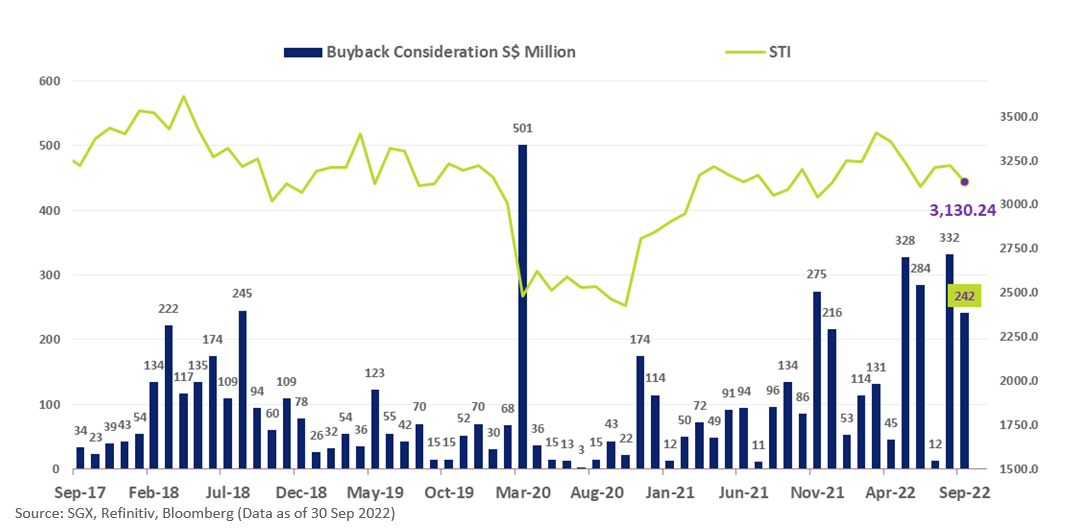

- In 3Q22, 46 primary-listed companies bought back shares with a total consideration of S$586 million, bringing the total buyback consideration for the first nine months of 2022 to S$1.54 billion, up c.150% from S$609 million for the same period in 2021.

- Non-STI stocks with the highest 3Q22 buyback consideration included YZJ Financial Holding, The Hour Glass, OUE, First Resources and Hong Fok Corporation. As of 30 Sep, YZJ Financial Holding had bought back 5.22% of its issued shares (excluding treasury shares). The 3Q22 buybacks were conduced at an average price of 38.2 cents per share.

- The Hour Glass commenced a new buyback mandate in 3Q22, with 2.05% of its shares bought back between 3 Aug and 30 Sep. The previous mandate saw 3.49% of its shares bough back through to 26 July. This saw the leading specialist watch retailer buy back 13.95 million shares in 3Q22, at an average price of S$2.23 per share.

During 3Q22, the STI generated a 0.9% price gain, with dividend distributions boosting the total return to 2.4%. This compared a 3.2% decline in total return for the FTSE Developed Index, with global bank stocks printing approximately half the declines of global technology stocks. During the quarter, 41% of the trading sessions saw STI annualised 30 day volatility above 10%, which was down from 89% in 2Q22.

Total buyback consideration was comparatively more consistent, with 46 primary-listed companies buying back shares with a total consideration of S$586 million, which was down from the S$657 million in consideration filed for 2Q22, but up from the S$241 million in consideration filed for 3Q21. The month of July 2022 saw the least monthly buyback consideration filed for Singapore’s primary-listed stocks since July 2021, which was a seasonal effect leading into seasonal semi-annual reporting. The following month of August 2022 saw the highest buyback consideration filed since the comparatively more volatile conditions of March 2020.

The table below details the primary-listed stocks that conducted share buybacks in 3Q22. Of the 10 stocks that led the buyback consideration tally in 3Q22, nine have also led the buyback consideration tally for the first nine months of 2022. These stocks were Keppel Corporation, Wilmar International, Oversea-Chinese Banking Corporation, CapitaLand Investment, Yangzijiang Financial Holding, The Hour Glass, Singapore Telecommunications, Singapore Technologies Engineering and OUE.

| Primary-listed Stocks that Conducted Buybacks in 3Q22 | Number of Shares/units Purchased | Buyback Consideration (including stamp duties, clearing changes etc.) paid or payable for the shares | Avg price paid per share | Pct of Shares bought back on Current Mandate% |

