What’s Driving the Resurgence in VIX Options Trading?

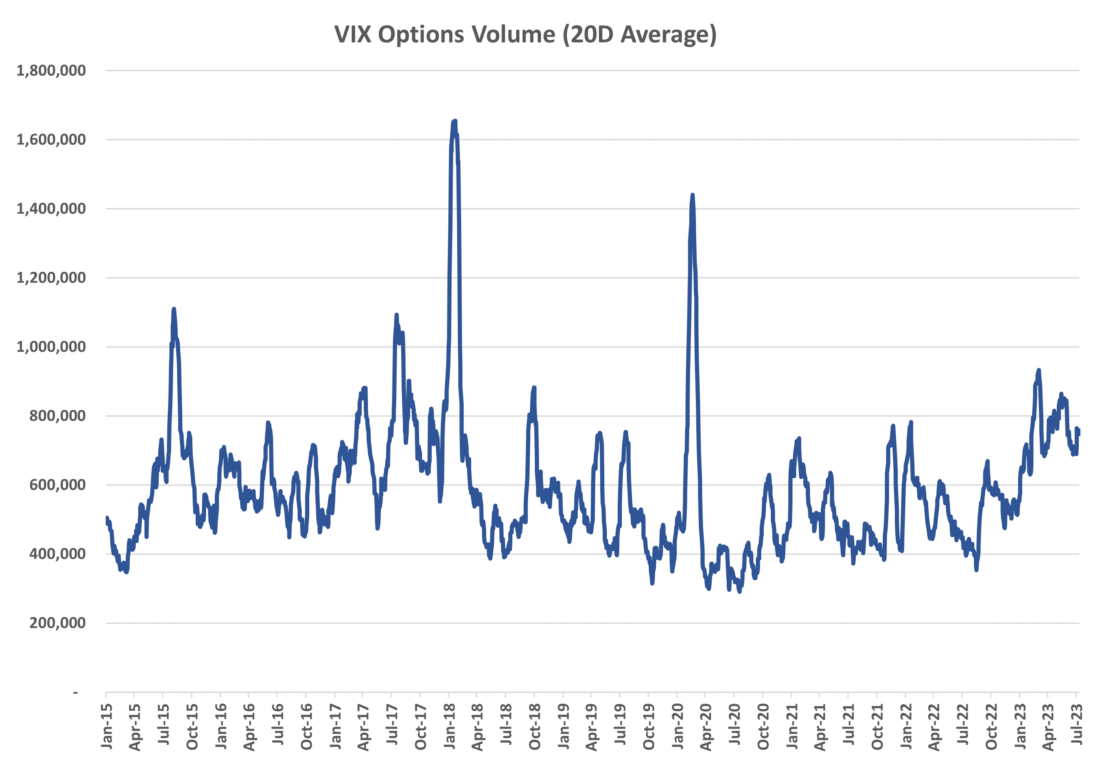

VIX® volatility index option volumes are averaging over 740k contracts a day so far this year, which if sustained, would make 2023 a record volume year. This is an impressive increase of 40% compared to recent years where volumes have hovered around the 500k ADV mark (see Exhibit 1). What’s behind this surge in VIX options activity?

