September Economic Release Overview

September economic data beat expectations. Remember Q2 2022 was Shanghai’s lockdown, which is why Q2 year-over-year GDP growth was comparatively high. Online retail sales now account for 26.4% of the total retail sales of consumer goods. Not surprisingly, September property sales and property investment were weak. The stronger-than-expected economic data validates the government’s incremental support of the economy, which has kept inflation in check and the government budget deficit low. However, investors are impatient with the slow policy support as the policy bazooka remains in the holster.

Key News

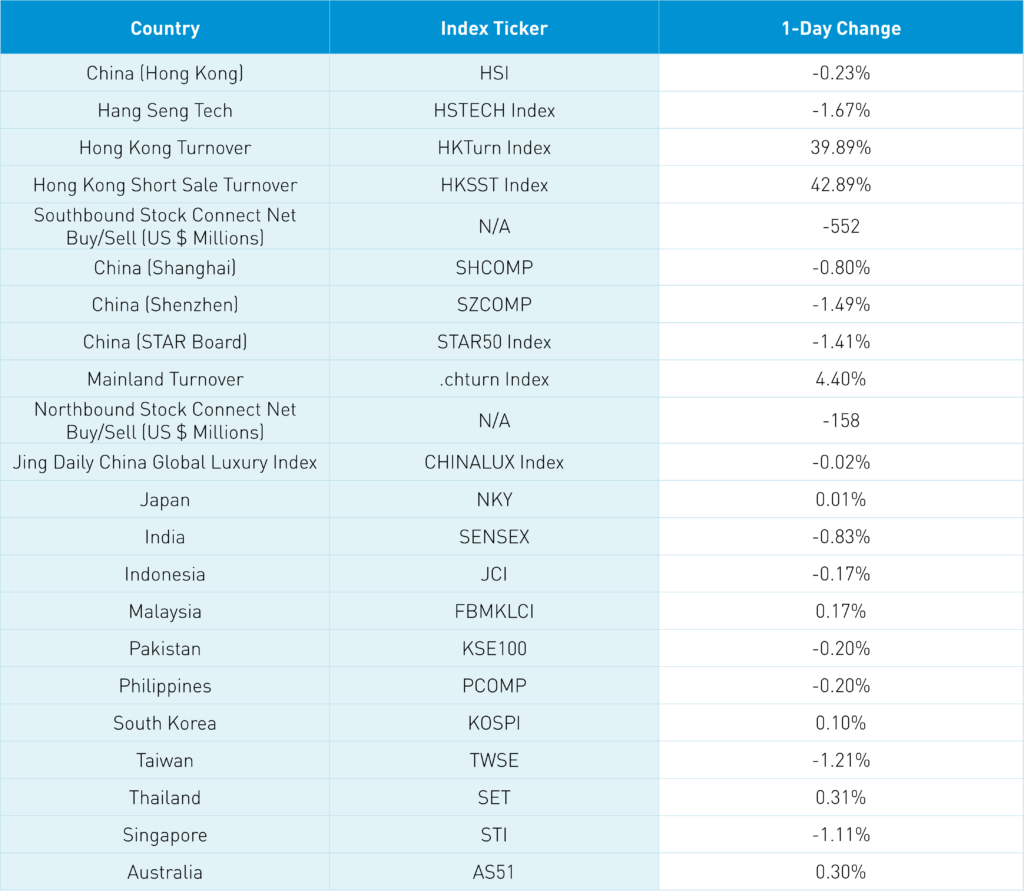

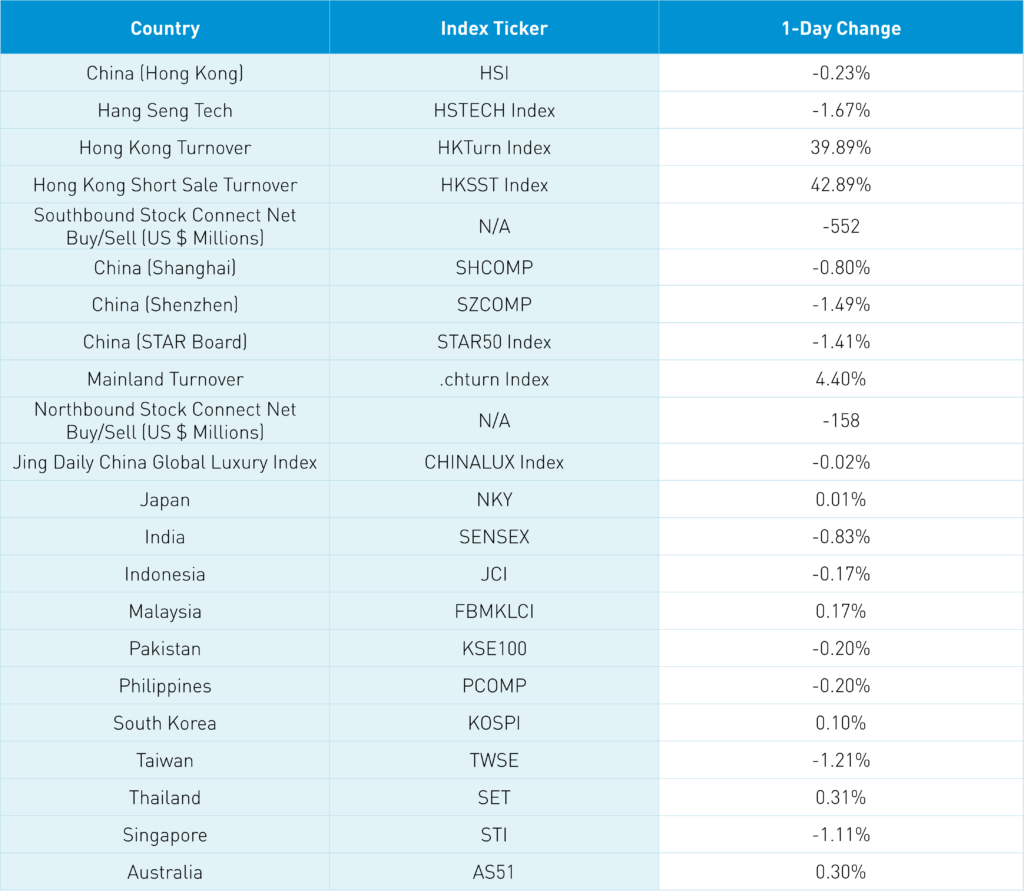

Asian equities were largely lower on light volumes.

