ varying durations, or time to expiration (aka tenors).

An investor looking to express an opinion about an underlying’s future performance can trade options that expire years in the future — SPX® options, for example, have expirations going out to 2028. Investors can also trade options that expire days from when the trade is implemented or, as a growing number of investors and traders have been doing lately, on the same day (depending on the underlying).

Same day options trading, colloquially known as zero days to expiration or “0DTE,” has grown in the past year, but it is hardly a new phenomenon. After all, any option, at some point in its lifetime, will offer the opportunity to trade on its day of expiration.

How Did We Get Here?

Back in 1973, a small upstart exchange listed (call) options on just 16 stocks. (It was us!) In the good ol’ days, expirations were quarterly but as the market for options grew, monthly expirations were added — that meant there were still only a small number of days out of the year when same-day trading was possible.

Let’s fast forward a few decades and focus on SPX options. In 2005, Cboe® introduced a.m.-settled SPX Weeklys options with Friday expirations to broaden the landscape of how traders and investors could manage risk. Today, many large-cap equities and major ETFs have weekly options.

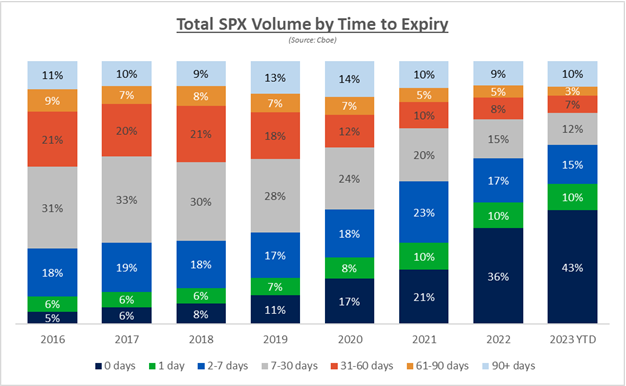

In early 2016, we launched Wednesday-expiring SPX Weeklys. This expiration profile aligned with the expiration of VIX® Weeklys futures and options. Monday Weeklys followed that year to address weekend risk. By 2022, Cboe had listed an SPX Weeklys option with an expiration for each day of the week (Monday through Friday). Those launches added scores of expiration cycles to SPX options (over the course of a year), which resulted in more opportunities for same day trading. What was once a more limited opportunity set is now vast, opening the door for market participants to trade and hedge with the precision of a hand surgeon. In 2023, SPX 0DTE options trading has represented roughly 43% of average daily volume (ADV).

Source: Cboe Global Markets data

How Are People Trading Same Day Options?

As evidenced by the recent volume growth, end users truly have embraced shorter-dated options trading, whether to manage exposure to key events, sell premium more frequently (predominantly in the form of spreads), implement different calendar spreads or pursue any number of other varying risk/reward objectives.

Defining outcomes in a much more granular way is part of another phase in the evolution of options markets — just like the introduction of monthly expirations, electronification or lower brokerage commission rates. Let’s dive into some of the same day trading activity using Cboe data on SPX options.

The same day trading of SPX options has made a relatively balanced market. The put/call ratio for same day SPX options trades is nearly 1, with puts slightly outweighing calls, and the order types are varied. This differs from the average aggregated put/call ratio for all SPX options over the past year (August 2022 – August 2023) which has been 1.37.

Roughly 45-50% of the volume is single leg volume, though importantly, that volume includes end users adjusting the existing individual legs of open spread positions.

Of the 50-55% of SPX 0DTE trading that is spread volume, roughly a third is vertical spreads with the remaining being comprised of more complex trade structures (butterflies, iron condors, ratio spreads, etc.). These trades are being entered on both a systematic and non-systematic basis.

Moreover, the participant pool is diverse — from the quantiest of institutions and prop traders to pro-tail and retail. Same day trading strategies are attractive to many types of investors because they eliminate overnight risk. Same day trading also allows people to harness the defined outcome nature of options trading: they can know their P&L at the end of a day and then can reload the trade, whether it be in the name of event-hedging or premium capture, the next day.

On the market-making side of this trading trend, more than 20 firms have ADV in the thousands of contracts. We do see market makers increasingly turning to options instead of futures to delta hedge.

Is ‘0DTE’ Just a Phase?

The diversity of same day trading strategies and end users makes for more healthy investor behavior than, for example, the activity during the meme stock craze, which was typified by indiscriminate (far) out-of-the-money call buying on single name equities (and select ETFs) in less-liquid markets than the SPX options complex. As we all saw, the meme stock surge was not sustainable behavior in the long run.

Similarly, other market commentators have compared same day options trading to 2018’s “Volmageddon.” This is an apples and oranges comparison. The volatility events in February 2018 were the byproduct of a highly leveraged, directional trade that took months to build up. We aren’t seeing that underlying dynamic in these 0DTE SPX trades, which essentially only exist for a brief moment in time and are wiped clean before the start of the next trading day.

Markets are constantly evolving and the past years in options trading are no exception. Annual volume has set successive records for the past three years, surpassing 10 billion contracts for the first time in 2022. If this year’s trading trends hold, we may see another annual record set.

Geopolitical risk is tangible. We passed the unfortunate one-year anniversary of the war in Ukraine. The COVID-19 pandemic forever altered perception of black swans (or grey rhinos, depending on one’s outlook). Interest rates are a ‘thing’ again and the 2024 U.S. presidential election is sure to be eventful.

All of this has led people to hedge differently, as it should. As markets change over time, so do trading strategies.

As a trusted market operator, we’re here to support market access, educate and provide robust technology infrastructure capable of handling whatever is thrown at us. We have taken, and will continue to take, that approach while monitoring the 0DTE options trading trend. For more details, register to receive our newest whitepaper – “The Rise of SPX & 0DTE Options.”

—

Originally Posted August 3, 2023 – The Evolution of Same Day Options Trading

There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2023 Cboe Exchange, Inc. All Rights Reserved.

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.