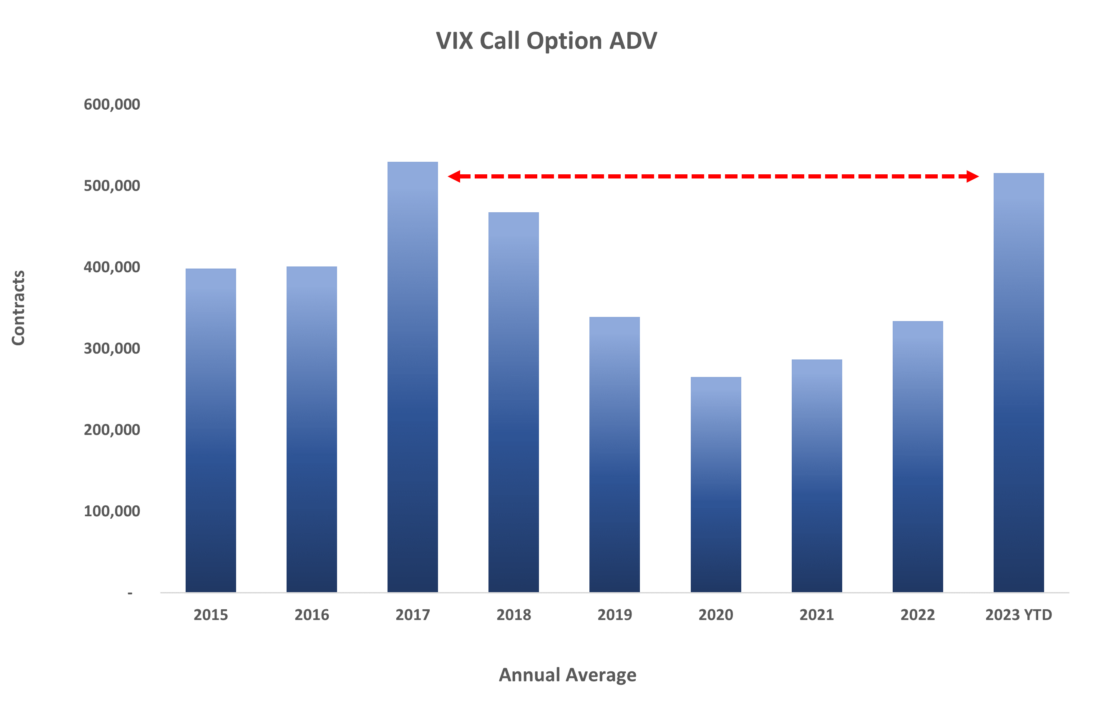

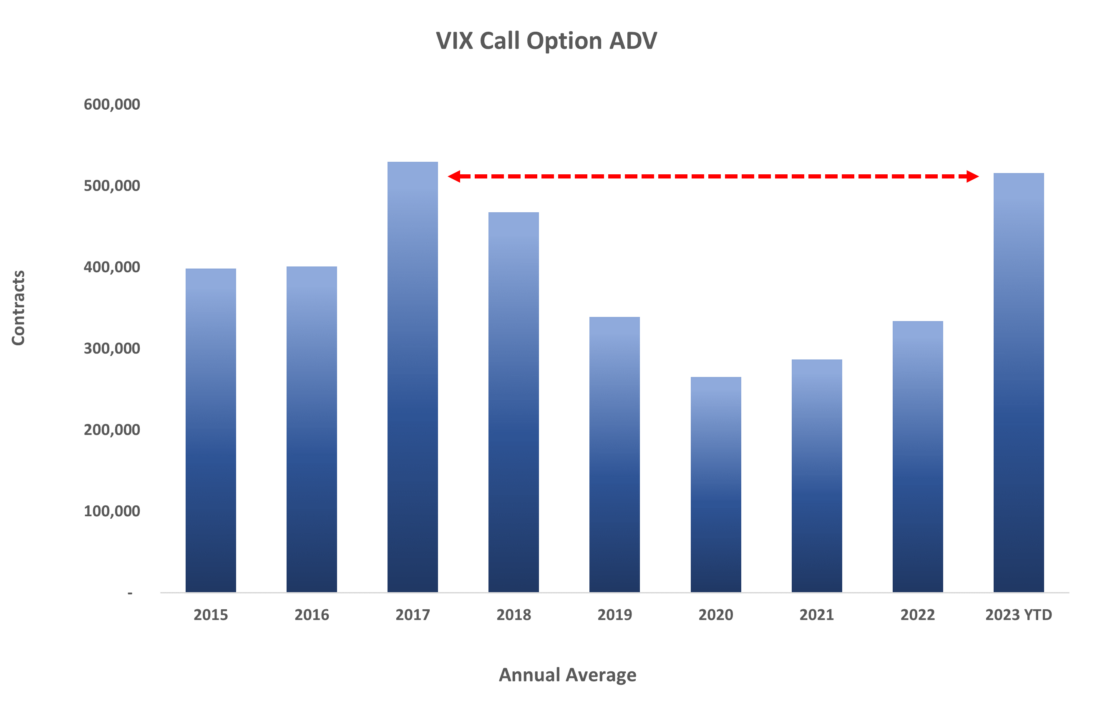

Looking at put vs. call volumes, it’s clear the increase is primarily coming from the call side. Call option volumes are up 54% (vs. 16% for puts), nearing the all-time high in ADV that we saw in 2017 (see Exhibit 2). Focusing specifically on customer activity and breaking it down by strategy, we see two areas that have seen the most pronounced growth: 1) calls and call spreads (+54% vs. 2022), suggesting an increase in demand for tail hedges and 2) combos (+237% vs. 2022) which is indicative of relative value volatility accounts getting more active as they typically trade VIX options delta-neutral (using combos to hedge their delta).

