According to the latest 2023 Global Data Centre Market Comparison report by Cushman & Wakefield, post-pandemic activity in the data centre space continued from 2021 through to 2022, despite headwinds in the overall economy.

There was a substantial move towards emerging markets, with hyperscale tenants and colocation providers evaluating and announcing new projects worldwide.

Recently, CapitaLand Investment (CLI) also announced the establishment of a China data centre development fund, which has committed to invest in two hyperscale data centre development projects in Greater Beijing.

Upon completion of these projects, it will add approximately S$1 billion to CLI’s funds under management.

Currently, CapitaLand has a portfolio of 26 data centres in Asia and Europe with total assets under management (AUM) of S$6 billion on completed basis.

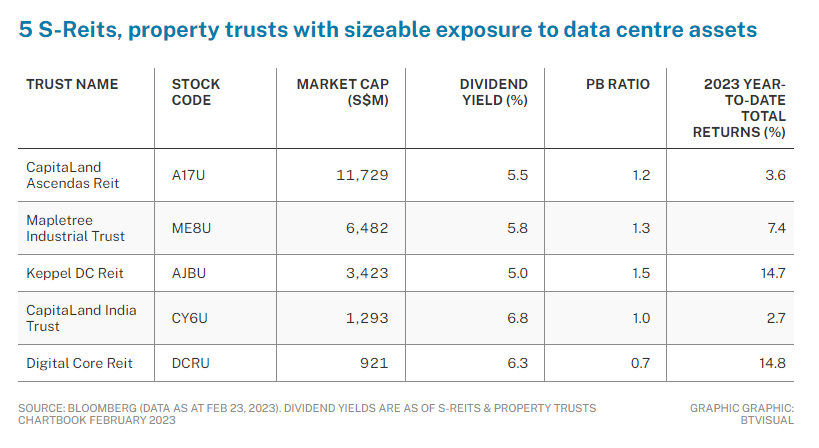

Among its five listed S-Reits & property trusts, two have exposure to the data centre space.

CapitaLand Ascendas Reit (CLAR)’s portfolio today consists of 17 data centre properties across Singapore and Europe, making up 8 per cent of its AUM.

This compares with three data centres which made up 4 per cent of its AUM back in 2020.

In its latest FY2022 results, CLAR noted that 8.9 per cent of its new international tenant demand by gross rental income came from IT and data centre sectors.

CapitaLand India Trust (CLINT) announced in the fourth quarter ended Dec 31, 2022, that it has plans to develop two more data centres in Hyderabad and Chennai in addition to Mumbai and Bangalore.

This brings CLINT’s data centre exposure to four prime India markets.

Aside from CLAR and CLINT, there are three other S-Reits which have significant exposure to the data centre segment. These are Mapletree Industrial Trust as well as Digital Core Reit and Keppel DC Reit.

The latter two are pure-play data centre Reits.

The data centre segment of Mapletree Industrial Trust’s (MIT) portfolio has increased significantly over the past few years.

Its data centre exposure increased from 41.2 per cent of AUM back in March 2021, to 53.5 per cent as at Dec 31, 2022.

Keppel DC Reit (KDCReit) has a portfolio of 23 data centres as at Dec 31, 2022, with AUM of S$3.7 billion.

The Keppel Group has more than S$2 billion in data centre assets, under development and management, through Keppel Corporation’s private data centre funds and KDCReit’s sponsor.

When completed and stabilised, and if it makes sense for the Reit and its unitholders, these are assets that KDCReit can potentially acquire.

Digital Core Reit (DCReit), in its first full-year result release since IPO, announced 3.8 per cent higher NPI of US$69.3 million compared to its IPO forecast.

In 2022, DCReit expanded into a new market through the acquisition of a 25 per cent interest in a freehold facility in Frankfurt.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted February 27, 2023 – REIT Watch – S-REITs increase exposure to data centre assets

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.