We Look at Goog’s Impressive Run and an Appealling Hedging Strategy

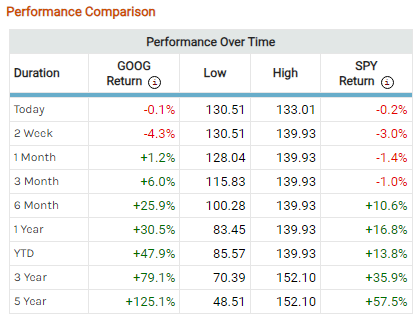

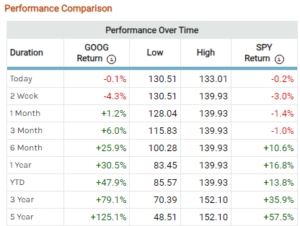

Google’s parent company, Alphabet Inc., has been on an impressive six-month run, with its stock gaining 25.9%, outpacing the broader market’s 10.6% increase, as you can see in the table below. However, the stock may face some headwinds in the short term, especially after such a substantial rise. Recent evidence suggests a weakening performance, with a two-week decline of -4.3%, compared to the market’s -3% decline, marking an underperformance of -1.3%. In light of this scenario, let’s explore an attractive bear call spread strategy that has been highlighted by the marketchameleon system. This strategy is designed to benefit from a flat to declining stock price outlook for Google over a one-month horizon.

GOOG Relative Performance

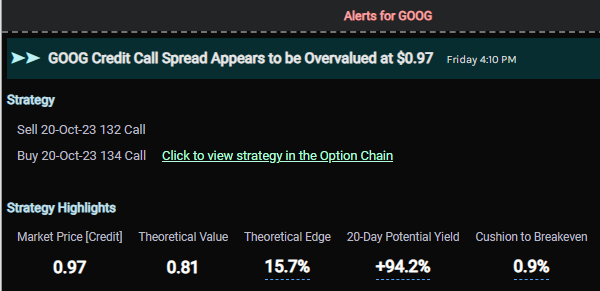

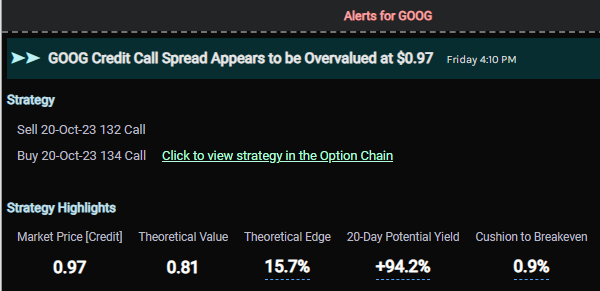

The Goog Bear Call Spread Set Up

Marketchameleon Opportuntiy Alerts

Strategy

Sell 20-Oct-23 132 Call

Buy 20-Oct-23 134 Call

Market Price: credit $0.97

Why We Like This Spread:

Great Potential Return

If Google’s stock remains below $132 within the next 20 trading days when the options expire, this strategy will yield a remarkable +94.2% return on the amount at risk. Given that the stock is already below that price point, as long as it remains flat or declines, this strategy will prove to be highly profitable.

Attractively Priced

By conducting a historical analysis of Google’s stock performance, we estimate a fair value of 0.81 cents for this spread. In essence, if the stock behaves similarly to its past performance, the long-term average value of this spread is approximately 0.81 cents. Currently, you can secure a credit of 0.97 cents, implying that you are theoretically getting a favorable deal on the trade. This added cushion can provide additional security if the trade faces adverse movements. The theoretical edge is estimated to be around 15.7%.

Limited Risk

In the event that Google’s stock soars beyond $134, the loss on this spread is capped because you are protected by the purchase of the 134 Call option. If the stock rises above this level, the spread would be worth $2. Since you collected 0.97 cents in credit upfront, your maximum loss would be limited to $1.03.

In Conclusion

While we cannot be certain of the precise direction of Google’s stock price in the coming weeks, the call spread highlighted by the marketchameleon system offers an appealing way to mitigate or hedge downside risk. This strategy is priced with an extra risk premium and comes with limited risk in case the stock experiences a significant surge beyond our upper strike price. Whether you are looking to capitalize on a potential decline in Google’s stock price or protect your existing position, this bear call spread in October may be worth considering. It provides an attractive risk-reward profile that aligns with a potentially uncertain market outlook.

—

Originally Posted September 23, 22023 – Why This GOOG Bear Call Spread May Be Worth Looking At

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

I am looking at all of the inputs in this article and one thing that is not mentioned is the price of the stock when calculating the fair value of this vertical (.81 cents).. How can one know the value without the underlying price?

The spread can now be sold for 1.10 at 3:45PM EST on 9/25/23 but the price of the underlying is 131.85