Earlier this week, ahead of the flurry of mega-cap earnings, we asked the question, “will a “Fantastic Four” power the “Magnificent Seven”? So far, after two of the four reported after yesterday’s close, the answer is a clear “not yet.” And ahead of tonight’s earnings from Meta Platforms (META), the more important question is what might happen if the roster of seven stocks shrinks?

In the piece referenced above, we noted:

My concern is that if we somehow remove constituents from the “Magnificent Seven,” turning it into a “Super Six,” “Fab Five,” or “Fantastic Four,” it would place an even greater importance upon a shrinking list of outperformers, revealing deterioration in the climate for equities and increasing fragility.

With Alphabet (GOOG, GOOGL) dropping about -9% this morning and Tesla (TSLA) remaining about -15% below its pre-earnings level, that concern seems even more relevant. Microsoft (MSFT) delivered a solid beat on multiple fronts, but the broad market malaise has dampened today’s gains to only +2.5%. It is certainly too early to declare that GOOGL and TSLA have been voted out the Magnificent Seven, but ahead of META today and Amazon (AMZN) tomorrow, the question about whether the fraternity is shrinking becomes ever-more relevant.[i]

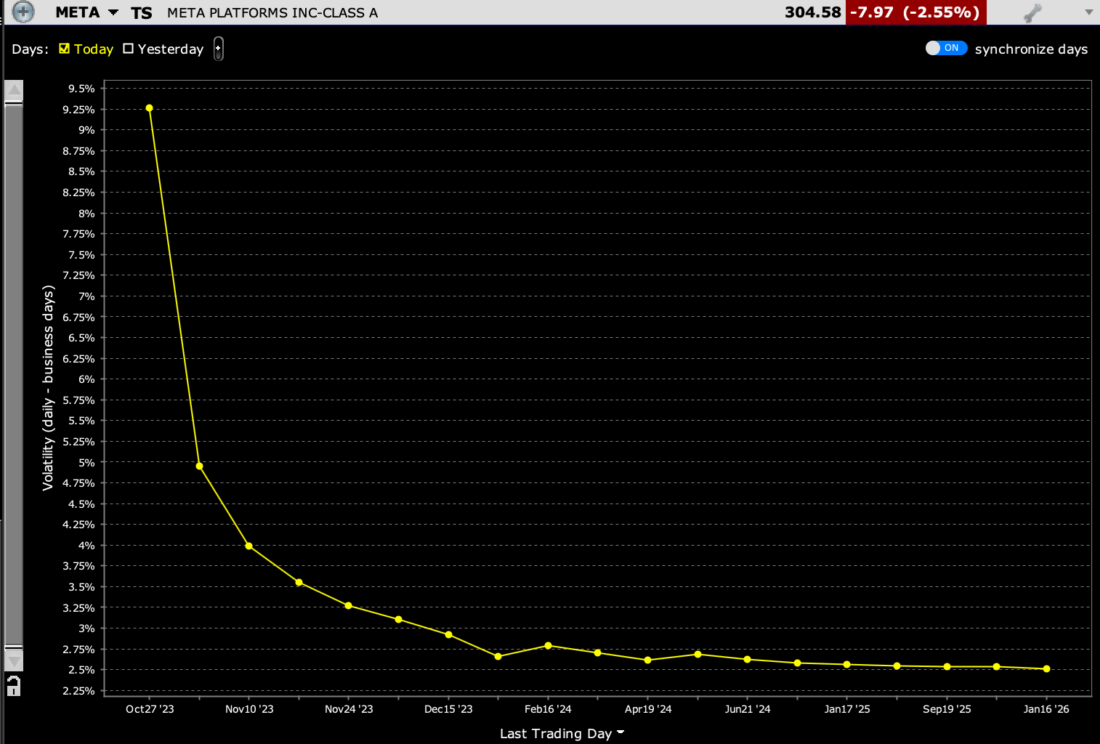

It certainly appears that the options market has a healthy regard for META risk today. It should, considering that the stock had double-digit percentage moves in both directions after 5 of its last 7 earnings reports (+4.4%, +13.93%, +23.38%, -24.56%, -5.22%, +17.59%, -26.39%). At-money implied volatilities for options expiring on Friday are above 9% daily, though that is well below that recent 16.5% average:

META – Volatility Term Structure, Expressed in Daily Percentage Terms

Source: Interactive Brokers

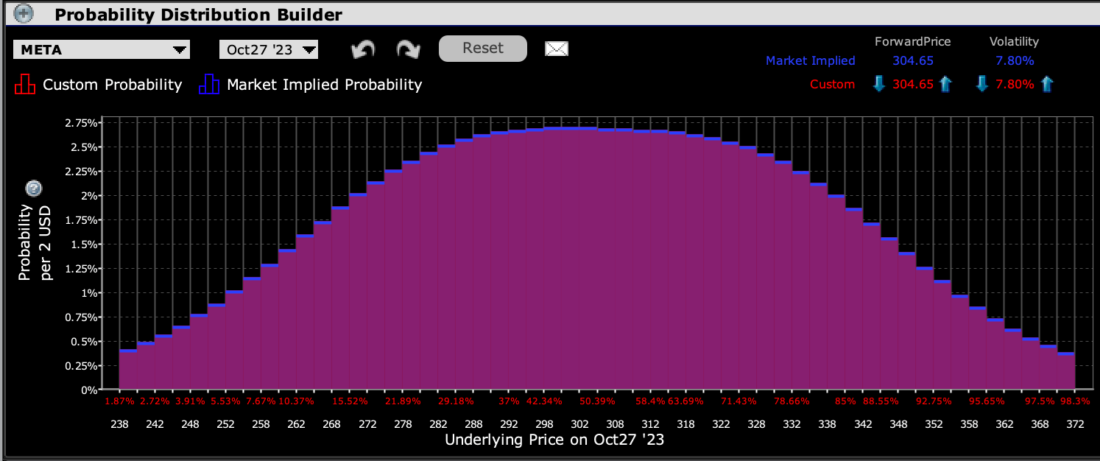

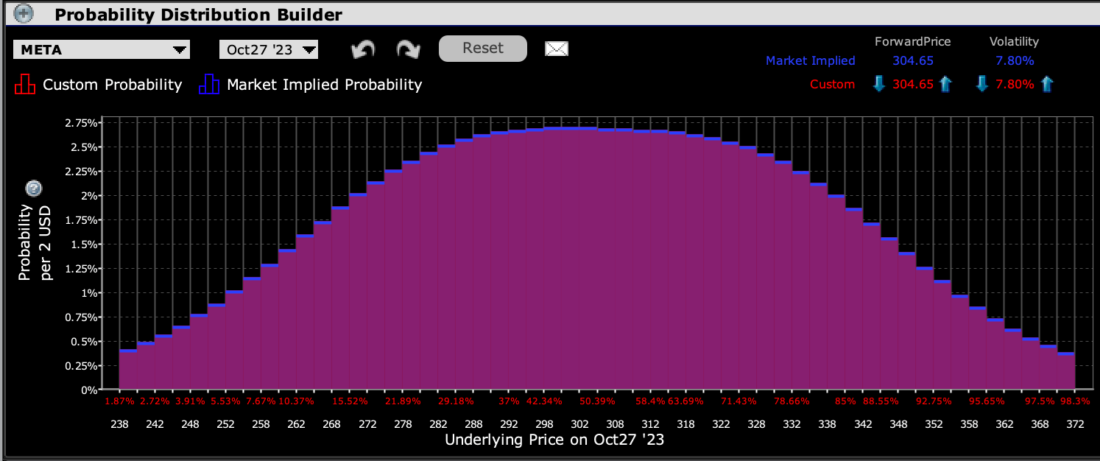

Not surprisingly, the IBKR Probability Lab shows a wide dispersion around its peak probability levels. Essentially the market is saying that any outcome between 288 and 320 is of roughly equal likelihood:

IBKR Probability Lab for META Options Expiring October 27th

Source: Interactive Brokers

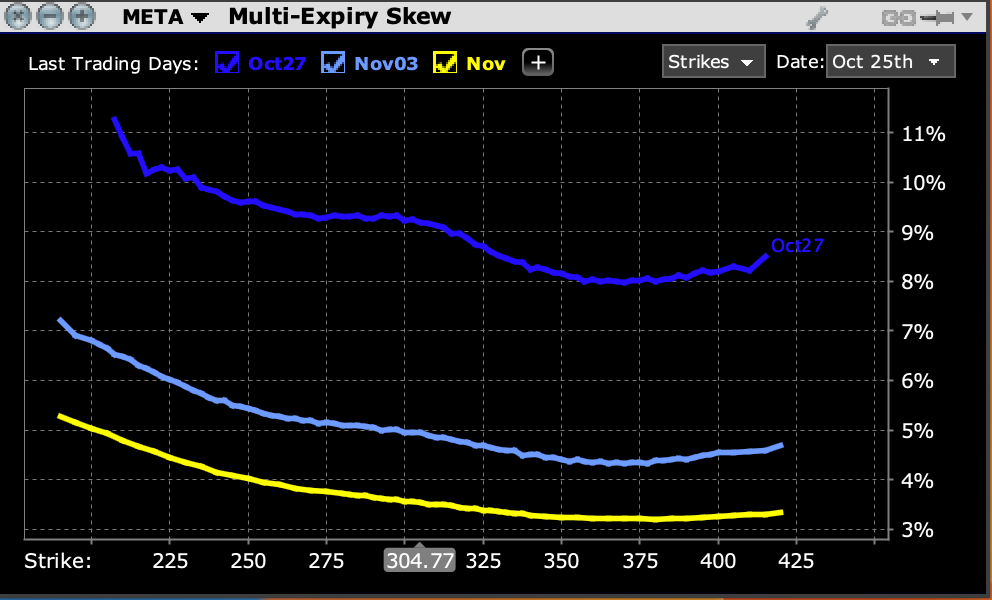

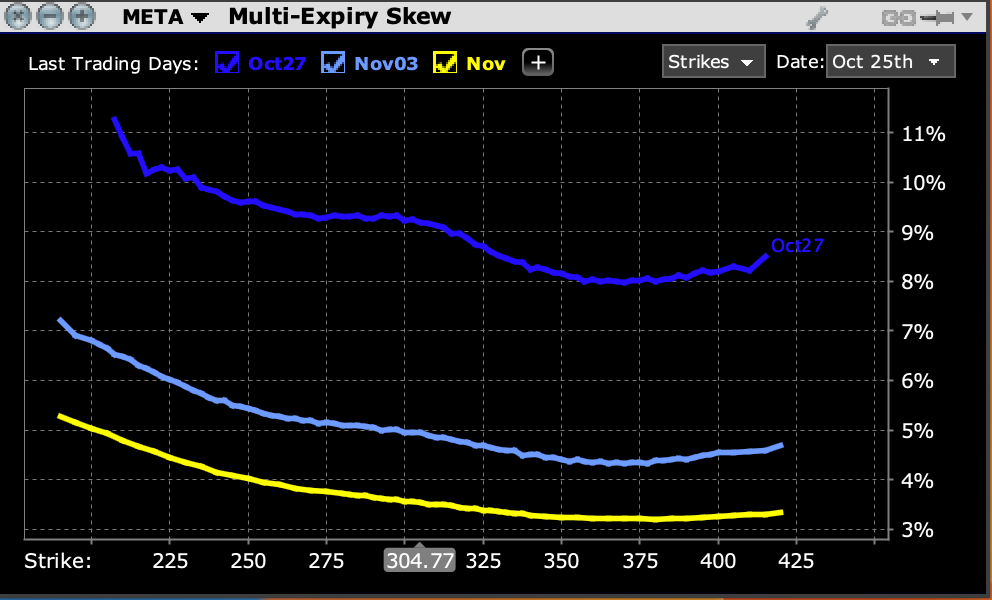

Skew for front-week options is relatively similar to those of next week’s and next month’s expirations. As we saw yesterday, there is a floor well above the current price, though here we see a flattish region just below the current market price. That fits with the probability chart:

META: Skew for Options Expiring October 27th (dark blue), November 3rd (light blue), November 17th (yellow)

Source: Interactive Brokers

Of course, we can’t know now how META will react to this afternoon’s report and whether they will prove consequential for the stock’s investors. But whether or not you have a position in META, you should pay attention. If the company performs well and the stock is rewarded, then we can continue hoping that a small cadre of mega-cap tech stocks can drive major indices higher. If the company fails to deliver, or worse, the market punishes META for even in-line results, that is an ominous sign about market sentiment.

—

[i] I realize that I switched nomenclature from “Fab Five” to “Big Five.” My regard for Philadelphia college basketball is far greater than that for Michigan’s.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.