| WILMAR INTERNATIONAL | 34,575,300 | $140,544,901 | $4.065 | 1.07 |

| KEPPEL CORPORATION | 19,024,500 | $136,187,343 | $7.159 | 2.70 |

| OVERSEA-CHINESE BANKING CORPORATION | 8,000,000 | $97,180,549 | $12.148 | 0.37 |

| YANGZIJIANG FINANCIAL HOLDING | 192,065,600 | $73,305,167 | $0.382 | 5.22 |

| THE HOUR GLASS | 13,953,000 | $31,129,043 | $2.231 | 2.05 |

| CAPITALAND INVESTMENT | 6,903,600 | $26,729,210 | $3.872 | 0.68 |

| OUE | 11,743,800 | $15,785,929 | $1.344 | 1.52 |

| SINGAPORE TELECOMMUNICATIONS | 3,662,791 | $9,752,800 | $2.663 | 0.02 |

| FIRST RESOURCES | 5,327,200 | $7,742,285 | $1.453 | 0.34 |

| SINGAPORE TECHNOLOGIES ENGINEERING | 2,000,000 | $7,712,640 | $3.856 | 0.13 |

| HONG FOK CORPORATION | 5,264,800 | $5,304,566 | $1.008 | 1.75 |

| SEMBCORP INDUSTRIES | 1,300,000 | $4,216,139 | $3.243 | 0.07 |

| VALUETRONICS HOLDINGS | 7,799,600 | $4,128,026 | $0.529 | 1.57 |

| G K GOH HOLDINGS | 3,620,700 | $3,331,833 | $0.920 | 1.72 |

| NANOFILM TECHNOLOGIES INTERNATIONAL | 1,521,800 | $3,262,500 | $2.144 | 0.21 |

| HRNETGROUP | 3,247,700 | $2,548,182 | $0.785 | 0.43 |

| STARHUB | 1,610,000 | $1,855,938 | $1.153 | 0.93 |

| JAPFA | 2,864,100 | $1,729,835 | $0.604 | 0.14 |

| FOOD EMPIRE HOLDINGS | 3,254,200 | $1,720,277 | $0.529 | 0.61 |

| GLOBAL INVESTMENTS | 10,800,000 | $1,510,670 | $0.140 | 1.86 |

| COSMOSTEEL HOLDINGS | 8,000,900 | $1,193,635 | $0.149 | 10.00 |

| GEO ENERGY RESOURCES | 3,000,000 | $1,077,521 | $0.359 | 0.21 |

| THE STRAITS TRADING COMPANY | 410,800 | $1,072,395 | $2.611 | 0.09 |

| SIA ENGINEERING COMPANY | 443,900 | $1,059,025 | $2.386 | 0.04 |

| CHINA SUNSINE CHEMICAL HOLDINGS | 1,831,100 | $872,640 | $0.477 | 0.24 |

| OXLEY HOLDINGS | 4,516,600 | $744,544 | $0.165 | 0.17 |

| PAN-UNITED CORPORATION | 1,641,600 | $708,530 | $0.432 | 0.42 |

| COMFORTDELGRO CORPORATION | 495,000 | $675,718 | $1.365 | 0.04 |

| AEM HOLDINGS | 140,000 | $592,318 | $4.231 | 0.09 |

| SARINE TECHNOLOGIES | 1,180,300 | $464,453 | $0.394 | 0.50 |

| IFAST CORPORATION | 106,900 | $400,977 | $3.751 | 0.17 |

| SPACKMAN ENTERTAINMENT GROUP | 65,266,000 | $327,356 | $0.005 | 3.43 |

| TIONG WOON CORPORATION HOLDING | 400,000 | $191,741 | $0.479 | 0.17 |

| GHY CULTURE & MEDIA HOLDING CO | 408,300 | $191,682 | $0.469 | 0.12 |

| ALLIANCE HEALTHCARE GROUP | 1,000,000 | $174,314 | $0.174 | 1.03 |

| BOUSTEAD SINGAPORE | 175,000 | $159,945 | $0.914 | 0.04 |

| MAXI-CASH FINANCIAL SERVICES CORPORATION* | 884,000 | $144,664 | $0.164 | 0.04 |

| BAN LEONG TECHNOLOGIES | 269,100 | $121,508 | $0.452 | 0.64 |

| PEC | 150,000 | $94,232 | $0.628 | 0.06 |

| TELECHOICE INTERNATIONAL | 448,000 | $53,698 | $0.120 | 0.22 |

| INTRACO | 151,700 | $48,208 | $0.318 | 0.30 |

| JUMBO GROUP | 126,200 | $33,577 | $0.266 | 0.02 |

| TUAN SING HOLDINGS | 51,300 | $19,444 | $0.379 | 0.02 |

| TIONG SENG HOLDINGS | 160,000 | $15,731 | $0.098 | 0.04 |

| CSC HOLDINGS | 1,000,000 | $13,049 | $0.013 | 0.03 |

| EUROSPORTS GLOBAL | 10,100 | $1,921 | $0.190 | 1.71 |

| Total | 430,805,491 | $586,130,658 |

* Company name now Aspial Lifestyle, Source: SGX, Refinitiv, Bloomberg (Data as of 30 Sep 2022)

Share buyback transactions involve share issuers repurchasing some of their outstanding shares from shareholders through the open market. Once the shares are bought back, they can be converted into treasury shares, which means they are no longer categorised as shares outstanding. Motivations for share buybacks can include employee compensation plans (such as share option schemes or employee share purchase plans) or long term capital management. Buybacks have also been observed to broadly pick up amidst market declines that are driven by international macroeconomic developments.

Share buyback information can be found on the company disclosure page on the SGX website, using the Announcement category and sub-category of Share Buy Back-On Market (click here). As best practice, companies should refrain from buying back their shares during the two weeks immediately before semi-annual financial statements and one month immediately before the full-year financial statements.

—

Originally Posted October 6, 2022 – Share Buyback Consideration of Primary Listings total S$586M in 3Q22

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.