CMT Association’s Market Insights features timely technical analysis of current global markets by veteran CMT charterholders. Each post appears on www.tradingview.com/u/CMT_Association/ in an effort to explain process, tools, and the responsible practice of technical analysis. Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

In part one, we discussed using a market momentum matrix to anticipate the business cycle, the potential inflection in the macro environment and shared the final distillation of the current momentum matrix. In part 2 we discuss how the MACD oscillator is used to build the matrix.

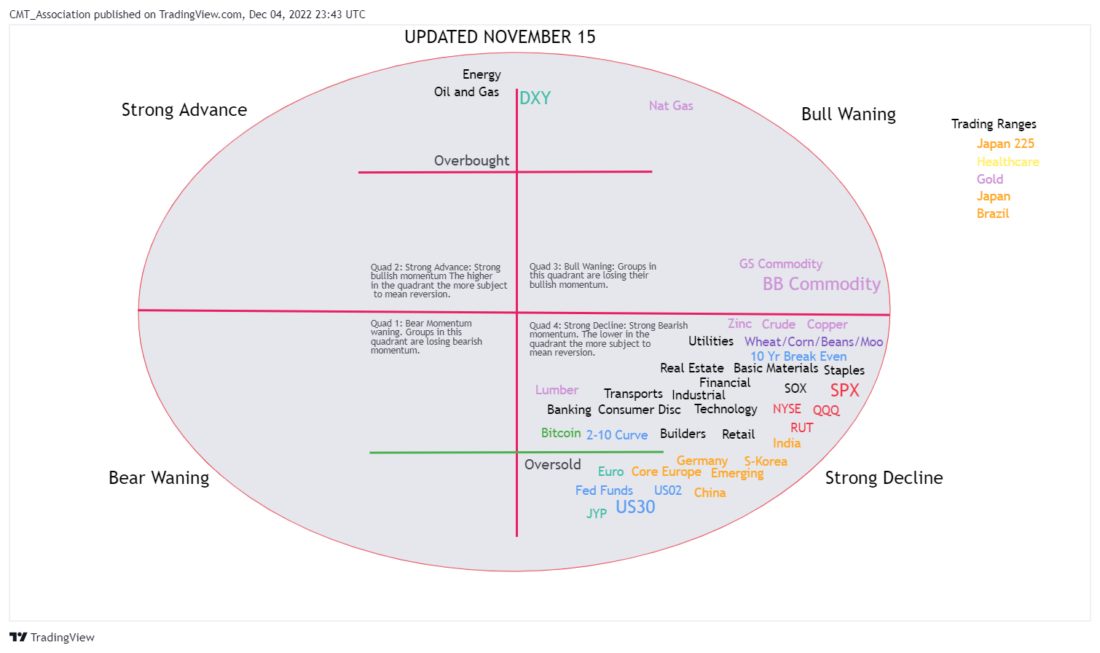

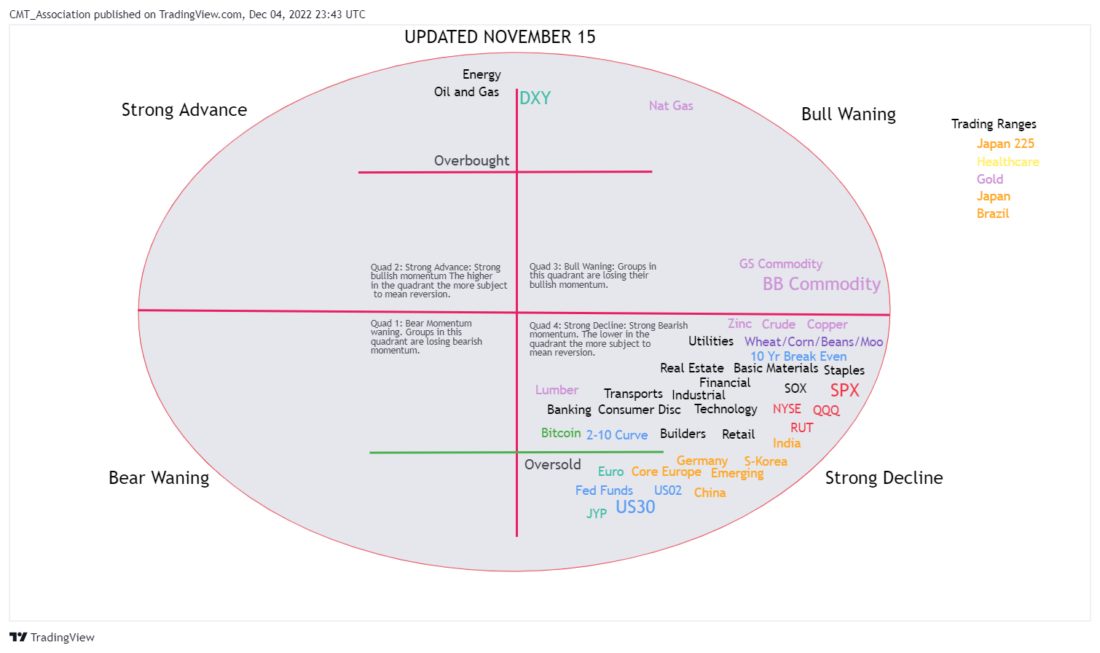

Methodology: Individual markets and ratios are plotted in the quadrant that best describes their combination of momentum and price action. The precise point where the individual plots fall in the matrix is not nearly as important as the overall pattern of multiple plot points and the general weight of the evidence. It is important to realize that the momentum state is not always obvious. Accept that its messy and use your best judgement in deciding on quadrants. The idea is to build a general view of the market and economic cycle.

