If someone made a movie about earnings season – why would they? – this week would be the key act, and today would be the key scene. Along with a host of important companies, five stocks that make up about 20% of the S&P 500 Index (SPX) and about 40% of the NASDAQ 100 Index (NDX) report in a three-day period this week. Three of those five have already reported, with Apple (AAPL) and Amazon (AMZN) – the stocks with the largest and third-largest index weights – set to arrive after today’s close.

So far, the response to megacap tech earnings has been generally positive. An unexpected disappointment from Alphabet (GOOG, GOOGL) shaved over 3.5% from the prices of both its share classes yesterday, but we saw enthusiastic responses to Microsoft (MSFT) closed nearly 5% higher yesterday and Meta Platforms (FB) is up over 11% as I write this. Looking back to last week, traders liked what they heard from Tesla (TSLA), giving the stock a 3% boost on the day after its quarterly report.[i]

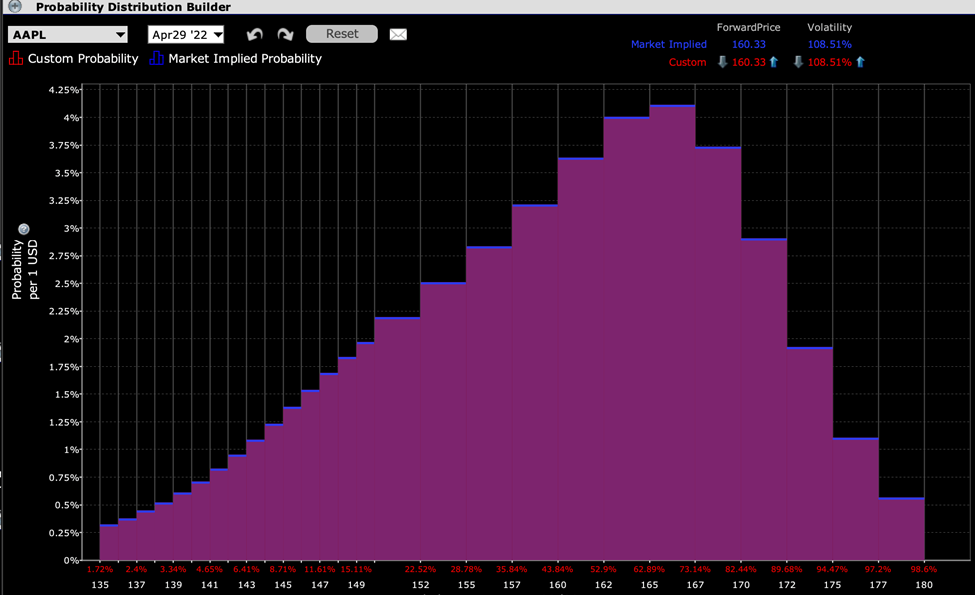

It should come as little surprise, therefore, that traders are expressing somewhat bullish sentiment about the post-earnings response to both AAPL and AMZN. Looking at AAPL options expiring tomorrow afternoon, the IBKR Probability Lab shows a peak likelihood at the $167.5 level, or about 4% higher than where it is currently trading:

Probability Distribution for AAPL Options Expiring April 29th

Source: Interactive Brokers

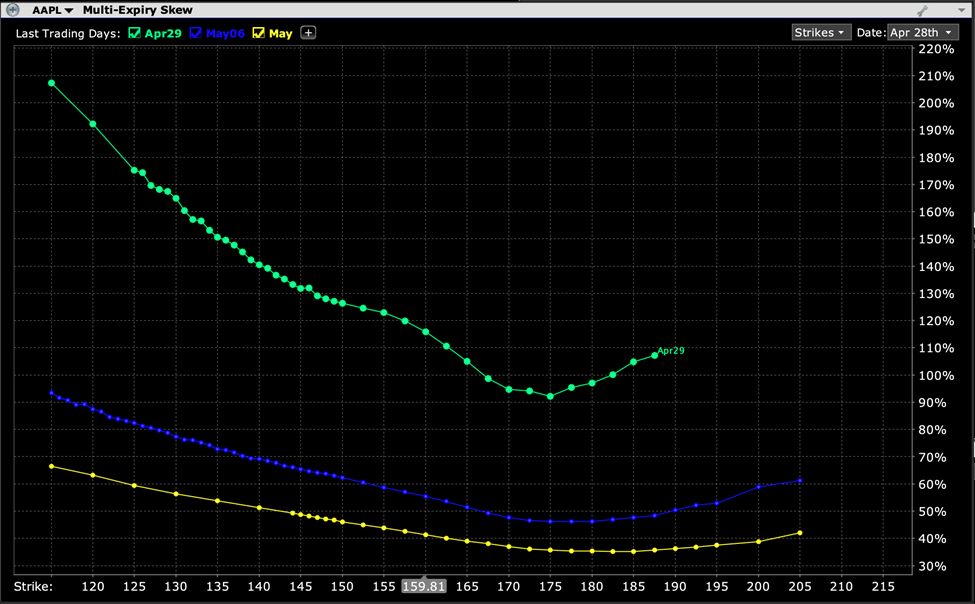

At-money implied volatilities are quite firm, pricing in a move of 6% or more. The average post-earnings move is about 4.5%, so between the steep downside skew and the high at-money implied volatility, not all traders are quite as bullish as the those bidding for upside calls. Over the past two years, AAPL has beaten its estimate 7 of 8 times, with the 8th meeting expectations. Interestingly, the stock has fallen on the day after 6 of those 8 reports, meaning that traders were already pricing in an earnings beat. The probability distribution reflects that bullishness among many traders, while the skew reflects some residual nervousness among many others.