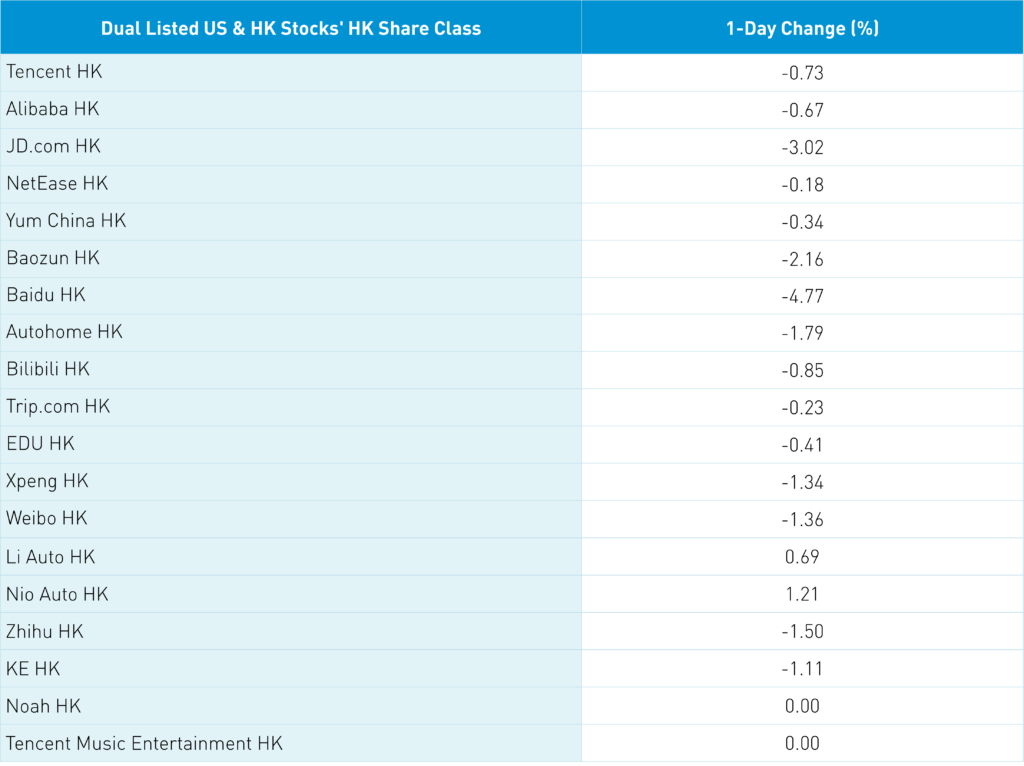

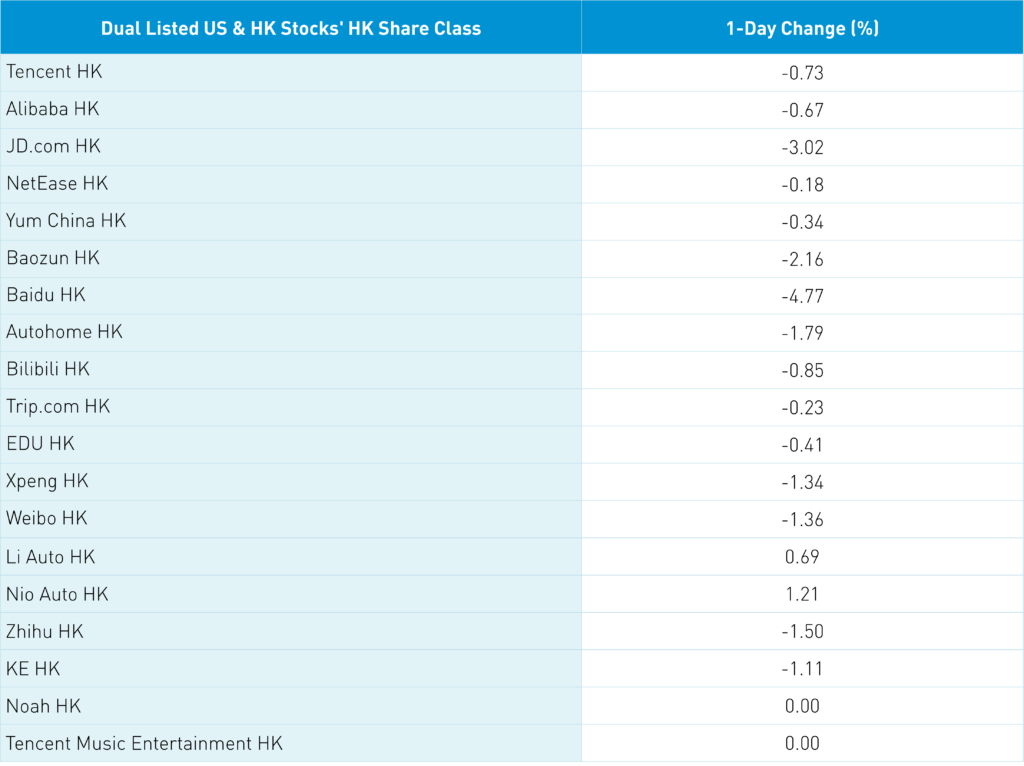

Potentially tighter US chip controls weighed on growth sectors and stocks in both Mainland China and Hong Kong. US chip stocks, other than Nvidia, were largely immune to the chip news during Tuesday’s US trading, which is a head-scratcher due to their high China revenue. The curbs shouldn’t have been too big of a surprise based on the recent US-China diplomatic dialogue. Though AI-oriented, Hong Kong-listed Lenovo, which fell -10.12%, and Baidu, which fell-4.77%, were hit especially hard.

