Study Notes:

Interactive Brokers’ ScaleTrader tool uses a sophisticated algorithm to break up a larger order into smaller pieces that take advantage of either averaging down or buying into a declining market or selling into a rising market. An investor may want to use the ScaleTrader to “scale” out of a long position obtaining a better average price over time. Scale orders to buy are designed to execute at ever lower prices, while orders to sell are designed to trade at increasingly higher prices.

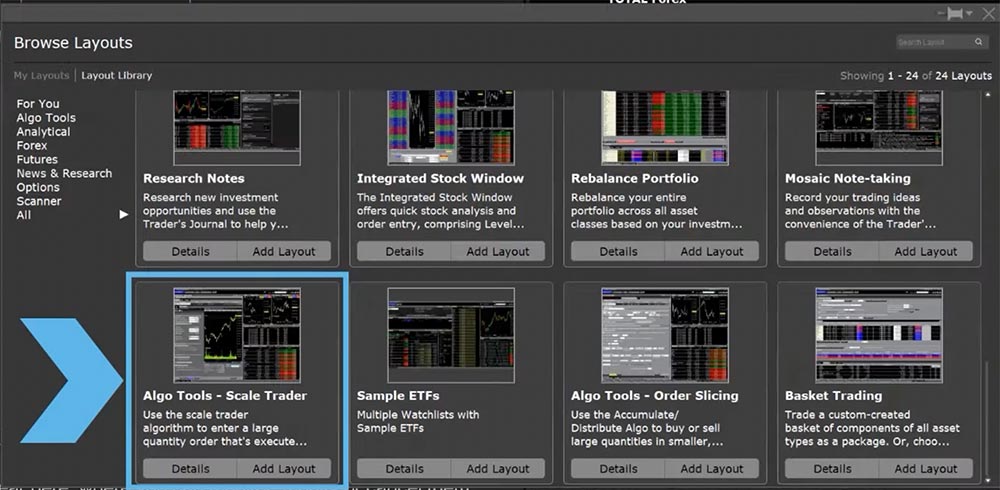

ScaleTrader supports all available products except Mutual Funds and is accessible in both Classic TWS and Mosaic and can also be added as a panel in a custom layout. Additionally, there is a pre-configured ScaleTrader layout available in the Layout Library.

To open ScaleTrader from Classic TWS, select Trading Tools from the top menu and click ScaleTrader underneath the Stock/Futures Focus section. ScaleTrader can also be added as a button by clicking on the arrow next to Configure, hovering over “Add More Buttons”, and clicking on the ScaleTrader button.

To open ScaleTrader from Classic TWS, select Trading Tools from the top menu and click ScaleTrader underneath the Stock/Futures Focus section. ScaleTrader can also be added as a button by clicking on the arrow next to Configure, hovering over “Add More Buttons”, and clicking on the ScaleTrader button.

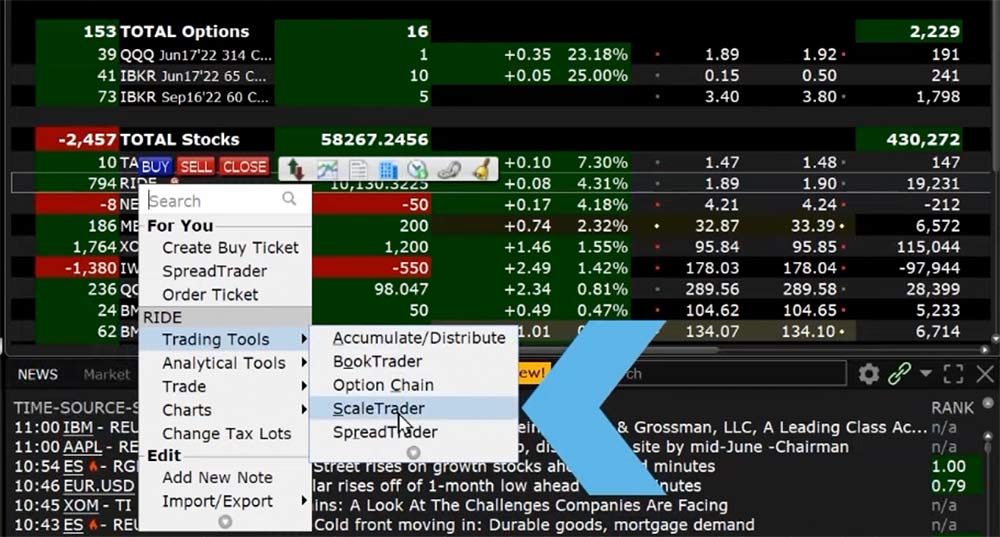

In Mosaic, right click on a symbol in a Watchlist or the Portfolio tab, scroll down to Trading Tools, and click on ScaleTrader. ScaleTrader can also be opened by selecting the New Window button in the top left corner and scroll to the bottom for More Advanced Tools. Hover over More Advanced Tools to open a sidecar menu and select ScaleTrader. ScaleTrader opens as a separate window.