Skew for AAPL Options Expiring April 29th (top), May 6th (middle), May 20th (bottom)

Source: Interactive Brokers

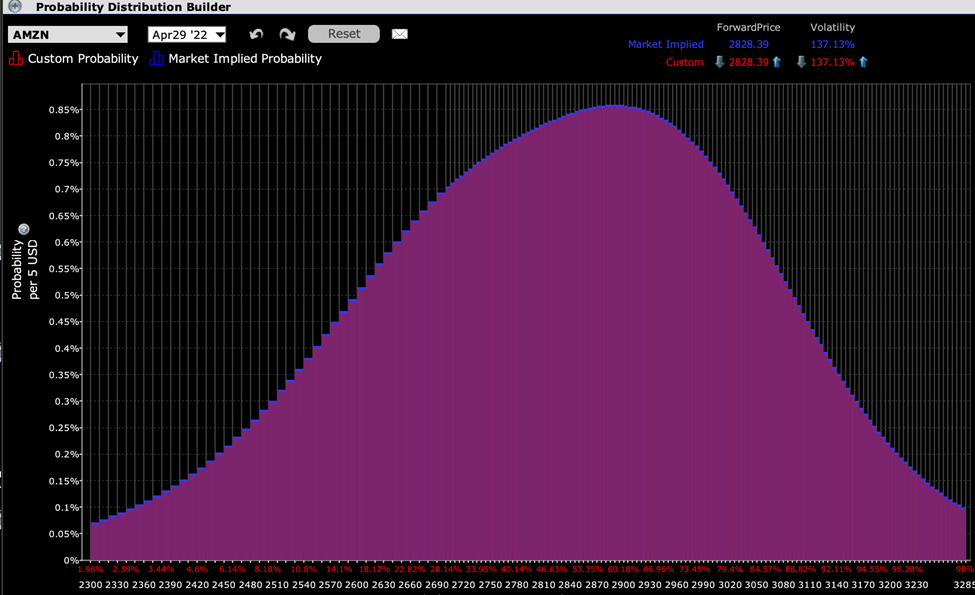

Traders of AMZN options are reflecting a similar outlook. We see in the graph below that the peak probability for options expiring tomorrow is around $2,900, up more than 3% from current levels. We also see high likelihoods placed up on outcomes from the current level through about 6% higher.

Probability Distribution for AMZN Options Expiring April 29th

Source: Interactive Brokers

The post-earnings track record for AMZN is a bit rockier than that of AAPL. AMZN has beaten expectations for 5 of the past 8 earnings reports, and as risen only twice afterwards. It shows an average post-earnings move of about 6.5% At-money options are trading at levels that imply an 8% post-earnings move, and the downside skew is fairly normal.

Skew for AMZN Options Expiring April 29th (top), May 6th (middle), May 20th (bottom)

Source: Interactive Brokers

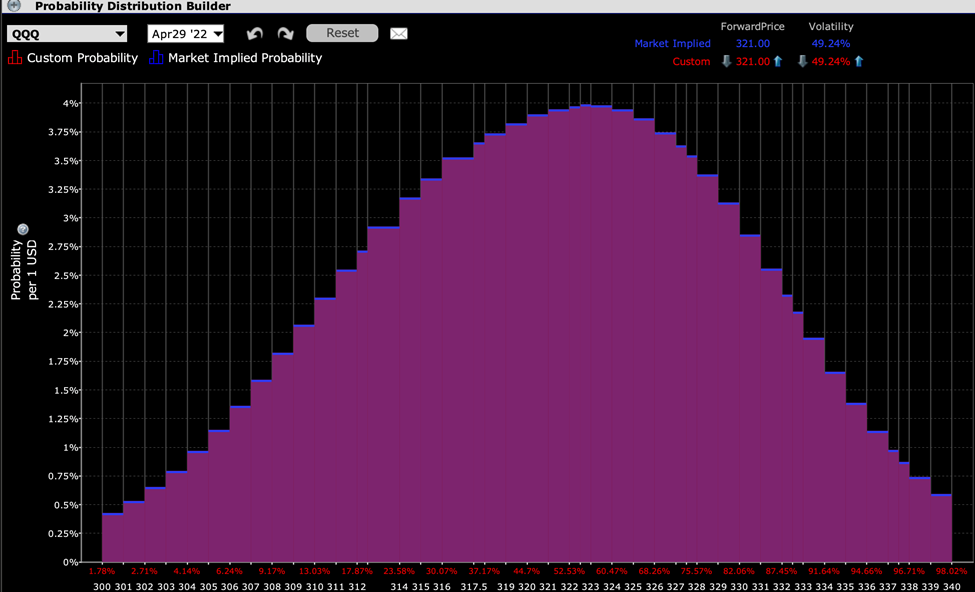

When we consider that these two stocks alone comprise about 20% of NDX, it is not surprising that the probabilities and for QQQ are quite similar to those of AMZN and AAPL, though the steep skew in weekly options indicate that traders are using those options as a short-term hedge.