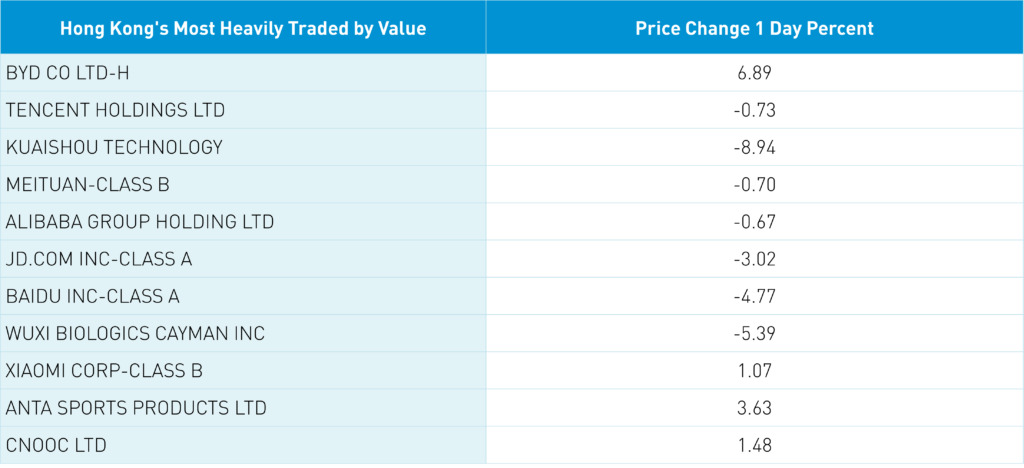

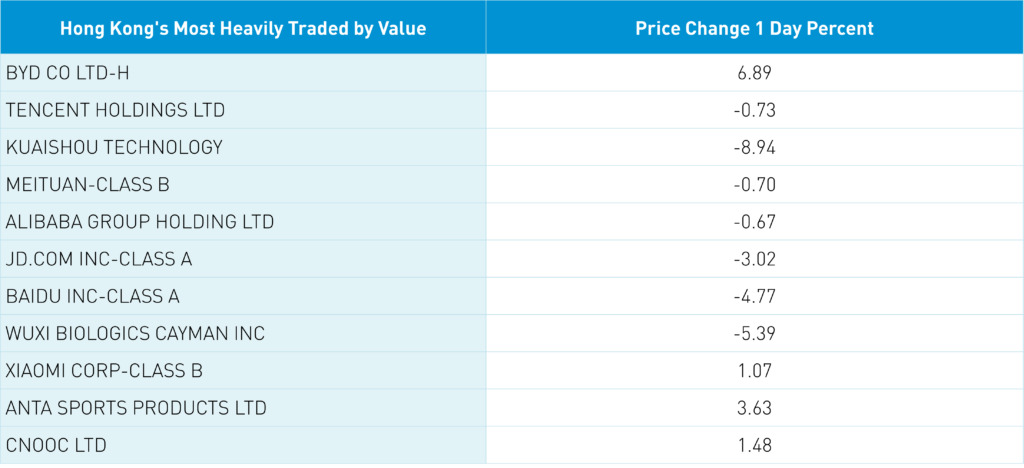

BYD was Hong Kong’s most heavily traded stock by value, gaining +6.89% after announcing preliminary Q3 net income will nearly double to RMB 11.5 billion ($1.6 billion) from RMB 5.7 billion. Impressive! It is entirely too bad that we can’t buy one of these great vehicles in the US. Their low-cost electric vehicle (EV) model called Seagull sells for $10,000 (RMB 73,000). BYD’s results lifted the EV ecosystem, which was one of the few bright spots today, though shorts being run over silently was a factor in the pop. Short video platform Kuaishou was off -8.94% on rumors that Tencent might cut its stake.

Distressed real estate developer Country Garden’s inability to pay an offshore coupon payment of $15.4 million would, in theory, push the company to bankruptcy, as offshore bondholders have the same rights as onshore bondholders. A restructuring would be a far more palatable outcome versus an outright default on the company’s $186 billion of total debt. The knock-on effect would be worse as, in theory, home buyers might lose their deposits, construction companies and their employees wouldn’t get paid as unfinished projects would be stalled. It would also negate the government’s efforts to raise property prices and consumer confidence. This is why restructuring is preferred to bankruptcy, though we’ll know soon enough.