Below, we delve into each of these in detail.

VIX Option Volumes Up 40% vs. 2022

Source: Cboe

VIX Call Volumes Nearing 2017 Record High

Source: Cboe

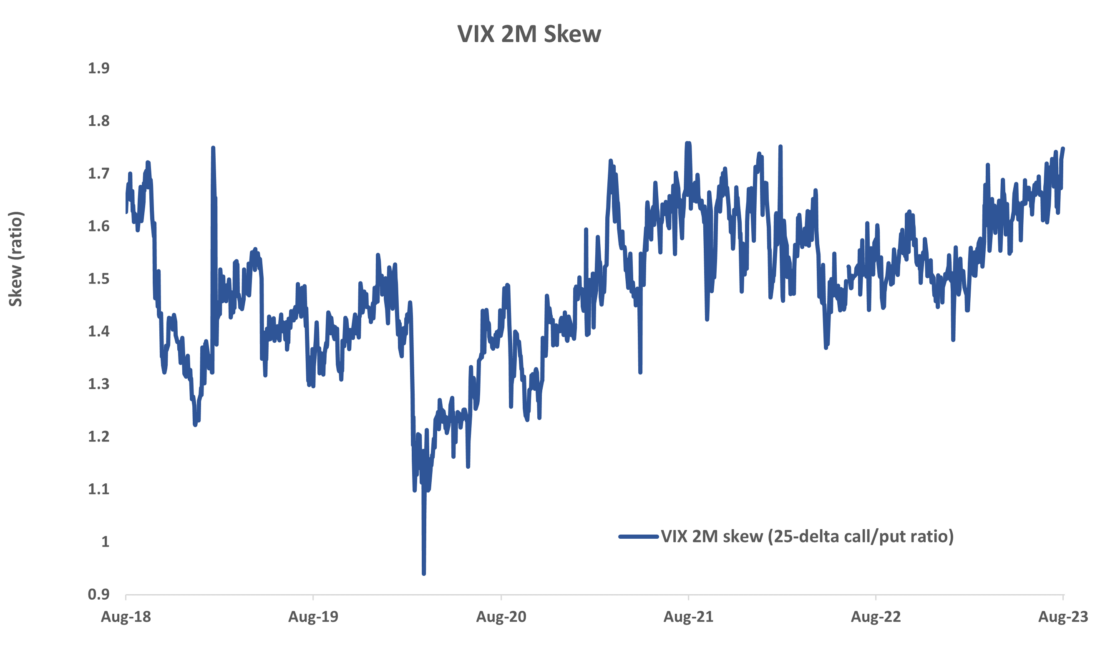

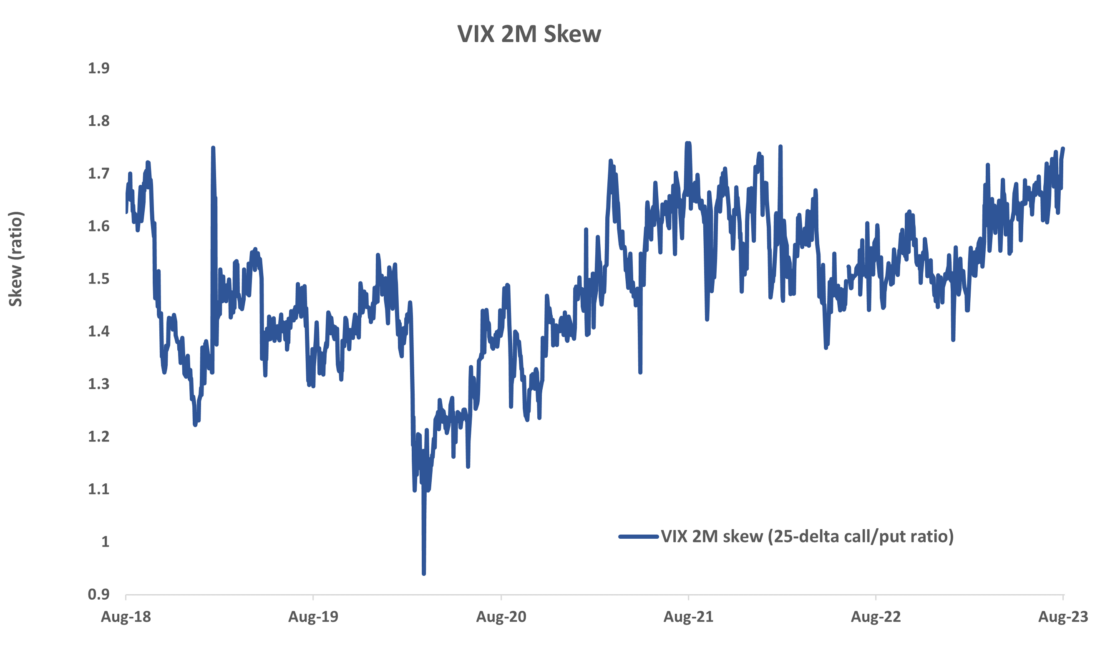

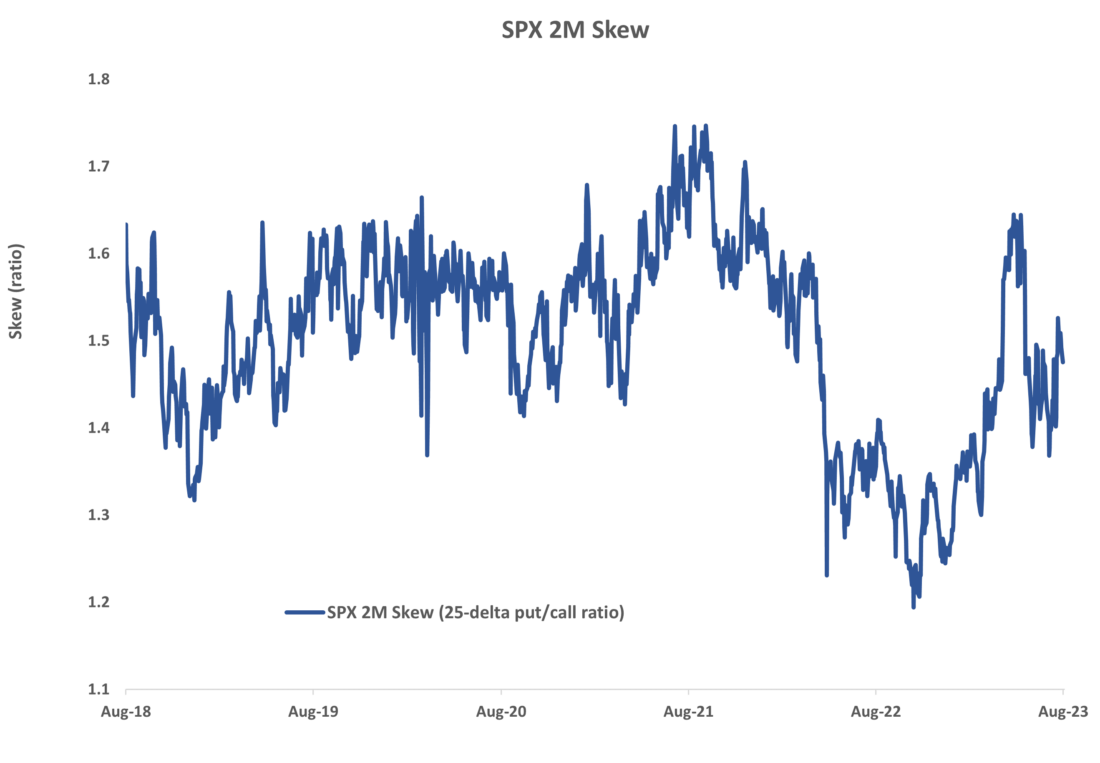

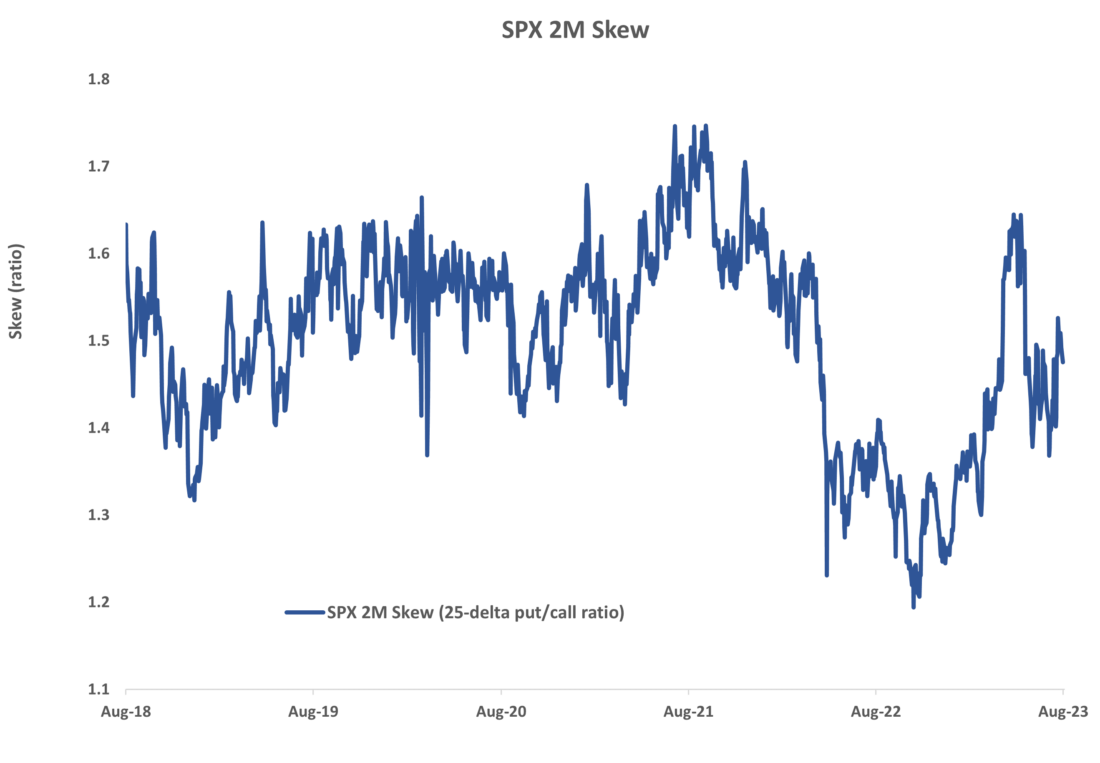

Using VIX® Options to Hedge Tail Risk

Following on the heels of 2022 – a year that was characterized by investors de-risking by moving to cash and thus foregoing any need to hedge with options – we’ve seen a steady re-steepening in VIX option skew which, coupled with the increase in call and call spread volume indicate a resurgence in using VIX options to hedge. For example, VIX 2M skew (25-delta call/put ratio) has increased to near a 5-year high (see Exhibit 3) on the back of demand for VIX upside calls. This contrasts with SPX skew which, while off the all-time lows we saw last year, still trades meaningfully below its long-term average (currently in the 36th percentile low over 5 years; see Exhibit 4).

Demand for VIX Hedges Jumps to Five-Year High…

Source: Cboe

…While SPX Skew Remains Below Average

Source: Cboe

What explains this divergence? Keep in mind that while SPX options are more commonly used for portfolio hedges to protect against your run-of-the-mill drawdowns (e.g. SPX -5% to -20%), VIX options are typically used for tail hedges to protect against true black swan events (e.g. covid in Feb/Mar 2020, Feb’18 “Volmageddon”, etc). The appeal of VIX options lies in the convexity of the underlying – the potential for volatility to triple or quadruple in a short period of time. That is much harder to do when the VIX Index was measuring in the mid-20s last year vs. the mid-teens this year. This is why VIX option volumes were so elevated in 2017 (when the VIX Index fell to a record low of 9) and so muted in 2020 (when the VIX index hit a record high of 82).

