(Musical accompaniment for today’s piece: The Clash)

It’s been well reported that seven mega-cap tech stocks are responsible for most of this year’s gains in the S&P 500 (SPX) and NASDAQ 100 (NDX). The last and best-performing of what I’d like to call “The Magnificent Seven” reports after the close today. We’re talking of course of Nvidia (NVDA).

NVDA’s phenomenal run and crucial importance in major indices – it is now #4 in both SPX and NDX – certainly raise the stakes for the stock’s investors and the market’s overall health. Anything that punctures the short-term prospects of AI could have spillover effects. Among the “Magnificent Seven”, all have benefitted to some extent from AI enthusiasm, not least of which include Microsoft (MSFT) and Alphabet (GOOG, GOOGL). Furthermore, NVDA is now an expensive stock by conventional metrics, sporting a trailing P/E of about 130, a forward P/E of 65, and an estimated PEG (P/E/G) ratio of 2.78. Pricy stocks propelled by high expectations have more room to fall if those expectations aren’t met.

After NVDA’s last earnings report in February we wrote:

Seemingly echoing its role when “crypto” was at the forefront, NVDA is perceived as a key beneficiary of the potential for widespread adoption of AI. There is a definite logic to this perception.

During the California and Klondike gold rushes, selling supplies to prospectors was a safer and smarter to make money than the actual prospecting. It is quite reasonable to think of NVDA as selling picks and shovels, first to the cryptocurrency gold rush, now to the AI gold rush.

It is quite clear that NVDA management is leaning heavily into the AI theme. By my count, management mentioned “AI” 70 times. They mentioned it 37 times even before the first question was asked!

Obviously, whatever management said on the call resonated with investors. On the surface, the numbers were good, not great. NVDA reported GAAP earnings of $0.645, seemingly well below the consensus of $0.813, but the market uses a pro-forma[i] comparison, so the $0.88 pro-forma number was a decent beat. The stock gapped 14% after reporting – from $207.50 to $236.60. The gap has not been filled, and by last week, the stock had gained over 50% in less than three months before pulling back somewhat.

NVDA, 4-Month Chart, Daily Bars

Investors who prefer that growth stocks, ahem, actually show earnings growth, put aside the unhelpful fact that $0.88 was well below the prior year’s $1.32, though it was above the prior quarter’s $0.58. To be quite fair, investors are rightly focusing on the fact that NVDA’s EPS likely bottomed in Q2 of 2022 and on the company’s growth prospects.

The current analyst consensus is for EPS of $0.92, up $0.04 from last quarter and down $0.44 from last year. Obviously, much is riding on future guidance, since a rosy AI future is clearly priced into the stock price. We believe that management will do anything it can to focus on the importance of AI on NVDA’s future – they’ve already done so – but the key will be if management can credibly assert that the benefits will flow to the bottom line in a reasonable timeframe.

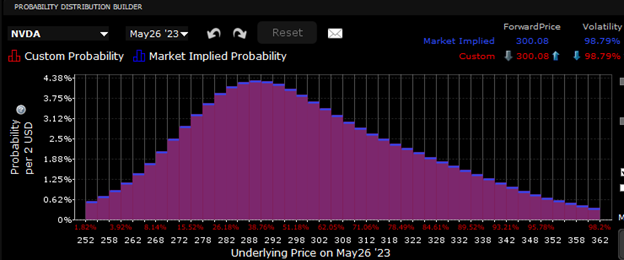

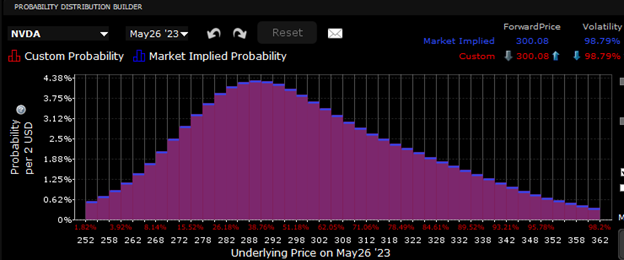

It appears that options traders are concerned about downside risk, at least to an extent. The IBKR Probability Lab shows that for options expiring on Friday, the highest probability outcomes are in the $288-292. That is a slight dip from the current $300 level (as I type this), and contrasts with how options prices were placing higher probabilities on an upward move in Tesla (TSLA) and for relative stasis in MSFT and GOOG. It is important to remember that ahead of earnings, options markets need to balance the relative desires of hedgers and speculators, none of whom know (or at least should know) what the company might actually report.

IBKR Probability Lab for NDVA Options Expiring May 26th

Source: Interactive Brokers

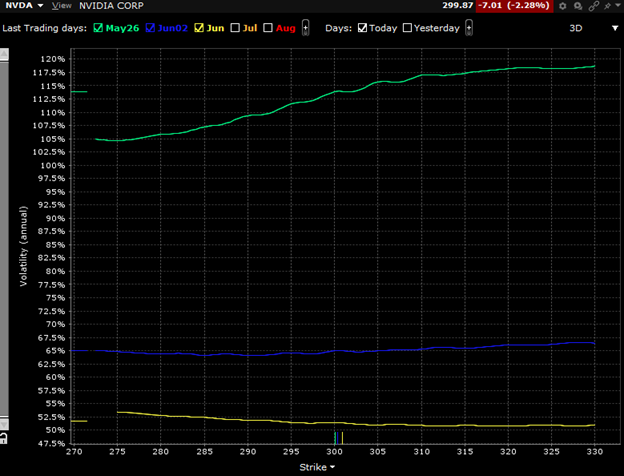

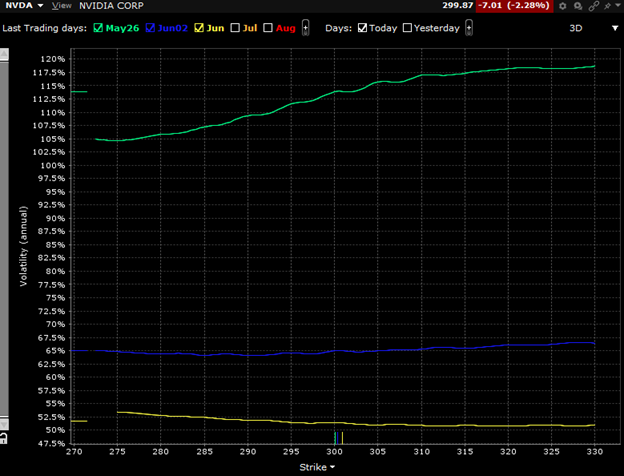

The downside bias, coming after a roughly 5% pullback in the stock, likely indicates that traders are concerned that the easy money might have been made already. That said, they are not TOO concerned, since the skew graph shows speculators paying higher implied volatilities for upside options than downside:

NVDA Implied Volatility by Strike, May 26th (green), June 2nd (blue), June 16th (yellow) Expirations

Source: Interactive Brokers

The current at-money volatility of 105, or roughly 6.5% daily, is in line with the average 6% move that the stock has seen after earnings reports since 2021. But remember, that average is increased substantially by last quarter’s 14% jump.

It has also become almost mandatory for companies, regardless of industry, to discuss their plans for incorporating AI into their business.

[That] reminds me of the heady days of the internet bubble.

NVDA is clearly not some “Johnny-come-lately” to the AI craze. It is a key driver and benefactor – indeed one of the stars of the Magnificent Seven. We will learn later today whether and when AI will be making a meaningful contribution to earnings.

—

[i] Pro Forma literally means “as a matter of form.” Pro forma earnings typically exclude a whole bunch of inconvenient expenses.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.