Study Notes:

Consumer sentiment reflects how consumers feel about the present and future. Sentiment is important because consumer activity comprises over half of the economy in Australia as well as in other countries. The Consumer Sentiment Index is comprised of five sub-indexes: current financial conditions, future financial conditions, current economic conditions, future economic conditions and whether now is a good time to buy a major household item. Taken together, the overall Consumer Sentiment headline index is an average of the responses to the five questions. More positive responses mean higher consumer sentiment while more negative ones mean lower consumer sentiment. Westpac Bank administers online and telephone interviews with roughly 1,200 randomly sampled survey respondents. The report is generally published on the second Tuesday of each month at 10:30am Australian Eastern Time. Westpac provides economic reports to help Australians succeed through better data-driven decisions.

Other providers also provide consumer sentiment figures for Australia.

Consumer sentiment is an important indicator of the economy’s health and more specifically, consumer demand. The global economy depends heavily on the consumer to fuel the economy as consumption makes up over half of the international economy, Australia’s economy also depends heavily on consumer spending.

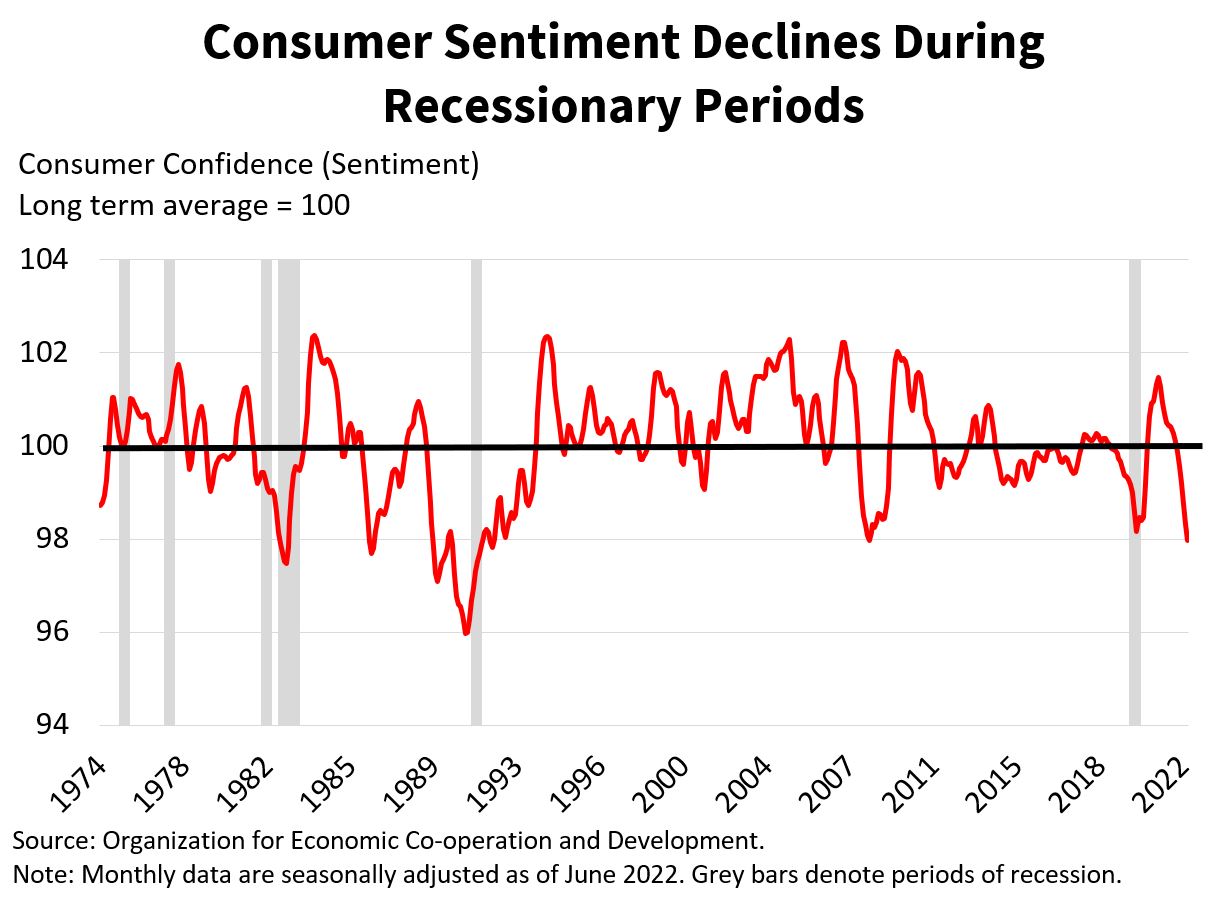

High consumer sentiment would reflect positive sentiments from consumers on the economy as they continue spending. Weak readings would reflect negative sentiments on behalf of consumers and the potential for economic weakness as they slow spending. Elevated sentiment benefits economic growth and paves the way for companies and the economy to continue growing. This leads to a positive chain of events as revenue growth will likely lead to growth in employment, income, investment, loans, tax revenue, and ultimately GDP. Weakening consumer sentiment is a risk for the domestic and the international economy as folks purchase less goods and services locally and abroad. Falling consumer sentiment, such as occurred during the 2008 financial crisis and during the COVID-19 recession, would likely weaken global economies.

Various economic indicators, such as retail trade, job vacancies, PMI-manufacturing and the yield curve are helpful in predicting consumer sentiment and in examining the possible risk of layoffs hampering spending, investment and economic activity. To determine whether consumers and goods are actively moving, foot traffic, port traffic, air passenger levels, and fuel sales can also provide valuable insights. Moreover, we would monitor the earnings calls and the stock performance of some of the most influential companies for signs of an economic slowdown or expansion.

Various economic indicators, such as retail trade, job vacancies, PMI-manufacturing and the yield curve are helpful in predicting consumer sentiment and in examining the possible risk of layoffs hampering spending, investment and economic activity. To determine whether consumers and goods are actively moving, foot traffic, port traffic, air passenger levels, and fuel sales can also provide valuable insights. Moreover, we would monitor the earnings calls and the stock performance of some of the most influential companies for signs of an economic slowdown or expansion.

Higher interest rates have weighed on consumer sentiment in the past as consumers faced higher costs to finance durable items such as cars, refrigerators and furniture. Paying attention to changes in monetary policy and the possible subsequent falls in consumer sentiment and company revenues are worth monitoring.

Although not always the driving market force, stock prices might drop if consumer sentiment falls short of economists’ expectations, and might lead to rising stock prices when better than expected. Increased sentiment from consumers leads to more economic activity and fundamentally supports higher stock prices globally.

Because consumers fuel company revenues on a global scale, tracking Australian consumer sentiment, for signs of an economic slowdown or expansion is integral.

The ‘Economic Indicators (Australia)’ module has the list of sub parts 1-8 (top right of window), with NO sub-part=#6.[A missing line]

The tests have an extra topic /sub-part ”Building Approvals – Australia”.

But there is no module by that name. Nor can I find it using the site search function (with the magnifying glass).

Hi, thank you for pointing this out to us. This change is now reflected in the lesson. We appreciate your feedback.