However, that’s not all. There have been periods of relative calm in the market without a corresponding uptick in VIX call volume – for example, the VIX Index averaged just 15 in 2019 yet option volumes remained languid. Another factor is positioning and leverage. Markets crash when investors all rush for the exit at once; as leverage builds, the potential for a disorderly sell-off increases. As the macro outlook has improved this year and realized volatility has fallen, investors have had to scramble to adjust their portfolio. Across both discretionary as well as systematic strategies, we’ve seen rapid re-risking. By some measures, equity positioning recently hit an 18-months high, bears have capitulated at the fastest rate in 7 years, and hedge fund net leverage is hovering near an all-time high. Retail investor sentiment, as measured by the AAII bull/bear survey, has gone from extreme bearishness to now the most bullish since Q1 2021. Systematic strategies (e.g. vol control funds, risk parity, CTAs, etc) have also significantly increased their equity positioning – for example, the equity allocation in a benchmark S&P risk-controlled index has more than doubled, up from 20% last year to now 45% (see Exhibit 5). As leverage builds and consensus shifts from recession to “soft landing”, investors have flocked to VIX options to hedge the unexpected.

Equity Allocation in Systematic Vol Target Strategies Near Three-Year High

Source: Cboe

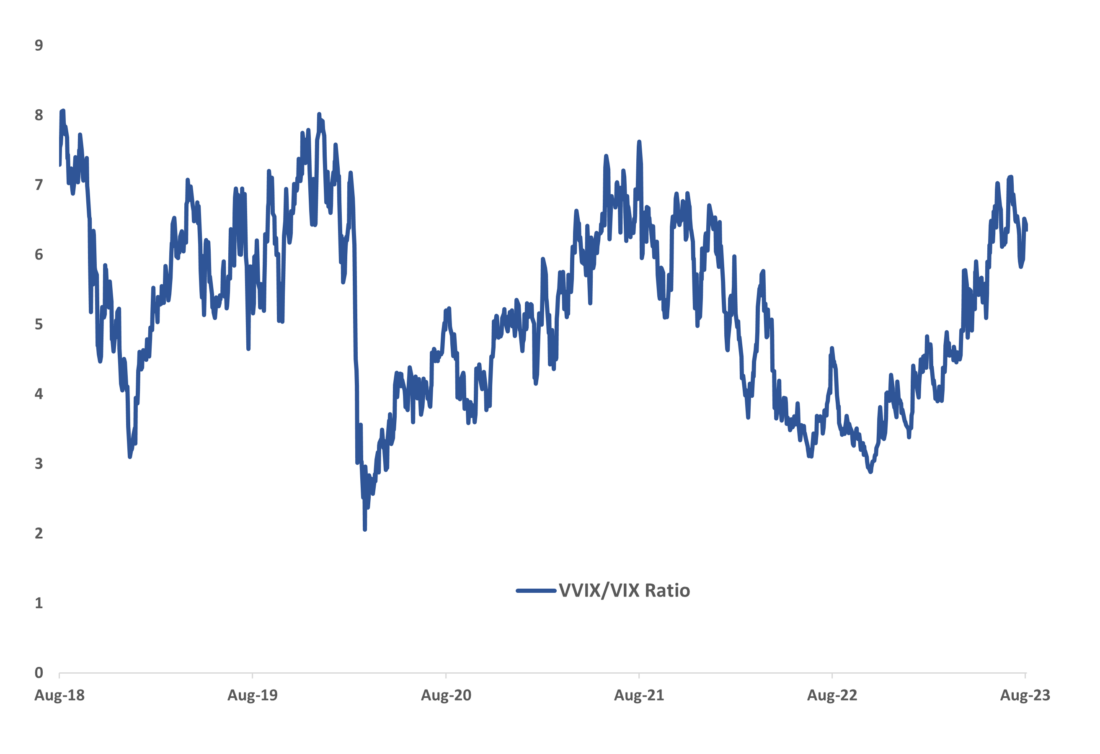

Monetizing VIX® Convexity

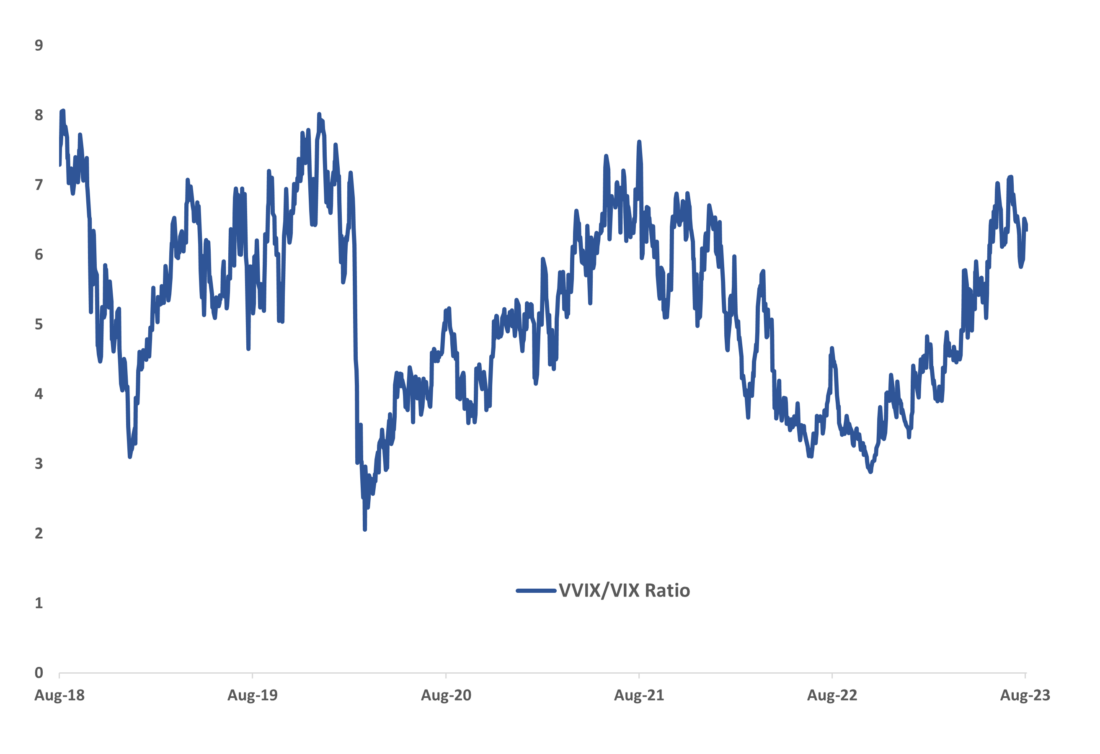

