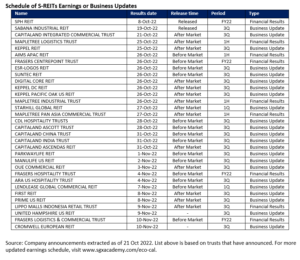

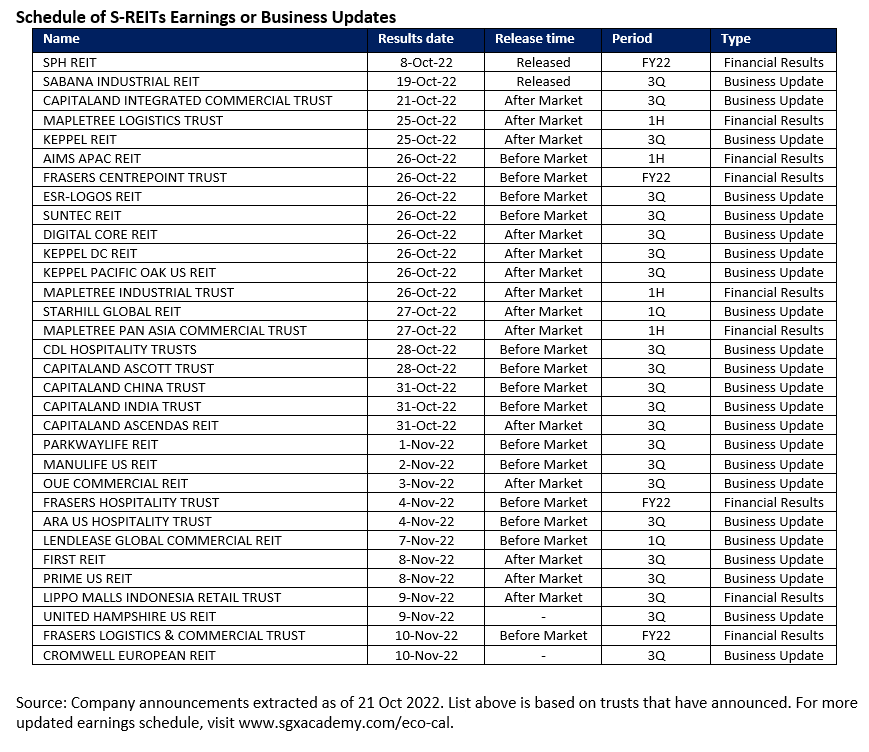

Some 33 S-Reits and property trusts have confirmed dates of their upcoming financial results or business updates for this reporting season, with SPH Reit 0% kicking off the release of its full year FY22 financial results, along with Sabana Industrial Reit’s +1.28% Q3 FY22 business update.

As rising interest rates and inflationary pressures continue to be drivers for the sector, investors will be keeping a close eye on the sector’s operational resiliency and balance sheet strengths.

SPH Reit reported higher distribution per unit of 5.52 Singapore cents for the 12 months ended Aug 31, 2022, up 2.2 per cent from the previous year. The Reit reported 1.7 per cent increase in gross revenue and 3.5 per cent increase in net property income, alongside improvement in rental reversions with a -2.8 per cent portfolio rental reversion rate compared to -8.4 per cent a year ago. With continued emphasis on capital discipline, SPH Reit sees ample debt headroom with a gearing ratio of 30 per cent and a weighted average term to maturity of 2.5 years.

Sabana Industrial Reit updated that it reached portfolio occupancy levels of 89.1 per cent, a new high since Q3FY17. Excluding its Tuas Avenue facility that is currently undergoing asset enhancement, total occupancy would have been 92.2 per cent. The Reit has signed 83,588 sq ft of new leases with tenants primarily from the logistics & supply chain and media & publishing trade sectors. It also renewed 71,266 sq ft of leases with a positive rental reversion of 10.2 per cent, recording 10 positive quarterly reversions over the past 11 quarters. On capital management, aggregate leverage was 33.7 per cent with average borrowing maturity at three years. Looking ahead, the Reit will continue to pursue green initiatives across its portfolio as it looks to improve the assets’ operational efficiency over the medium-term.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted October 25, 2022 – REIT Watch – S-Reits confirm schedule for latest results and updates

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.