Study Notes:

Land, labor and capital are often referred to as common factors of production. By combining a variety of material inputs using plans and know-how, the production process creates consumable units of output. These factors are primary inputs and are generally brought together by the power of the evolved factors of technology and entrepreneurship. The Production Function considers the mix of inputs relative to the quality of output.

How an economy fares as a result of production processes can be measured by economic well-being. Everything is produced to satisfy consumers’ needs or wants, and how that is achieved determines whether the economy is behaving optimally. Increasing productivity or growing the quality of output over time should increase as gross domestic product rises.

Producers are assumed to want to maximize profits as a primary objective. The value of an output less its production costs results in a profit. The economics of production is influenced by factors such as consumption patterns, how efficient the process is, technology used during production, how much influence the producer has concerning pricing of both inputs and outputs.

Wellbeing within an economy occurs between the production and consumption sides of the economy. The occurrence of efficient production and the ensuing interaction between consumers and producers increases economic wellbeing. A consumer can both consume from the producer as well as supply the production process. Consumers benefit through consuming the output resulting from the production process. While suppliers’ wellbeing is related to the income received from production delivered.

Stakeholders of Production

Stakeholders are persons, groups or organizations that have some form of interest in the producer’s business. Their relationships disperse economic wellbeing throughout the production process. Stakeholders can be defined as customers, suppliers and producers.

A customer is usually a consumer or end-user. However, the term could include another producer of the same product or a producer supplying the public sector.

Suppliers have their own production process, and offer to the production process raw materials, energy, capital and services.

Producers perform the production process and are comprised of the labor force, owners and those participating in the production process. Producers generate income as the production process grows and hopefully develops. Economic wellbeing tends to increase over time as the price of commodities declines due to process efficiencies and technological developments. This tends to improve the wellbeing of the consumer since they benefit from getting more for less. For their part, producers who successfully grow their production generate increasing amounts of income.

Production Growth and Performance

Economic growth can be defined as a production increase of an output during the production process. This can be described as a percentage or incremental increase in production output.

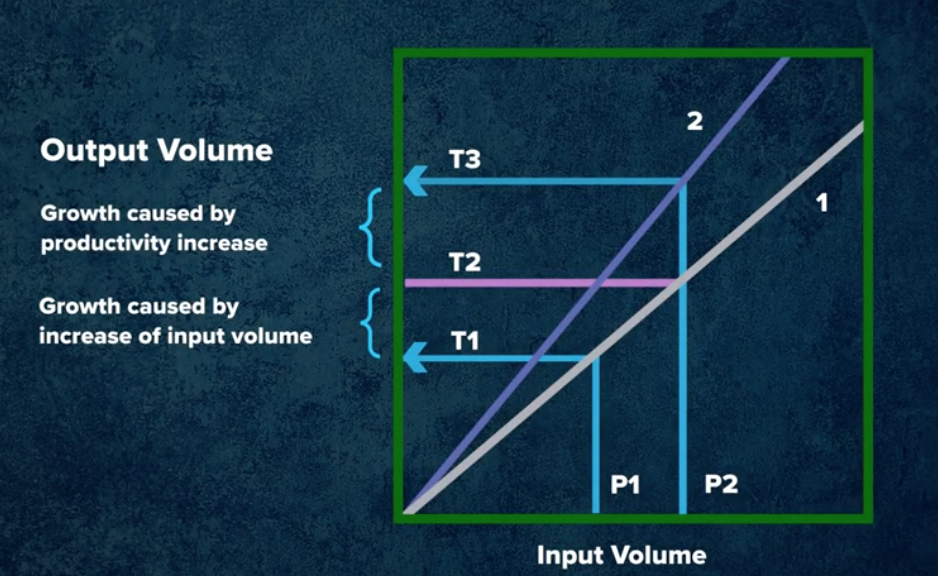

The Production Function graphically illustrates the relationship between inputs used during the production process and the output achieved. It can also be used to show the income generation of the production process. The production function can display change in production and change in productivity.

Line 1 on this chart shows how output may increase as the number of inputs employed in the production increase occurs. At that time, P1 inputs are used to produce output of level T1. Should the production level increase, requiring the use of P2 inputs, T2 level of output would be recorded

To illustrate how productivity might increase output over time, consider Line 2, which associates greater output for the same level of inputs. Using P2 to denote the level of inputs, you can see a clear increase in output (T2 on Line 1 and T3 on Line 2). The steeper gradient of Line 2 explains the increased level of output due to growth caused by an increase in productivity and growth caused by increased input volume.

Growth in productivity is a critical economic metric of successful innovation. New products can be introduced, and production processes may be streamlined and improved. The structure of the organization or production process can, over time, be improved upon, costs can be cut, and productivity gains can be seen through a growth in outputs in excess of the growth in inputs.

Conclusion – The conversion of inputs to outputs and the organization of the factors of production govern economic wellbeing. For consumers this occurs through rising economic wellbeing. And for producers this occurs through creation of additional income. Gains in production processes, including efficiencies can lead to greater economic wellbeing and growth in incomes measured by productivity gains using the production function.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.