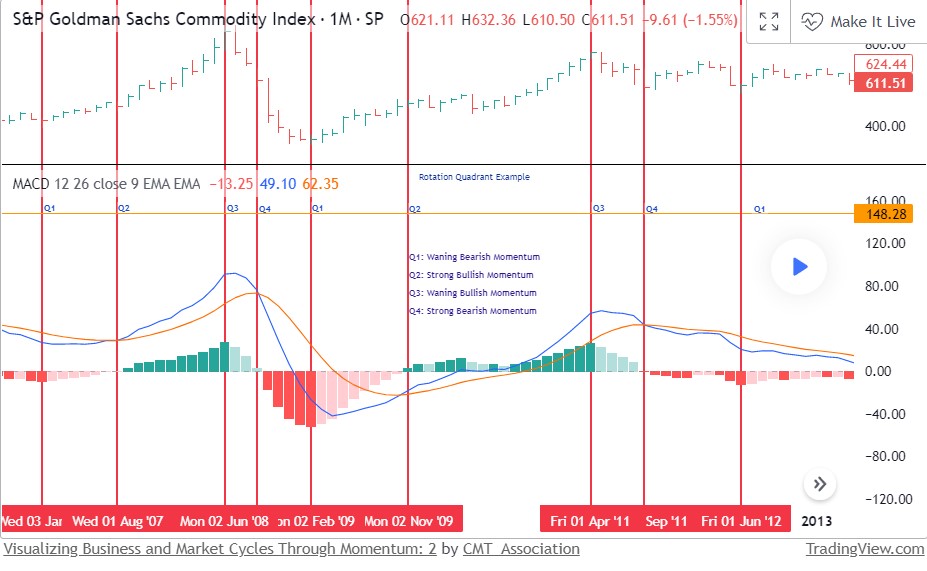

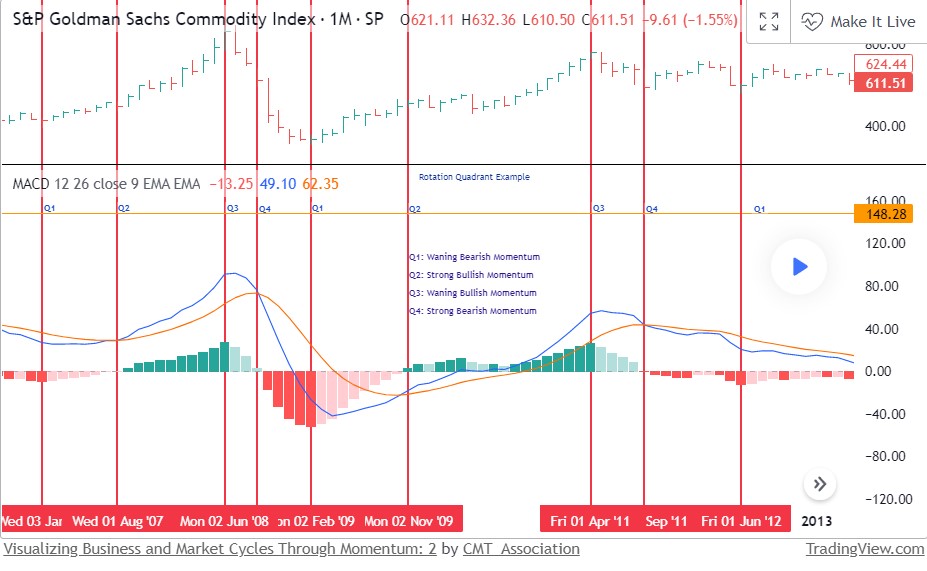

What defines the momentum quadrant? The monthly perspective moving average convergence divergence oscillator (MACD). The individual quadrants reflect the relationship between the 13 and 26 month exponentially smoothed averages.

Quadrant One: Waning Bear: In this quadrant momentum is bearish with the shorter average below the longer average, but the difference between the two is becoming less. Momentum is still lower, but at a decreasing rate.

Quadrant Two: Strong Advance: In this quadrant momentum is bullish with the shorter average above the longer average and the difference between the two is becoming greater. Momentum is higher at an increasing rate.

Quadrant Three: Waning Bull: In this quadrant momentum is bullish with the shorter average above the longer average, but the difference between the two is becoming less. Momentum is still higher, but at a decreasing rate.

Quadrant Four: Strong Decline: In this quadrant momentum is bearish with the shorter average below the longer average and the difference between the two is becoming greater. Momentum is lower at an increasing rate.

Trading Ranges: A market in a trading range is removed from the matrix until it breaks from the range even if MACD momentum has been falling/rising for months.

Recycling: It is not unusual for auctions to become overbought or oversold, lose momentum, move into a neighboring quadrant for a few months and then cycle back. When this happens, use your judgment as to which quadrant to place the auction in. This pattern most typically occurs in an market that has reached a momentum extreme in the perspective of one lower degree and typically appears only once.

I think this is currently happening in equities. Bearish momentum is waning as weekly momentum became deeply oversold, but monthly price charts, in my estimation, don’t support a change in trend.

In part 3 we will place individual auctions into the matrix and begin to outline market relationships to the business cycle.

And finally, many of the topics and techniques discussed in this post are part of the CMT Associations Chartered Market Technician’s curriculum.

—

Originally Posted December 4, 2022 – Visualizing Business and Market Cycles Through Momentum: 2

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: CMT Association

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CMT Association and is being posted with its permission. The views expressed in this material are solely those of the author and/or CMT Association and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)