On the back of demand for VIX upside calls from investors looking to hedge tail risk, we’ve seen significant richening of VIX volatility, as measured by the VVIX Index. While the VIX index has been on a steady down trend for most of the year, the VVIX index has been steadily rising, and is currently ~25 pts off the lows we saw in January. The VVIX/VIX ratio, which measures the relative richness of VIX options vs. SPX options, has surged to ~80th percentile high over the past 5 years (see Exhibit 6). In particular, this is being driven by out-of-the-money calls, with the VIX 2M call wing (10D vs. 25D call ratio) recently hitting a 5-year high.

VVIX/VIX Ratio Shows Richening of VIX Convexity

Source: Cboe

This divergence has in turn attracted the relative value vol community to step in to monetize the rich VIX convexity. We see this in the significant increase in delta-hedged VIX option trades (+237% YoY increase in combos volume) which are typical from this investor base as they seek to trade VIX index volatility without any directional delta exposure to the underlying. The two-way flow – with directional accounts buying VIX calls to hedge and relative value accounts selling VIX volatility to monetize the rich vol premium – shows how robust the VIX options ecosystem can be with a diverse range of market participants and use cases.

—

Originally Posted August 22, 2023 – VIX® Options Volume on Pace to Exceed 2017 Record

- There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at https://www.cboe.com/us_disclaimers.

- These products and digital assets are complex and are suitable only for sophisticated market participants.

- These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position.

- Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle.

© 2023 Cboe Exchange, Inc. All Rights Reserved.

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.