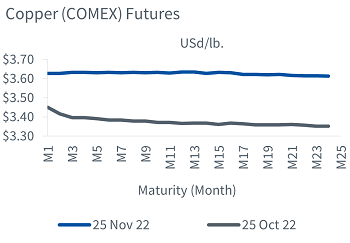

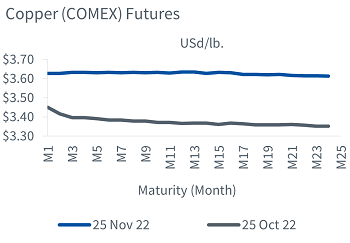

Something curious has happened in the copper market: copper futures curves have shifted into contango from a state of backwardation1. Backwardation is a sign of market tightness: people are willing to spend more on copper for immediate delivery rather than lock into a contract and wait a month at a lower price. As far as we can tell, the copper market is super-tight. A reversion to contango, we believe, doesn’t signify a loosening of the market and we believe backwardation will reign again soon.

Curious contango

Both CME COMEX2 and LME3 curves have made the transition. In fact, several base metals including lead, tin, and zinc have flipped to contango in recent weeks from backwardation. Investors in rolling futures strategies benefit from backwardation: as the futures prices approach spot through the passage of time (assuming curve shape does not change), its price should rise.

Source: Bloomberg WisdomTree. Data from 25 November 2022 and 25 October 2022. USd/lb = cents per pound, USD/MT = Dollars per Tonne.

Historical performance is not an indication of future performance and any investments may go down in value.

Rolling futures have outperformed spot this year

So far this year, the Bloomberg Commodity Industrial Metals Total Return Subindex has outpaced the Bloomberg Commodity Industrial Metals Spot Index: a product of backwardation in base metals. The erosion of backwardation could threaten this outcome.

Source: Bloomberg WisdomTree. Data from 1/1/2022 to 30/11/2022. Total Return = Bloomberg Commodity Industrial Metals Total Return Subindex and Spot = Bloomberg Commodity Industrial Metals Spot Index.

Historical performance is not an indication of future performance and any investments may go down in value.

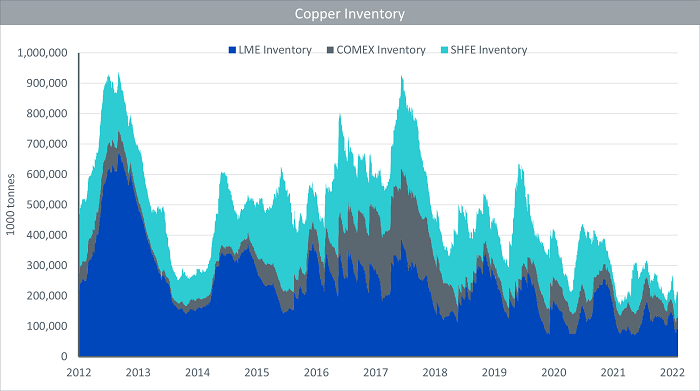

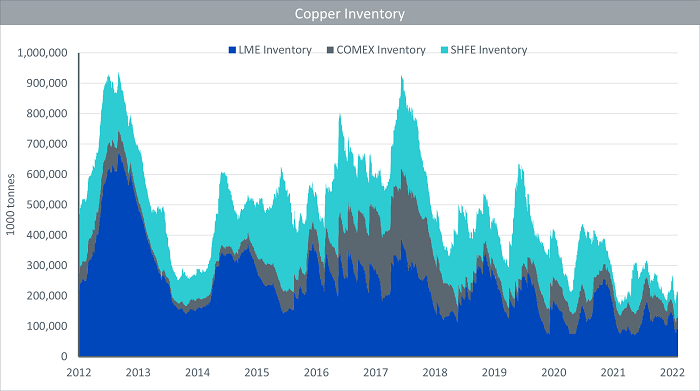

Inventory perilously low

However, we believe contango will be short-lived as tightness remains. Firstly, copper inventory levels are very low. A small uptick in Shanghai inventory in the past month may not be sustainable if China starts to soften its excessive zero-COVID policies.