Mainland investors continued their Jekyll and Hyde behavior by selling Hong Kong-listed ETFs via Southbound Stock Connect. Foreign investors sold Mainland stocks via Northbound Stock Connect, though a lower amount than has been the trend recently. CNY eased versus the US dollar overnight as the Shanghai Composite and Shenzhen Composite remain below our “line in the sand” levels of 3,200 and 1,900, respectively. Today’s disappointing market performance on good economic news reaffirms the potential for the government to do something bigger.

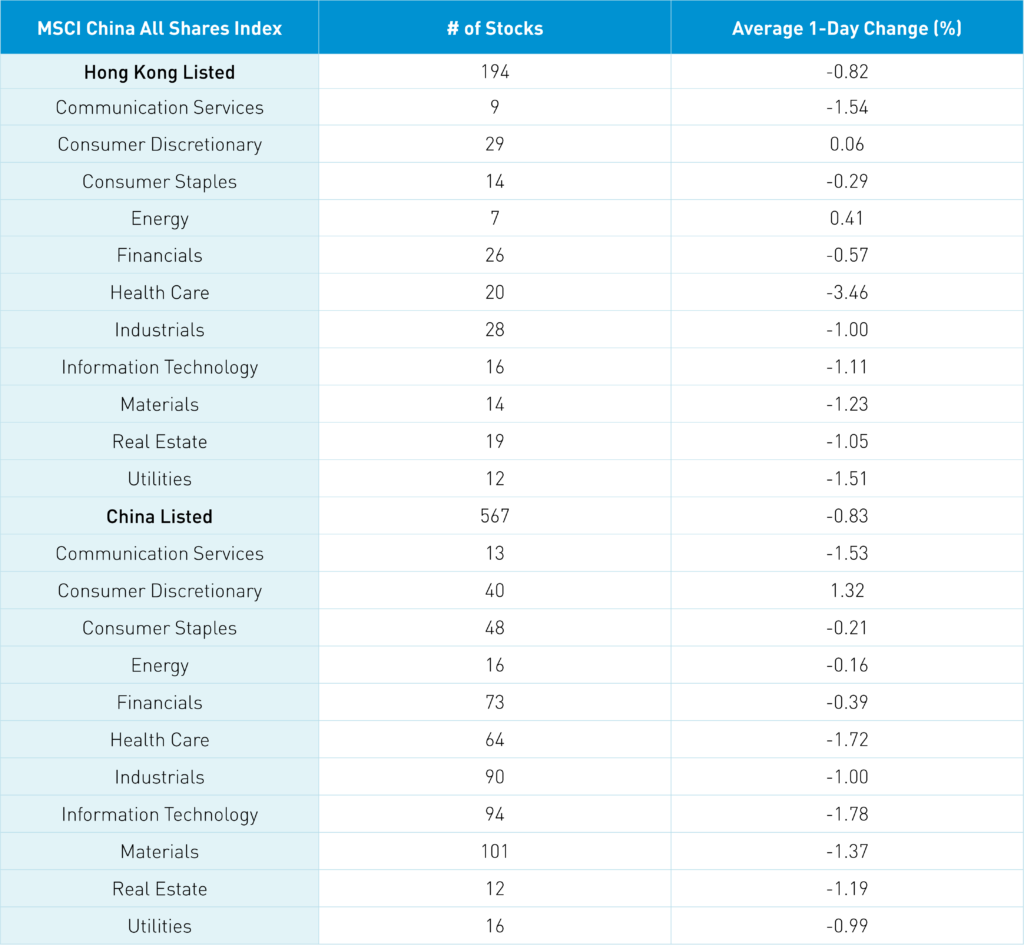

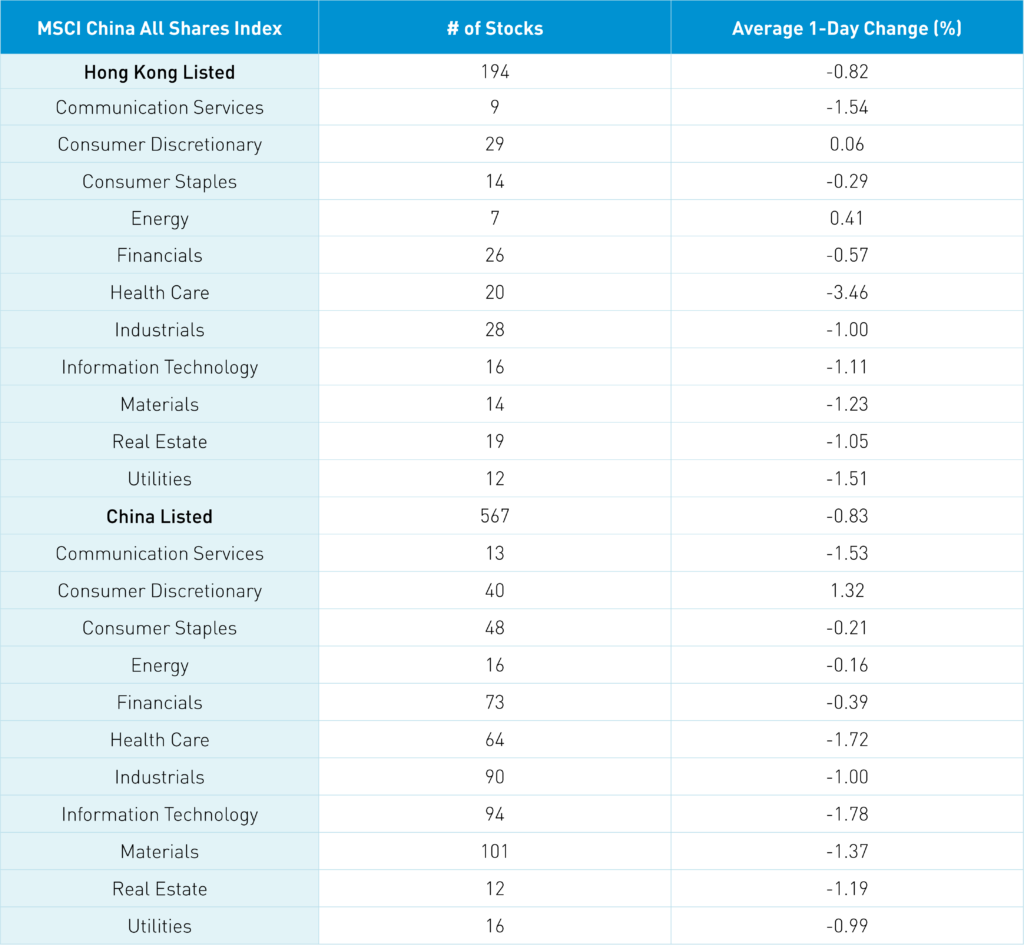

The Hang Seng and Hang Seng Tech fell -0.23% and -1.67%, respectively, on volume that increased +39.89% from yesterday, which is 78% of the 1-year average. 111 stocks advanced, while 373 declined. Main Board short turnover increased by +42.84% from yesterday, which is 79% of the 1-year average as 17% of volume was short turnover (remember that Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor “outperformed” (i.e. fell less than) the growth factor as large caps “outperformed” small caps. Energy and consumer discretionary were the only positive sectors gaining +0.41% and a James Bond +0.07%, respectively, while healthcare fell -3.46%, communication services fell -1.54%, and utilities fell -1.51%. The top-performing subsectors were the Foxconn ecosystem, EV charging stations, and fuel cells. Meanwhile, short video, security monitoring, and intelligent building were the among the worst-performing. Southbound Stock Connect volumes were light/moderate as Mainland investors sold a net -$552 million worth of Hong Kong-listed stocks and ETFs with China Mobile, CNOOC, and Meituan as small net buys while the Hong Kong Tracker ETF was a large net sell and BYD was a small net sell.

