It’s Monday morning, and we’re higher. As we noted two weeks ago, that’s become a frequent occurrence. We broke a 15-week streak last week (of course, after we wrote about it), and noted that Mondays have closed higher 80% of the time this year, when 53% has been normal for all days and Mondays prior to this week. But there are a number of potentially market-moving events coming down the pipe this week. Any or all of them can disrupt today’s good mood.

The first key number comes out this afternoon at 3pm EDT. That is when the US Treasury releases the estimate for its borrowing needs over the coming months. The last report, on July 31st, clocked in at a fairly shocking $1.007 trillion. That spooked bond markets, and the latest leg higher in bond yields (lower bond prices) can be largely attributed to that announcement. The 10-year yield was at 3.96% prior to that announcement. It’s currently 4.89%. That is a staggering move. Also, neither the S&P 500 (SPX) nor NASDAQ 100 (NDX) has closed above its July 31st close since then.

Hence it will be very interesting to see the bond market’s reaction. It is difficult to get a consensus estimate for today’s announcement, though our senior economist, Jose Torres, puts it somewhere in the $1.4-1.5 trillion range, and he is at $1.6 trillion. A few hundred billion here, a few hundred billion there, pretty soon we’re talking about real money, right? There is much more focus on today’s announcement than there was last quarter, but a significant reaction from bond traders could certainly spill over into stocks.

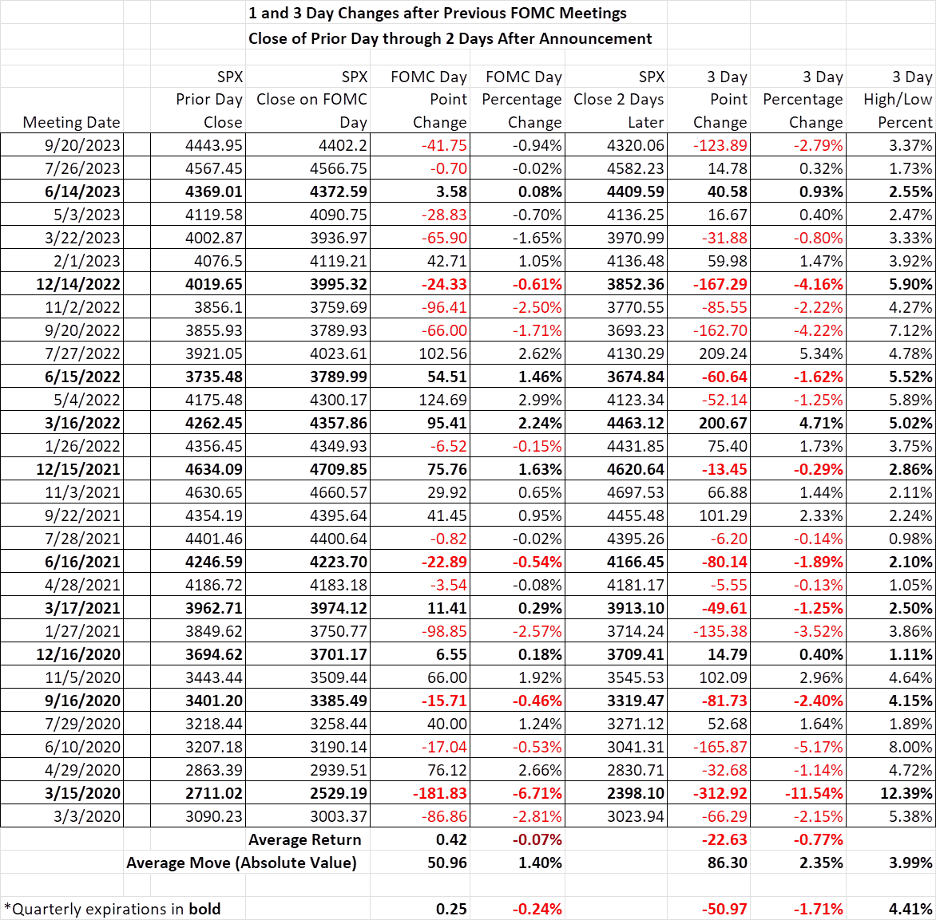

Meanwhile Wednesday of course promises to be noteworthy. We will learn the likely composition of the Treasury’s borrowings that morning at 8:30am EDT. That could have a significant on the shape of the yield curve, depending upon whether the borrowing will skew short-term or long-term. And the Big Kahunas of market events, the FOMC meeting and Chairman Powell’s press conference follow at 2:00pm and 2:30pm that afternoon. The table at the bottom of today’s piece shows SPX’s post-FOMC reactions after the past several meetings. Volatility is hardly guaranteed, but it often accompanies these events.

Finally, after the close on Thursday and before the open on Friday we have two highly consequential reports. Thursday afternoon brings Apple (AAPL) earnings. As we have seen recently, a big post-earnings move from a mega-cap tech stock – and this is the most mega of the mega-caps – can drag the broad markets in its wake. Friday morning brings the monthly employment data. The combination of Nonfarm Payrolls, Unemployment Rate and wage data have often demonstrated their potential to move markets.

When we wrote about the phenomenon of consistently rising Monday markets, we were at a loss for a solid explanation. We guessed:

Maybe there is something about avoiding major trouble over the weekend that makes traders bullish on Mondays.

That explanation seems to be relevant today. Stocks, if not bonds, seem to be having a bit of a relief rally. With the events facing the markets this week, it will be fascinating to see whether this morning’s good feelings can persist.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. "Characteristics and Risks of Standardized Options"

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.