Source: Bloomberg WisdomTree. Data from 22/10/2012 to 25/11/2022. Chicago Mercantile Exchange’s Commodity Exchange (COMEX), London Metal Exchange (LME), Shanghai Futures Exchange (SHFE).

Historical performance is not an indication of future performance and any investments may go down in value.

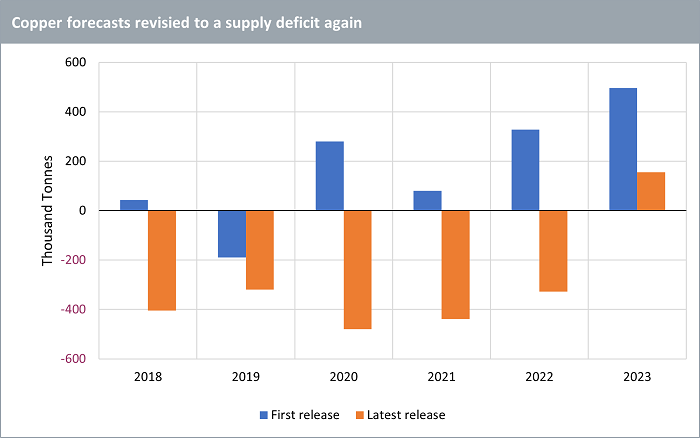

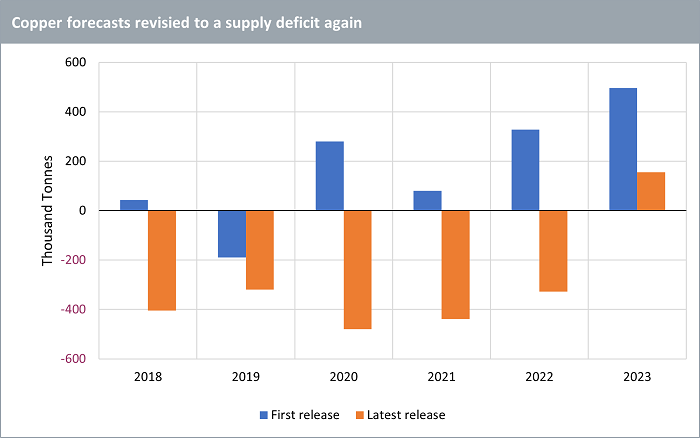

Further deficits to come

Copper production forecasts are falling fast. The International Copper Study Group (ICSG)’s first forecast for 2022 copper balances (demand less supply), cast in October 2021, was for a sizeable surplus of 328 thousand tonnes. Its latest forecast (cast on 19 October 2022) is for a deficit of 328 thousand tonnes in 2022.

Source: WisdomTree, International Copper Study Group (ICSG). ICSG’s latest forecast from 19 October 2022.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Since the ICSG put these forecasts out, we have seen further signs of tightening in the market and we doubt that 2023 will be a surplus year. Codelco, the world’s biggest copper producer, will halve its refined copper sales to China in 2023, citing major production challenges at its Chuquicamata complex and closure of the Ventanas smelter, both in Chile. One of the main unions at BHP’s Escondida copper mine in Chile rejected a company proposal to address alleged contract and safety breaches on 24 November. Failure to reach an agreement could result in strikes in the coming days.

Investors finally taking note

Positioning in copper futures appears to have been weighed down by macro concerns. With central banks bent on killing inflation and risking a recession, many investors have ignored the fundamentals in copper and focused on potential for demand destruction. But the mood is shifting. Speculative positioning in copper has shifted to net long after being net short since March 2022.

Source: Bloomberg WisdomTree. Data from 25/11/2017 to 25/11/2022. Chicago Mercantile Exchange’s Commodity Exchange (COMEX). Stdv = standard deviation.

Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

Copper supply is tight and we expect a state of backwardation to return very soon.

Sources

1 Commodity ETPs are Exposed to Futures Contracts Not the Physical Spot. Why Does it Matter?

2 Chicago Mercantile Exchange’s Commodity Exchange.

3 London Metal Exchange

—

Originally Posted December 1, 2022 – What’s Hot: Dr Copper’s misdiagnosis

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)