The type of market gyrations that we have seen over the past few trading sessions can be very treacherous for active traders, particularly those without a disciplined strategy. Traders who fall victims to markets that swing back and forth are said to be “whipsawed”. The term refers to an old lumberjack’s tool, a two-man saw that is pushed and pulled rapidly and can swing wildly if one user lets go:

The equity market’s version of a whipsaw looks like the following, illustrated by a 10-minute chart in SPY that displays the sharp swings that have punctuated the broader indices:

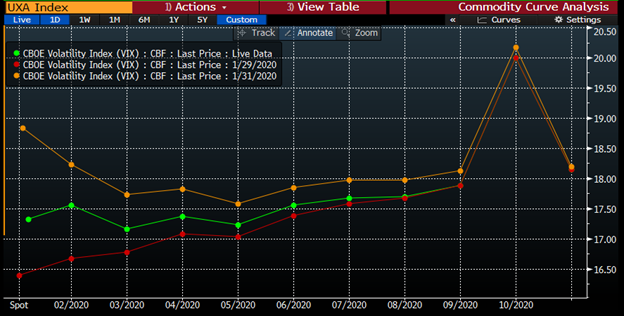

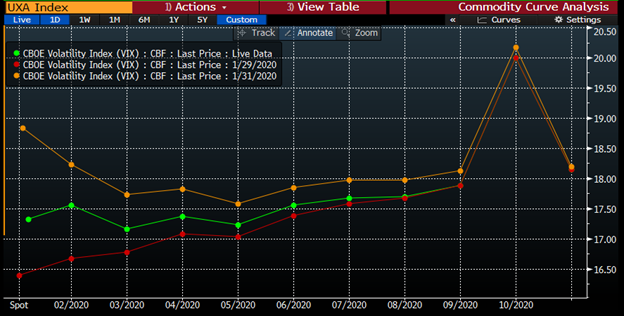

And the options market’s version of a whipsaw looks like this, illustrated by comparing snapshots of the VIX futures curves 3 days ago and 1 day ago to the current one:

I expect that many readers find the first graph familiar but would be unaccustomed to seeing the second. Futures on the VIX index are actively traded and usually show an upward sloping curve when the forward months are displayed on a graph. That phenomenon, displayed for most of the red line is known as “contango”, the normal state of most futures markets. Contango reflects a relatively stable supply of a given commodity and the risk-free rate of capital over that time period. The opposite phenomenon, shown for most of the orange line is called “backwardation”. That reflects relative scarcity. The current reading, displayed on the green line, displays a disjointed market for volatility.

Many of you may be wondering about the large hump at the back of the curves. That hump reflects the preemptive volatility hedging that is occurring in the markets ahead of November’s Presidential election. The bumps that we see in the upcoming months may be reflecting uncertainty surrounding the Democratic primary process.

While savvy traders will often view market movements as opportunities, they throw the tradeoff between risk and reward into focus. Here are some tips that I find helpful for avoiding losses in market environments like the current one:

- Know your loss tolerance in advance! If a 2% drawdown in the S&P500 is enough to cause you pain, then you are taking on too much risk. Fast moving markets tend to have wider spreads and quotes that can seem ephemeral, making it very difficult to cut risk while others are hoping to do the same. Knowing your risk tolerance also helps you with the next suggestion…

- Don’t panic! Panic means that you are acting viscerally, not intellectually. A trader’s “gut” can be a very important decision tool, but not when it outweighs the signals sent by that trader’s brain.

- You can make money trading delta (the moves in the underlying) and you can make money trading volatility, but it is incredibly difficult to do both in the same trade. If a trader is engaging in a trade that attempts to capture movements in volatility – using a call spread, for example – he needs to be careful about exposing himself to unhedged delta exposure. Conversely, if a trader attempts to trade a direction move using outright puts or calls, that trader needs to be conscious that a move in the underlying asset is likely to be accompanied by a change in its implied volatility

- Go wider. Market makers protect themselves by widening their quotes, while individual options traders can protect themselves by widening their strike or time horizons. The VIX graphs above show that there is plenty of profit potential by trading beyond the front months, though the swings are more manageable. By widening one’s strike space, you avoid selling near money calls and puts that suddenly become in the money.

These are some of the techniques that numerous other techniques that I have learned from decades of trading. I’ll be glad to reveal more in future articles and videos.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.