FOR the five trading sessions that spanned Sep 23 to 29, the Straits Times Index (STI) declined 4.5 per cent, with the FTSE China A50 Index gaining 1.0 per cent, the Hang Seng Index falling 4.1 per cent and the FTSE Bursa Malaysia KLCI slipping 3.2 per cent.

Overall, institutions were net sellers of Singapore stocks for the five sessions ended Sep 29, with S$420 million of net outflows. OCBC, Sats, UOB, CapitaLand Integrated Commercial Trust and Singapore Airlines led the net institutional outflows during the period.

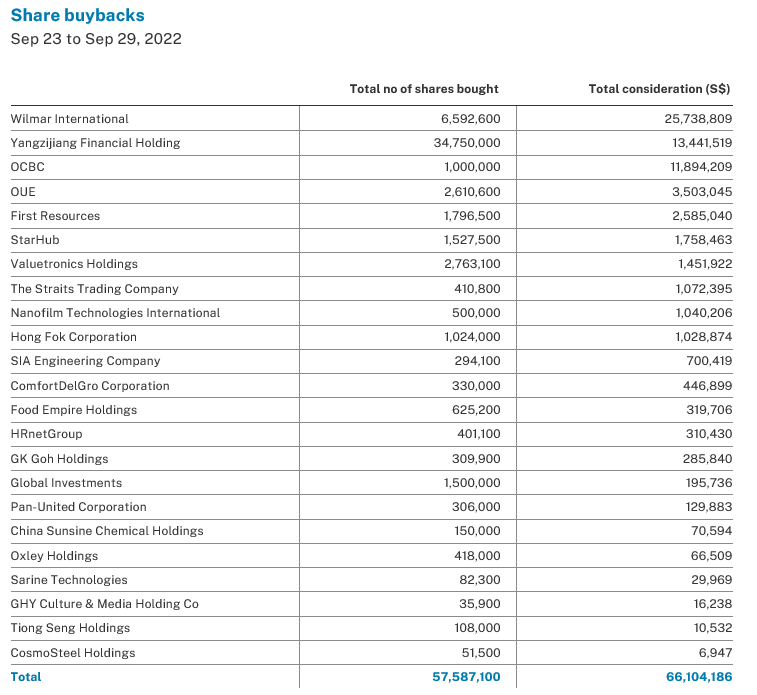

Share buybacks

There were 23 primary-listed stocks conducting share buybacks over the five sessions ended Sep 29, with a total consideration of S$66 million, up from the preceding week’s S$48 million.

Wilmar international again led the five-session buyback consideration tally, buying back 6.59 million shares at an average price of S$3.90 per share. It has bought back 1.07 per cent of its issued shares (excluding treasury shares) on the current mandate, as of Sep 29.

Director and substantial shareholder transactions

The five trading sessions saw more than 100 changes to director interests and substantial shareholdings filed for 40 primary-listed stocks. This included 28 company director acquisitions with three disposals filed, while substantial shareholders filed 11 acquisitions and one disposal.

Suntec Reit

A filing lodged on Sep 27, detailed that the preceding week saw Suntec Reit substantial shareholder Gordon Tang increased his direct interest above the 9.00 per cent threshold. He acquired 600,000 units of the Reit for a consideration of S$979,648 at an average price of S$1.63 per unit, taking his direct interest to 9.02 per cent.

Suntec Reit’s portfolio comprises high quality office assets, complemented by retail and convention components. Of the 10 properties, three are in Singapore, with five located in Australia, and two located in the United Kingdom.

Sabana Industrial Reit

On Sep 28, Sabana Industrial Reit substantial shareholder Quarz Capital Asia (Singapore) increased its deemed interest above the 13.00 per cent threshold. The fund management company acquired 110,000 units of the Reit at 42.5 cents per unit, taking its direct interest from 12.99 per cent to 13.00 per cent.

As of Dec 31, Sabana Industrial Reit maintained a diversified portfolio of 18 quality properties in Singapore, in the high-tech industrial, warehouse and logistics, chemical warehouse and logistics, as well as general industrial sectors.

Lian Beng Group

Between Sep 22 and 28, Ong Sek Chong & Sons acquired 1,476,100 shares of Lian Beng Group. At an average price of 53.3 cents per share, the consideration for the acquisitions totalled S$786,961. The transactions took the total interest of Ong Sek Chong & Sons in the company from 58.30 per cent to 58.59 per cent.

This followed acquisitions of 7,291,000 shares between Sep 12 and 14, and 1,364,200 shares between Sep 15 and 21, at 53.5 cents per share.

Lian Beng Group chairman and managing director, Ong Pang Aik, and executive director, Ong Lay Huan maintain deemed interests in Ong Sek Chong & Sons.

