What you need to know about the SG market

#whatstrending feat. Syfe

Ever wondered what is currently driving the local and regional markets? #whatstrending is a new series addressing some of the most trending questions/topics on the markets for investors. Designed to be educational, expect to get factual information on what is driving sectors and stocks listed on SGX, featuring insights from professionals in the community.

Today, we hear more from Syfe, a digital platform now offering Singapore listed-stocks. Samantha Horton, Chief Business Officer, shares her thoughts on market developments.

Q: With the recent market volatility and rate hikes, what have you observed in terms of investor trends?

From Samantha Horton, Chief Business Officer:

Individual investors tend to turn towards more familiar local stocks during times of increased volatility.

Intuitively, this makes sense as local investors are able to more easily have access to data points and earnings information on Singapore companies operating in their homeground – for example policy shifts, or have malls added new tenants, are restaurants full, how easy it is to book a table at restaurants on weekends, the chatter about how expensive traveling is getting. These inform investors on how a company is faring and how much potential pricing power they have, in addition to gauging broader economic momentum.

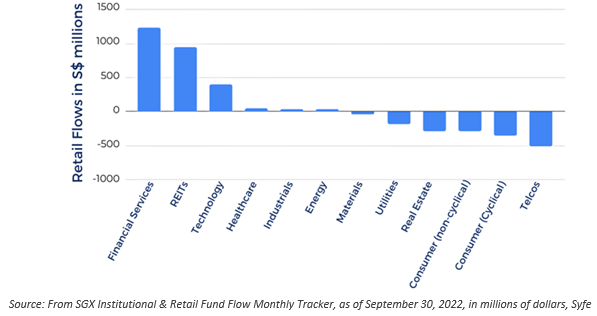

Looking at investor flow data from SGX, retail investors have poured assets into Singapore-listed stocks with Financial Services, REITs and Technology gaining the most net inflows.

Creating a globally diversified portfolio

Singapore, being an export-led and open economy, would be tied to the business cycles of the largest economies of the world and the global macroeconomic environment. However, looking at financial markets data, there are still diversification benefits for investors looking to add Singapore-listed stocks to their US-heavy holdings and vice versa.

Over the last one and two years, correlation between STI and S&P 500 has been low (<0.2). So far this year, Singapore stocks have provided better downside protection in comparison during this period of drawdown. Over a longer time period, 3 years and 5 years, the correlation increases to 0.6-0.7 as equities globally have had a good run.

Just like how sports teams tend to perform better for home games as compared to away games, homeground advantage in investing exists too!

Looking at World Cup victories, teams from Uruguay, Italy, England, Germany, Argentina, France won when the tournament was held at home. The 2014 World Cup was especially heartbreaking for Brazil though!

This phenomenon of “winning at home” is supported by academic research too: several authors including Feng and Seasholes (2004), Ivkovic and Weisbenner (2005), Massa and Simonov (2006), and Bodnaruk (2009) lend some support for the theory that individual investors’ domestic holdings outperform their international ones. Liao et al. (2012) goes further to show that investors not only prefer stocks with regionally close headquarters but also stocks that are listed locally.

Flight to familiarity showing up in numbers

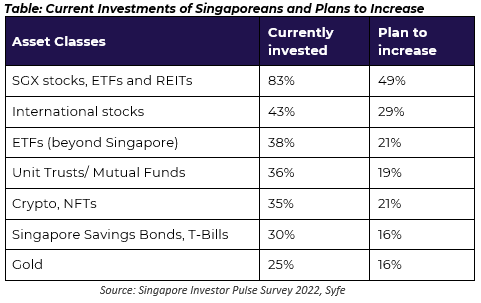

The “flight to familiarity” theme shows up in Syfe’s “Singapore Investor Pulse Survey 2022” too. The survey gathered the views of over 1,000 Singaporeans who have indicated an interest in investing, across the ages of 18 to 55 with a special focus on perceptions and investing intent in relation to the Singapore market, as well as existing barriers.

Singapore-listed stocks, ETFs and REITs are the leading areas (Table below) where Singaporeans who currently invest, are investing in, and 49% plan to maintain or increase their exposure.

This signals a strong homeground appeal among Singaporean investors. STI returned positive gains of 3.80% as of end-September 2022 as compared to the global benchmark of MSCI World Index with a 21.60% drop in the same period.

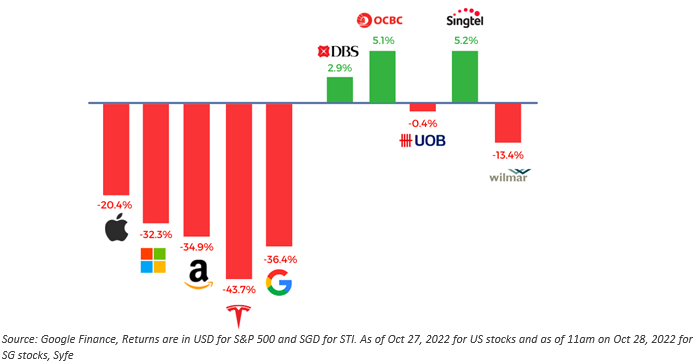

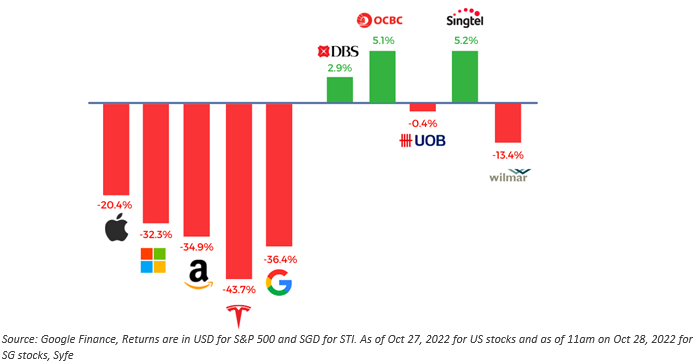

Looking at the YTD returns of the 5 largest stocks in S&P 500 versus the STI, investors invested into the 5 largest STI stocks would have a more resilient return of -0.12% versus the 33.5% declines averaging across S&P 500’s 5 largest stocks.

For more Syfe Research, visit www.syfe.com.

—

Originally Posted October 31, 2022 – What’s Trending: Flight to Familiarity

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.