Are these the value stocks to consider for 2023?

Value stocks are those that are believed to be trading at a discount to their intrinsic value. This can be due to a variety of reasons. For example, a temporary downturn in the company’s performance, a lack of investor interest, or simply because the market is not properly valuing the company’s future potential. As a result, value investors believe that these stocks have the potential to significantly appreciate in value over time as the market catches up to their true worth.

What Makes a Stock a Value Stock?

Value stocks are typically identified based on certain metrics – such as price-to-earnings (P/E) ratios or price-to-book (P/B) ratios – that suggest that the stock is undervalued compared to its peers. For example, when assessing a company’s P/E ratio, an investor looks at how much money it would cost to buy one share of the stock relative to how much profit the company is making per share. A lower P/E ratio suggests that the stock is undervalued. As result, investors could find them attractive if they believe they can benefit from buying them at a bargain price.

Benefits Of Investing [Or Avoiding] Value Stocks

Investing in value stocks offers many benefits to investors including lower risk compared to other types of investments. For example, growth or speculative stocks; greater diversification; and higher potential returns due to the fact that these types of investments are often trading at discounts relative to their intrinsic values.

Additionally, since many value stocks tend to be low-volatility investments, they can provide stability for portfolios during market downturns while still providing upside potential when markets recover. Considering this, let’s check out three value stocks to watch in the stock market for 2023.

Value Stocks To Watch For 2023

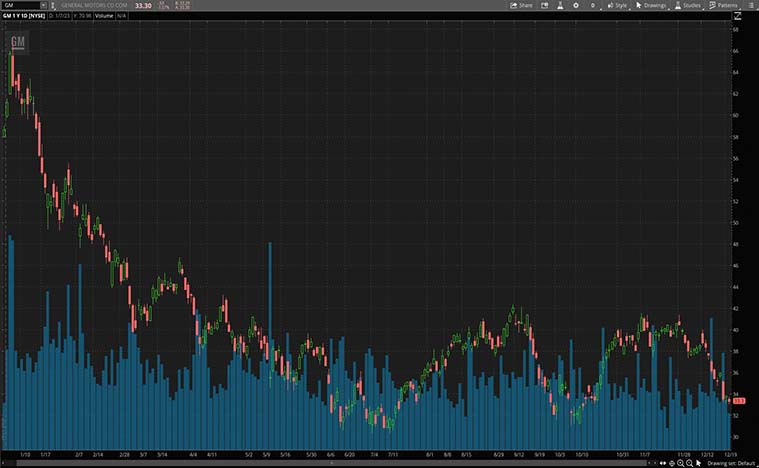

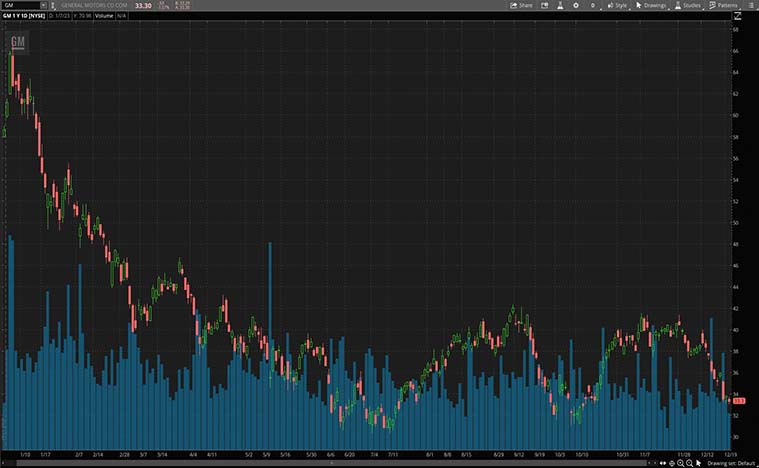

General Motors (GM Stock)

First, General Motors Company (GM) is the largest American automobile manufacturer and one of the biggest carmakers in the world. General Motors designs, manufactures, markets, and distributes cars, trucks, vans, and commercial vehicles.

Last month, General Motors announced that it expects its electric vehicle (EV) portfolio to be profitable in North America by 2025. This comes as the company looks to scale up production capacity to more than 1 million units annually, generating significant greenhouse gas benefits and benefits from clean energy tax credits. GM plans to aggressively pursue EV leadership in the next three years, as EV adoption is expected to reach 20% of US industry sales in 2025.

Meanwhile, as of December 27, 2022, General Motors Company has a PE Ratio of 5.658. Also, shares of GM stock have dropped 45.53% year-to-date. As of Tuesday’s closing bell, GM stock is trading at $33.32 a share.

Source: TD Ameritrade TOS

AT&T Inc. (T Stock)

Next, let’s look at AT&T Inc. (T). AT&T Inc. is an American multinational conglomerate that primarily provides communication services and entertainment across the world. AT&T provides its customers with wireless, broadband, and business services, among other services.

Just this month, the company announced that it has declared a quarterly dividend of $0.2775 per share on its common shares. As well as quarterly dividends on its Series A and Series C preferred stock. The Series A dividend is $312.50 per preferred share and the Series C dividend is $296.875 per preferred share. The dividends will be payable to shareholders on February 1, 2023 to stockholders of record on January 10, 2023.

Aside from that, as of December 27, 2023, AT&T has a PE ratio of 6.833. Moreover, shares of T stock are down 3.80% so far in 2022, outperforming the broader markets YTD. Meanwhile, on Tuesday, AT&T stock closed modestly higher on the day by 0.82% at $18.46 a share.

Source: TD Ameritrade TOS

Pfizer (PFE Stock)

Finishing off the list is Pfizer Inc. (PFE). Pfizer Inc. is a multinational pharmaceutical company. It produces medicines, vaccines, biologic therapies, and consumer products. Pfizer primarily focuses on the discovery, development, and manufacture of medicines throughout the world.

The company’s board of directors announced an increase in the quarterly cash dividend on its common stock to $0.41 for the first quarter of 2023. The dividend is payable on March 3, 2023, to shareholders of record on January 27, 2023. As a result, this will be the 337th consecutive quarterly dividend paid by the company. The increase in the dividend reflects the company’s strong financial performance in 2022 and demonstrates its commitment to returning value to shareholders.

As of December 27, 2022, Pfizer has a PE Ratio of 9.831. Meanwhile, as of the end of the day Tuesday, shares of PFE stock closed lower by 1.35% at $51.13. Year-to-date, Pfizer stock has dropped by 9.74%.

Source: TD Ameritrade TOS

—

Originally Posted December 27, 2022 – Value Stocks To Consider For 2023? 3 To Watch

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from StockMarket.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or StockMarket.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)