At the top of the ScaleTrader window is a Quote Panel where investors can enter the ticker symbol for simple, pair or combo scale trades. Use the wrench icon in the upper right corner of the Quote Panel to manage the data columns displayed.

At the top of the ScaleTrader window is a Quote Panel where investors can enter the ticker symbol for simple, pair or combo scale trades. Use the wrench icon in the upper right corner of the Quote Panel to manage the data columns displayed.

Directly underneath is the Action area where the investor chooses to Buy or Sell. Continuing downward is the Scale Orders section where parameters are set for the order including:

- Maximum Position which is the maximum position for the order and does not take into account any existing position the investor has.

- Initial Component Size which is the initial order size and must be entered in round lots.

- Subsequent Component Size, this must be entered in round lots, and if left blank, the value used for the initial Component Size will be used.

- The investor can choose to randomize the size of the order and/ or route to IBKRATS by checking the box next to each line.

- The Starting Price at which the initial component will be submitted.

- The Price Increment which defines the levels for each scale component. The price increment can also be set by using the chart to the right of the box.

- The top and bottom price will automatically fill in.

- Click on the box next to Order Type to see which are available for the instrument.

Investors will submit a basic scale order for AT&T (Symbol – T) to buy 10,000 shares with an initial component size of 500 and subsequent component size of 200 shares. They also choose to randomize the size increments. They will leave the starting price at the current price and choose .02 (or two pennies) for the price increment and keep it as a limit order.

Investors will submit a basic scale order for AT&T (Symbol – T) to buy 10,000 shares with an initial component size of 500 and subsequent component size of 200 shares. They also choose to randomize the size increments. They will leave the starting price at the current price and choose .02 (or two pennies) for the price increment and keep it as a limit order.

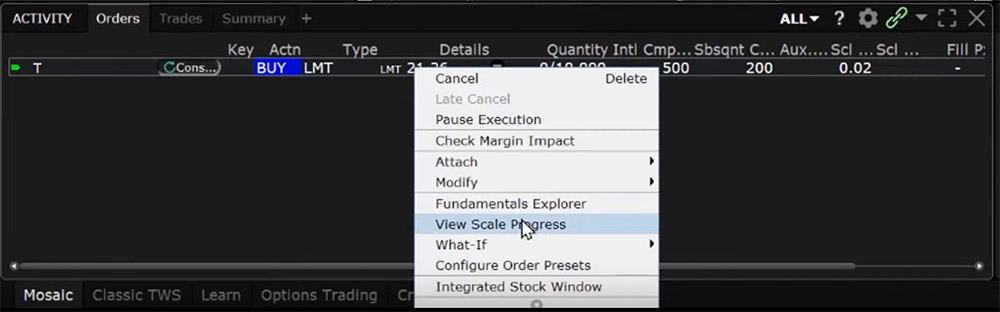

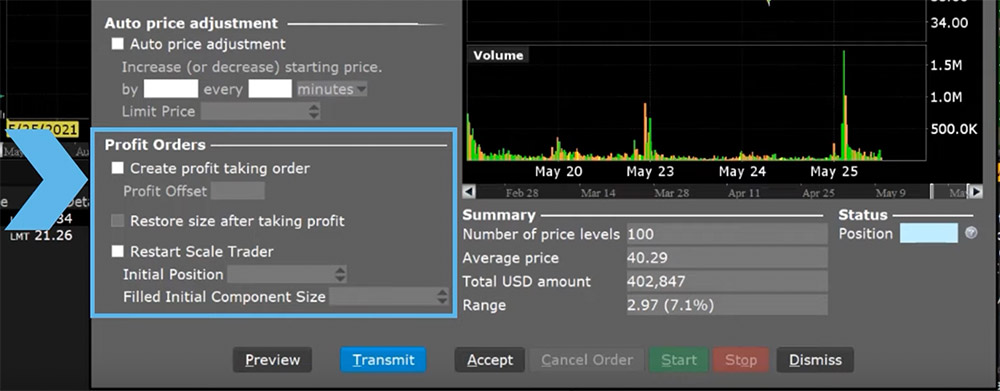

Click the Preview button prior to submission to double check the order. Either click Transmit from the Order Preview window to send the order immediately or click Close and when ready click Transmit on the ScaleTrader tool. An Order Confirmation window will appear. When ready, click Transmit and the status of the algorithm can be monitored in the Summary area in the bottom right-hand corner. The progress of the order can also be viewed by clicking on the order line in the Activity Panel, scrolling down to View Scale Progress and clicking on it.

