Don’t miss the first installments in this series: Power Couple: Prop Trading & Education. Robot Wealth Part 1 and Robot Wealth Part Two: Collaborative Research for Systematic Trading

According to Kris Longmore, founder of prop trading and trading education hybrid Robot Wealth (RW), the firm anchors its approach with three core components: flexibility, opportunism and finding ‘edges’ – opportunities that, supported by statistical data, have a high expected probability of success. In other words, rules-based, systematic trading.

“We don’t have the structural advantages some firms have, like exchange membership or co-located server infrastructure. Most things we trade eventually dry up, so flexibility is key. For example, we’ve done trades at opposite extremes – from high-frequency latency arbitrage in crypto to monthly seasonality trades in US ETFs. We just work with whatever opportunities come up.”

On the educational side of RW, Longmore says he and co-founder James Hodges have taught collaborative systematic trading to over a thousand retail traders in bootcamps they run twice a year. Graduates are invited to join the RW Pro Community, which boasts over 400 members from six continents. The co-founders share their own trades and strategies in bi-weekly live webinars, and members support each other in ongoing chats.

In Longmore’s view, a systematic approach can be a foundational edge not just for professionals but for independent traders.

“It allows them to combine edges. You can achieve remarkable results at the portfolio level by combining a bunch of uncorrelated edges that look pretty average on their own. A systematic approach facilitates that.”

Longmore and Hodges also share posts with their learning community about more complex edges. For example, one of their videos walks through how they first learned, basically in real time, to profit from crypto trading (https://robotwealth.com/a-case-study-in-finding-edge/).

“In the early days of DeFi (decentralized finance) you’d often find instances of stale crypto quotes on a DEX (decentralized exchange) that you could hit without even being particularly fast. We built a model of fair value, and we coded systematic rules that defined when a quote was worth hitting based on cost hurdles.

“The strategy was dynamite – for six months it made money every day. Then someone turned up who was either faster or had a better model and our PNL curve went from being a straight line up and to the right, to sideways. We knew the game was up, took our money and moved on to the next edge.”

As examples of ‘next edges,’ Longmore lists risk premia harvesting, VIX basis and timing the volatility risk premium, equity pairs (with a particular focus on the universe selection algorithm), crypto basis arbs, crypto trend and momentum, and structural trades (for example, tracking errors in leveraged ETFs).

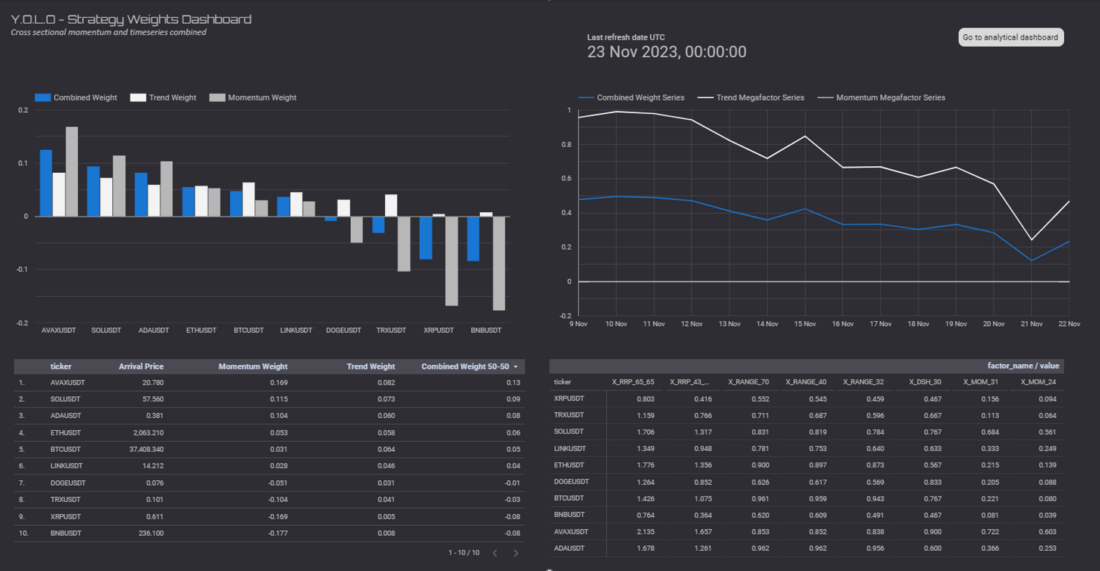

Above, dashboard for managing a crypto trend and momentum strategy

Attribution: robotwealth.com

Longmore and Hodges share their research with the RWPro community in GitHub repositories and discuss it via webinars and Slack.

“Our community gets to look over our shoulders and see what we’re doing and how we’re doing it.”

RW also maintains a repository of articles and code that have appeared on the blog: https://github.com/Robot-Wealth/r-quant-recipes.

The firm has developed an open dashboard for managing a portfolio of relatively simple edges. Users can set volatility targets, input current positions and cash balances, and see their next-day portfolio target weights with a single click.

“I’m actually not a good enough trader to trade without systematic rules in place. When you’re trading a number of different edges in a portfolio at the same time, having systematic rules in place helps you manage what could otherwise turn into an unruly mess.”

Two RW webinars that deal with the basics of finding an edge and running data analysis:

Basics of Edge Extraction: https://www.youtube.com/watch?v=iDxMhUxnXsg

Data Analysis for Traders: https://www.youtube.com/watch?v=Nbq5eyVk-0w

RW posts about edges and trading rules of thumb:

- Trader smarts: How to get serious about making money trading (high level things you need to think about if you want to trade seriously, examples of things that work or used to work).

- Exploring a market observation including data analysis and code: Beyond stocks: The surprising volatility returns of oil and gold (pulling data from an API, exploring a hypothesis, modelling an effect).

- Exploring two simple risk premia: Diving deep: My personal approach to equity and volatility risk premia

- A “how-to” of interest to quants: How to connect Google Colab to a local Jupyter runtime (something quants might be interested in for doing reproducible research)

- Exploring a tool of interest to quant traders: Machine learning for trading; Adventures in feature selection (deep dive on a specific tool)

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.