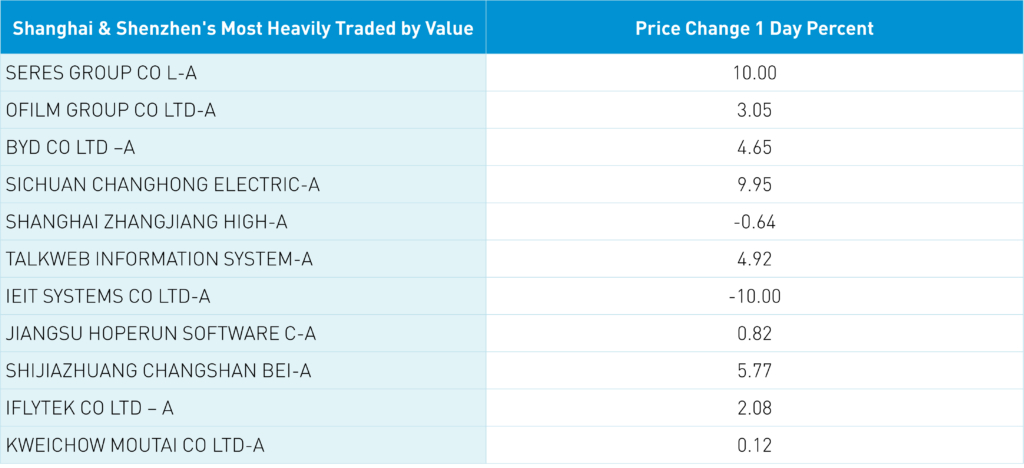

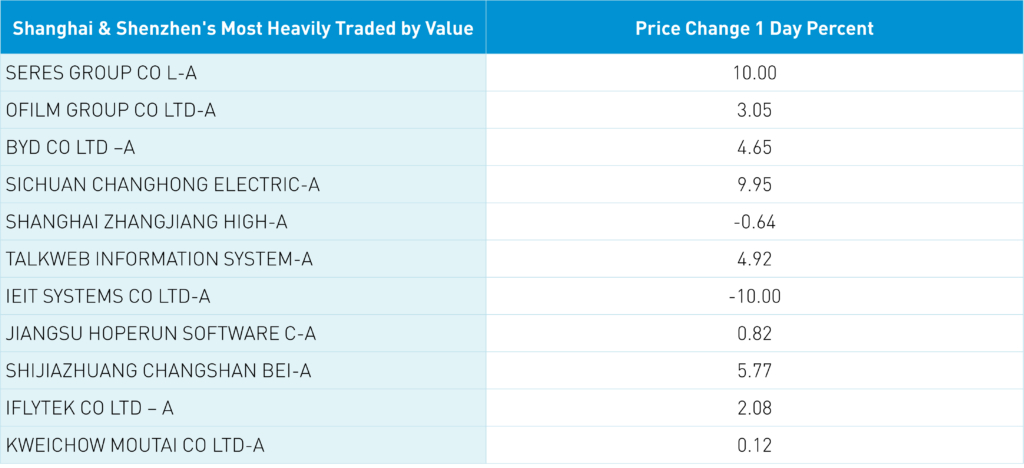

Shanghai, Shenzhen, and the STAR Board fell -0.8%, -1.49%, and -1.41%, respectively, on volume that increased +4.4% from yesterday, which is 87% of the 1-year average. 479 stocks advanced, while 4,467 declined. The value factor “outperformed” (i.e. fell less than) the growth factor as large caps “outperformed” small caps. Consumer discretionary was the only positive sector, up +1.33%, while technology fell -1.77%, healthcare fell -1.7%, and communication services fell -1.52%. The top-performing subsectors were EVs, autos, and gold, while cell phone cameras, robots, and eye medicine were among the worst-performing. Northbound Stock Connect volumes were light/moderate as foreign investors sold a net -$158 million, as BYD was a large net buy, Zongji Innolight and ZTE were small net buys, while JAC, Wuliangye, and CATL were small net sells. CNY fell versus the US dollar, though the Asia Dollar Index managed a small net gain. Treasury bonds were sold along with steel while copper rallied.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.31 versus 7.31 yesterday

- CNY per EUR 7.72 versus 7.71 yesterday

- Yield on 10-Year Government Bond 2.70% versus 2.68% yesterday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.75% yesterday

- Copper Price +0.48% overnight

- Steel Price -0.49% overnight

—

Originally Posted October 18, 2023 – BYD Runs Over Hong Kong Shorts As September Economic Data Beats

Author Positions as of 10/18/23 are KLIP, KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LIUS

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.