The Scale Progress box will appear displaying the complete scale price ladder, the open/filled component list for the parent scale order, and if applicable the open/filled list for child profit orders.

The Scale Progress box will appear displaying the complete scale price ladder, the open/filled component list for the parent scale order, and if applicable the open/filled list for child profit orders.

A scale order can also be created using the Scale Chart to the right of the input area to set the initial and bottom price. After the investor enters the Maximum position, initial component size, and subsequent component size they can adjust the top and bottom prices by dragging the top and bottom horizontal price lines to the desired level. Once set the price increment will automatically be calculated and the investor can set the order type and click transmit.

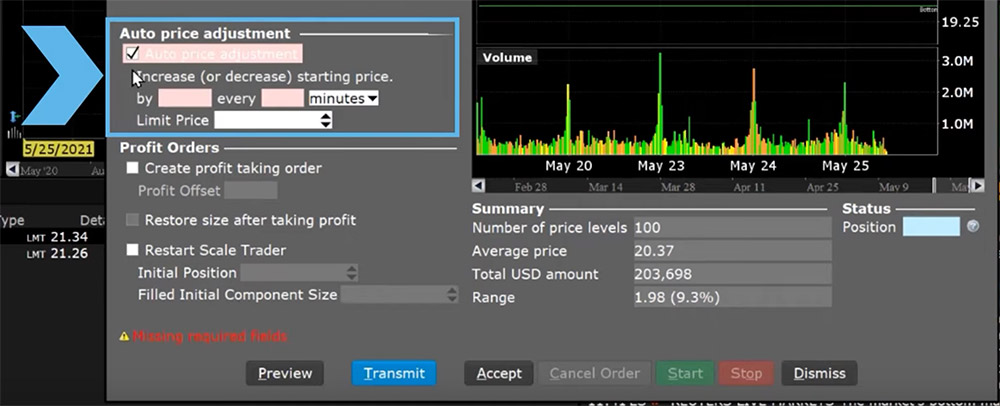

ScaleTrader offers the functionality of taking a basic scale order and adding in price adjustments for the starting price. The Auto price adjustment is used to increase or decrease the price by a set increment over a period of seconds, minutes, hours, or days when orders are not immediately filled. The investor can set a limit price to ensure that they do not pay more than they want to or sell lower than they want to if stock moves away from their order.

ScaleTrader also allows the investor to set a Profit Taking order to take advantage in price movements and liquidate your positions built up using the tool. The investor can click on the box next to “Create Profit Taking Order” in the lower left-hand corner and input an offset amount. The offset will be adjusted to reflect the difference between the last scale order trade that took place. If the investor uses a profit offset of $3 and the last ScaleTrader buy purchase was $40, then the profit taker sell order will be for $43. Consequently, if another purchase takes place at $39.75 then the corresponding profit taking sell will adjust to $42.75.

If using the profit taker feature, investors can choose whether they would like to restore the size after taking profit. Clicking on the box will set the algorithm to try to buy or sell the shares they just traded for a profit at their original price. This feature allows them to buy and sell repeatedly in a fluctuating market. If the box is unchecked, then investors will buy and sell once at each price level only and the algorithm will be finished.

If using the profit taker feature, investors can choose whether they would like to restore the size after taking profit. Clicking on the box will set the algorithm to try to buy or sell the shares they just traded for a profit at their original price. This feature allows them to buy and sell repeatedly in a fluctuating market. If the box is unchecked, then investors will buy and sell once at each price level only and the algorithm will be finished.

If the “Restore Size After Taking Profit” box is checked investors can select whether they want to restart the ScaleTrader in the event the algorithm is stopped. The initial position must be set to be greater than or equal to the existing position value, up to a maximum of the initial component size. The ScaleTrader will restart at the price level it left off at. For example, if the next scale order was to buy 200 shares at $42.35, then that would be the level at which the order will resume.

The ScaleTrader can be used to build or liquidate a position over an average “scaled” price level using the basic settings or as a potentially rewarding trading strategy just as long as the investor is comfortable holding the specified maximum position should the price continue to move in one direction without the profit taker orders being filled.

A scenario for liquidating a position with ScaleTrader would be helpful as that isn’t immediately obvious.

Thank you for commenting. You can find more information about ScaleTrader in our TWS user guide: https://www.ibkrguides.com/tws/scaletradertop.htm. We hope you find what you are looking for there.

Can you use this to automate options trading ?

Hello Will, thank you for asking. ScaleTrader is available for options trading. Please follow the steps outlined in this Users’ Guide to configure the ScaleTrader tool in TWS.

https://www.ibkrguides.com/tws/usersguidebook/algos/about_scaletrader.htm

We hope this helps!