Probability Distribution for QQQ Options Expiring April 29th

Source: Interactive Brokers

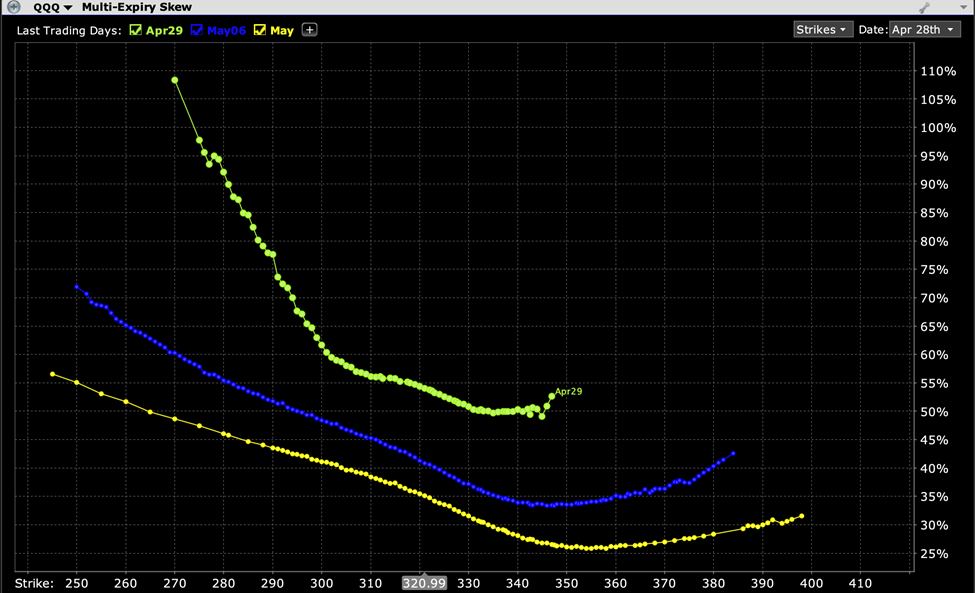

Skew for QQQ Options Expiring April 29th (top), May 6th (middle), May 20th (bottom)

Source: Interactive Brokers

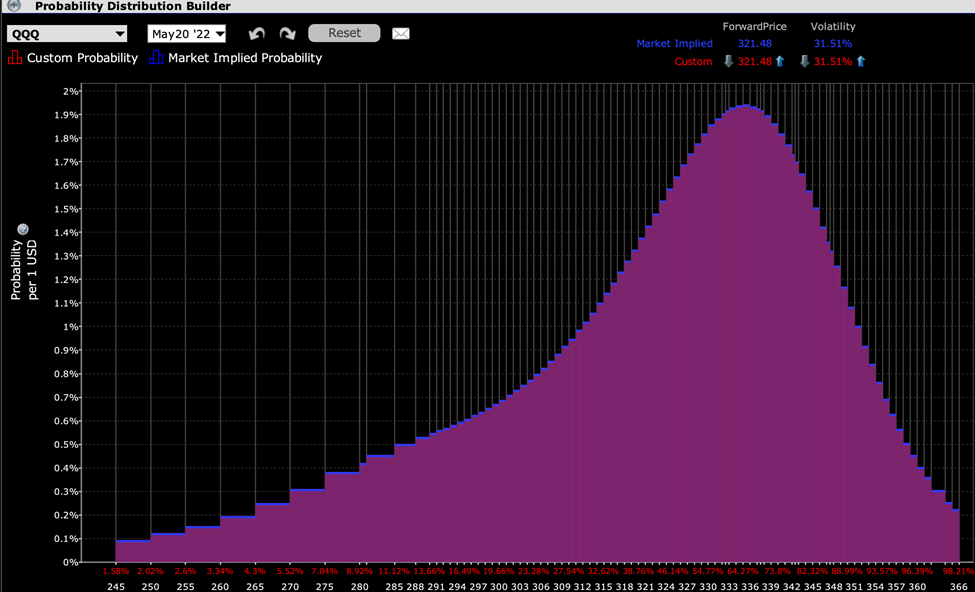

Finally, this struck me as fascinating. Regardless of what we see and hear about negative sentiment in the market, options expiring on the next regular monthly cycle appear to reflect a steep peak probability for a move of 5% or more. For better or worse, a significant group of traders appear to be continuing to utilize QQQ options to express their faith in a resurgent technology sector.

Probability Distribution for QQQ Options Expiring May 20th

—

[i] Since then, TSLA has fallen 20%, as traders worry about Elon Musk’s use of TSLA stock as loan collateral and possible sales to pay for his purchase of Twitter (TWTR)

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