Gold and gold mining stocks have historically been sought by investors as a defensive play during times of economic uncertainty, one of the biggest reasons being that these assets have had a low to negative correlation to the broader equities market. For the 40-year period through May 9, 2023, the correlation between the S&P 500 and the Philadelphia Gold and Silver Index was negative 0.01, suggesting that the two have moved in opposite directions.

As for when we might see a recession, the economic data continues to be mixed. On the one hand, employment remains strong in the U.S. with a consensus-beating 253,000 new jobs created in April.

This data point is historical, however, and if we look at leading indicators, a fuller picture of the U.S. economy’s health begins to take shape.

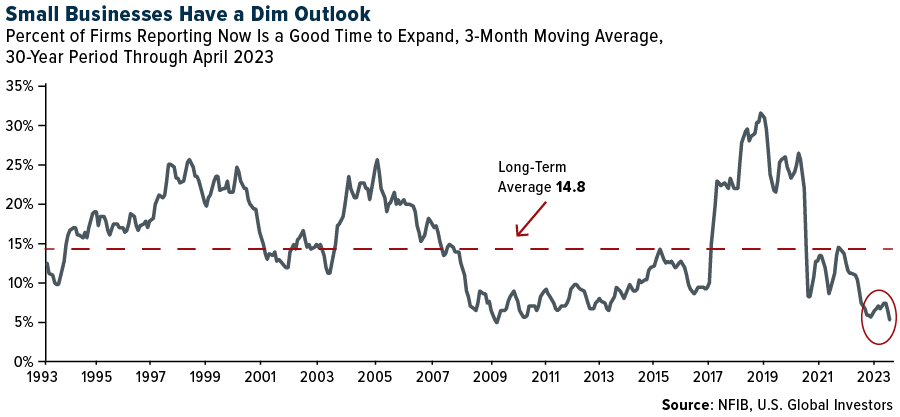

Since 1973, the National Federation of Independent Business (NFIB) has been polling small businesses on their outlook on the U.S. economy and business conditions in general. In April, the NFIB’s Optimism Index sank to 89, the lowest reading in a decade and, as the organization points out, the 16th straight month below the 49-year average of 98.

When asked if the next three months were a good time to expand, only 3% of small businesses said yes in April—meaning 97%, or nearly all, said no. This is slightly up from 2% in March, but on a three-month moving average, the reading is 3.7%. That’s the lowest point since March 2009, when the S&P 500 bottomed during the financial crisis.

Small Businesses As A Leading Indicator

It’s worth pointing out how important small businesses are to the U.S. economy. Huge multinational corporations like Apple and Amazon may get all of the headlines, but I believe small businesses are the real backbone of America.

Loosely defined as those with fewer than 500 employees, these companies represent 99.9% of all firms in the U.S., according to the U.S. Small Business Administration (SBA). They collectively employ 61.7 million Americans as of March, or 46.4% of the workforce, and are responsible for 43.5% of the country’s $26 trillion economy.

In other words, when only 3% of small businesses say the conditions are right to expand, it may be time for investors to diversify with assets that have shown a low to negative correlation to the market. I believe gold and gold equities could be an attractive option.

Diversifying With Gold Royalty Companies

During an economic recession, gold mining stocks can potentially benefit from increased demand for gold as a safe-haven asset. However, their performance depends on factors such as the company’s management, operational efficiency, production costs and the overall health of the mining industry. It’s also worth remembering that gold mining stocks are still equities and can still be affected by broader stock market trends.

That’s why we prefer to focus on high-quality, well-managed companies, which can be an important factor in mitigating risks while also potentially benefiting from their stock performance.

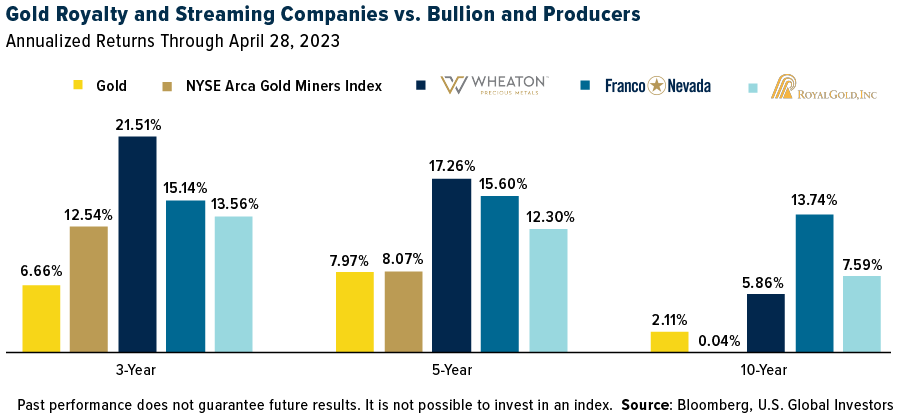

Among our favorites are gold royalty and streaming companies, the largest of which are Franco-Nevada, Wheaton Precious Metals and Royal Gold. As a quick reminder, these companies lend upfront capital to producers and explorers in exchange for either a share of the metal sales (royalty) or a share of the metal itself (stream).

We consider these firms to be the “smart money” of the gold mining industry because they have a history of strong management and operational efficiency. They’ve taken on little to no debt and have allocated their capital wisely, building their stable of active mines across the globe.

You can see the results for yourself below. For the three-, five- and 10-year periods through the end of April, Franco-Nevada, Wheaton Precious Metals and Royal Gold have beaten the price of gold bullion and the NYSE Arca Gold Miners Index.

—

Originally Posted Is It Time To Get Defensive With Gold Mining Stocks?

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Investing involves risk including the possible loss of principal. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Past performance is no guarantee of future results. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. Diversification does not protect an investor from market risks and does not assure a profit.

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Philadelphia Stock Exchange Gold and Silver Index is a capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It provides a indication of the health of small businesses in the U.S., which account of roughly 50% of the nation’s private workforce. Correlation in finance is a measure of the relationship between the returns of two or more assets or investments. Correlation is expressed on a scale of -1 to +1, where -1 indicates a perfect negative correlation, +1 indicates a perfect positive correlation, and 0 indicates no correlation.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund as a percentage of net assets as of 3/31/2023: Wheaton Precious Metals Corp. 2.10%, Royal Gold Inc. 1.13%, Franco-Nevada Corp. 0.95%.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.