Mapletree Industrial Trust

On Sep 23, Mapletree Industrial Trust Managemen non-executive director Cheah Kim Teck acquired 100,000 units of Mapletree Industrial Trust (MIT) at S$2.47 per unit. This increased his direct interest in the Reit to 250,000 units or 0.01 per cent.

Cheah is currently director, business development of Jardine Cycle & Carriage (JC&C) and is responsible for overseeing JC&C’s investment in Truong Hai Auto Corporation and developing new lines of business in the region. He was formerly the chief executive Oofficer for JC&C’s motor operations (excluding those held by PT Astra International) until he stepped down from his position in December 2013. He also served on JC&C’s board from 2005 to 2014. Prior to joining JC&C, Cheah held several senior marketing positions in multinational companies, namely, McDonald’s Restaurants, Kentucky Fried Chicken and Coca-Cola.

MIT will announce its H1FY23 (ended Sep 30) results after the Oct 26 close. The manager reiterated near the end of August that while inflationary effects are expected to affect distributions negatively, it would adopt cost-mitigating measures while focusing on tenant retention to maintain a stable portfolio occupancy. The MIT portfolio is focused on industrial real estate assets in Singapore, excluding properties primarily used for logistics purposes, as well as data centres worldwide beyond Singapore. Of the 141 properties within the portfolio, there are 85 located in Singapore, with the remaining 56 comprising of data centres located in North America.

Envictus International Holdings

Between Sep 26 and 28, Envictus International Holdings : BQD 0% vice-chairman and non-executive director Sam Goi Seng Hui increased his total interest in the company from 25.96 per cent to 26.05 per cent. He acquired 223,100 shares for a consideration of S$31,234 at 14.0 cents per share. This closely followed his acquisition of 148,900 shares on Sep 15, also at 14.0 cents per share. The executive chairman of Tee Yih Jia Group, GSH Corporation and Hanwell Holdings, joined the board of Envictus International Holdings as vice-chairman and non-executive director on Jan 9, 2013.

Parkway Life Reit

On Sep 28, Parkway Trust Management Limited non-executive director, Joe Sim Heng Joo acquired 6,000 units of Parkway Life Reit for a consideration of S$24,840. This took his direct interest in the Reit to 18,000 units. Sim was appointed as group chief operating officer of IHH Healthcare on Jan 1, 2020 and has more than 19 years’ experience in the healthcare industry.

Prior to joining Parkway Pantai in June 2017, he was group deputy chief executive of National University Healthcare System in Singapore and concurrently the chief operating officer and CEO of National University Hospital.

ISEC Healthcare

On Sep 23, ISEC Healthcare CEO Wong Jun Shyan acquired 66,200 shares at 33 cents per share. With a consideration of S$21,846, this increased his total interest in the company from 4.79 per cent to 4.80 per cent. Dr Wong is an ex-officio member of the Medical Board of ISEC Healthcare. He was also one of the founding members of ISEC KL and has been a consultant ophthalmologist at ISEC KL since 2007. He is considered a key opinion leader in his fields of subspecialty and honorary part-time lecturer for the Department of Optometry, Faculty of Allied Health Sciences in Universiti Kebangsaan Malaysia. For its H1FY22 (ended Jun 30), the international specialist eye centre group reported its profit after tax increased 77 per cent to S$5.57 million from S$3.14 million in H1FY21, mainly due to the significant increase in patient visits and business activities of its eye clinics as countries lifted their international travel restrictions in H1 2022. The acquisition of IE Centre and Kampar Eye also contributed S$1.07 million revenue to the group in H1FY22.

A-Sonic Aerospace

Between Sep 27 and 29, A-Sonic Aerospace CEO Janet LC Tan acquired 36,000 shares for a consideration of S$19,846, at an average price of 55.1 cents per share. This took her direct interest in the company from 60.54 per cent to 60.58 per cent. She has gradually increased her total interest in A-Sonic Aerospace from 53.35 per cent at the end of 2018.

LHT Holdings

On Sep 26, LHT Holdings managing director, Yap Mui Kee, acquired 21,700 shares of the company for a consideration of S$14,980. At an average price of 69.0 cents per share, this took her direct interest in the manufacturer of high-quality wooden pallets, boxes, and crates from 15.11 per cent to 15.15 per cent.

Yap has gradually increased her direct interest in LHT Holdings from 14.12 per cent in August 2021.

She has been an executive director of LHT Holdings since January 1988 and heads the sales and marketing functions of the group. For its H1FY22 (ended Jun 30), the manufacturer of high-quality wooden pallets, boxes, and crates reported its profit before income tax increased 46 per cent to S$3.17 million from S$2.17 million in H1FY21, mostly due to higher gross profit margin and higher other income, mainly due to higher service income from logistics, packaging, and waste collection services.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted October 3, 2022 – S-Reits draw acquisitions from directors and substantial shareholders

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.