Here are three entertainment stocks to watch in the stock market now.

Entertainment stocks are publicly traded companies that derive a significant portion of their revenue from the entertainment industry. The industry includes businesses involved in the production and distribution of film, television, music, sports, gaming and other forms of entertainment. Entertainment stocks are often volatile, as they tend to be highly dependent on consumer spending. For example, the global pandemic has had a major impact on the entertainment industry, resulting in widespread cancellations and postponements.

As a result, many entertainment stocks have declined sharply in value. However, the industry is expected to recover in the long term as people continue to return to normalcy. Entertainment stocks offer investors an opportunity to profit from the continued growth of the entertainment industry. Considering this, let’s look at three trending entertainment stocks to check out in the stock market right now.

Entertainment Stocks To Watch Right Now

- Roku Inc. (NASDAQ: ROKU)

- Netflix Inc. (NASDAQ: NFLX)

- The Walt Disney Company (NYSE: DIS)

Roku Inc. (ROKU Stock)

Leading off, Roku Inc (ROKU) is a consumer electronics company that specializes in digital media players. The company manufactures Roku streaming devices, which are used to access Roku’s platform of streaming content and Roku Channel Store.

Earlier this month, Roku reported its financial results for Q3 2022. In the report, the streaming company announced a loss of $0.78 per share and revenue of $761.4 million for Q3 2022. This is versus analysts’ consensus estimates which was a loss of $1.27 per share, with revenue of $901.7 million for the quarter. What’s more, the company’s revenue increased by 12% versus the same period, in 2021.

In the company’s letter to shareholders, they commented, “In Q3, we delivered meaningful growth in scale and engagement. We added 2.3 million incremental Active Accounts, and The Roku Channel’s Streaming Hours increased more than 90% year over year. Platform revenue grew 15% year over year, which was lower than our historical growth rates but positive given the difficult macro environment.” Meanwhile, on Wednesday afternoon shares of ROKU stock are up 4.22%, trading at $56.66 a share.

Netflix (NFLX Stock)

Now, let’s turn our focus to Netflix (NFLX). For starters, Netflix is a streaming service that offers a wide variety of TV shows, movies, anime, documentaries, and more on thousands of internet-connected devices. For a sense of scale, the company currently has 222 million paid memberships in over 190 countries. Moving along, just last month Netflix reported better-than-expected third-quarter 2022 financial results.

In detail, the streaming giant reported Q3 2022 revenue of $7.9 billion and an EPS of $3.10. This came in better than analysts expected, which was earnings of $2.11 per share, and revenue of $7.8 billion for the third quarter of 2022. Additionally, Netflix said it expects Q4 2022 earnings of approximately $0.36 per share, and revenue estimates of approximately $7.776 billion.

Moreover, in the release to shareholders, Netflix’s management team had this to say about the quarter, “After a challenging first half, we believe we’re on a path to reaccelerate growth. The key is pleasing members. It’s why we’ve always focused on winning the competition for viewing every day. When our series and movies excite our members, they tell their friends, and then more people watch, join and stay with us.” During Wednesday’s power hour trading session, shares of NFLX stock are up 1.77% at $291.78 a share.

Walt Disney Company (DIS Stock)

Topping off the list, The Walt Disney Company (DIS) is a diversified entertainment company. Specifically, Walt Disney Co has operations across five business segments: Media Networks, Parks and Resorts, Studio Entertainment, Consumer Products, and Interactive.

Just this week, the company announced today that it has appointed Robert A. Iger to come back and lead Disney as Chief Executive Officer. For the uninitiated, Mr. Iger has spent more than 40 years with the company, 15 of those years as its CEO.

Mr. Iger commented, “I am extremely optimistic for the future of this great company and thrilled to be asked by the Board to return as its CEO. Disney and its incomparable brands and franchises hold a special place in the hearts of so many people around the globe—most especially in the hearts of our employees, whose dedication to this company and its mission is an inspiration.“

Since this news announcement, shares of DIS stock have increased by 7.58%. Meanwhile, on Wednesday afternoon, Walt Disney Co stock is trading up 2.99% at $99.10 a share.

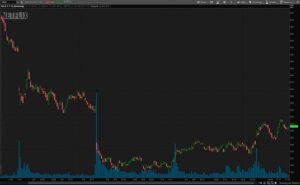

Source: TD Ameritrade TOS

—

Originally Posted November 23, 2022 – Stocks To Consider Now? 3 Entertainment Stocks To Check Out

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.