In the AutoRegressive Moving Average (ARMA) models: A Comprehensive Guide of my ARMA article series, I covered the theoretical aspects of Autoregressive Moving Average models (ARMA). In the AutoRegressive Moving Average (ARMA) models: Using Python, I simulated different ARMA models, their autocorrelations and their partial autocorrelations. We also provided a strategy based on these models. In this article, we’ll do the same as in part 2 but the implementation will be made in R. Let’s enjoy!

We cover:

- Simulation of ARMA models

- Autocovariance and autocorrelation functions in R

- Estimation of the best ARMA model with real-world data in R

Simulation of ARMA models

Because there is no second without a third, we have this article to use the ARMA models in R. Let’s code.

Import libraries

First, we install and import the necessary libraries

# Installing the necessary libraries

install.packages('quantmod')

install.packages('TTR')

install.packages('forecast')

install.packages('stats')

# Importing the libraries

library('TTR')

library('quantmod')

library('forecast')

library(stats)

install_and_import_libraries.R hosted with ❤ by GitHub

Create an empty dataframe in R

Then we create an empty dataframe with 1000 rows as previously done in Python.

# Create an empty dataframe df <- data.frame(matrix(0, ncol = 13, nrow = 1000))

create_empty_dataframe.R hosted with ❤ by GitHub

Simulate ARMA models using R

Next, we simulate the ARMA models as we did before. However, we’re going to make a change. This time we’re going to use the Autoregressive integrated moving average (ARIMA) function provided by the forecast library to create the models.

This is an opportunity to see a different code here in R!

# Set the simulation ARMA parameters

params = c(.1, .25, .5, .75, .9, .99)

# Set the seed

set.seed(2023)

# Use a loop to simulate the ARMA models

for (i in 1:6) {

# Simulate an AR(p) model based on each parameter

df[,paste0('X',i)] <-arima.sim(1000, model=list(ar=params[i]))

# Create the string version of the parameter

param_string = as.character(params[i])

# Change the AR(p) model column name

colnames(df)[i] = paste0("ARMA_1_0_0",substr(param_string,3,nchar(param_string)),"_0")

# Simulate an MA(q) model based on each parameter

df[,paste0('X',(i+6))] <-arima.sim(1000, model=list(ma=-params[i]))

# Change the MA(q) model column name

colnames(df)[(i+6)] = paste0("ARMA_0_1_0_0",substr(param_string,3,nchar(param_string))) }

# Create an ARMA(1,1) model

df[,paste0('X',13)] <-arima.sim(1000, model=list(ar=0.3, ma=-0.3))

# Change the ARMA(1,1) model column name

colnames(df)[13] = paste0("ARMA_1_0_03_03")

create_simulated_arma_models.R hosted with ❤ by GitHub

Suggested Reads:

- Autocorrelation and Autocovariance: Calculation, Examples, and More

- How to Get Historical Market Data Through Python Stock API

Autocovariance and autocorrelation functions in R

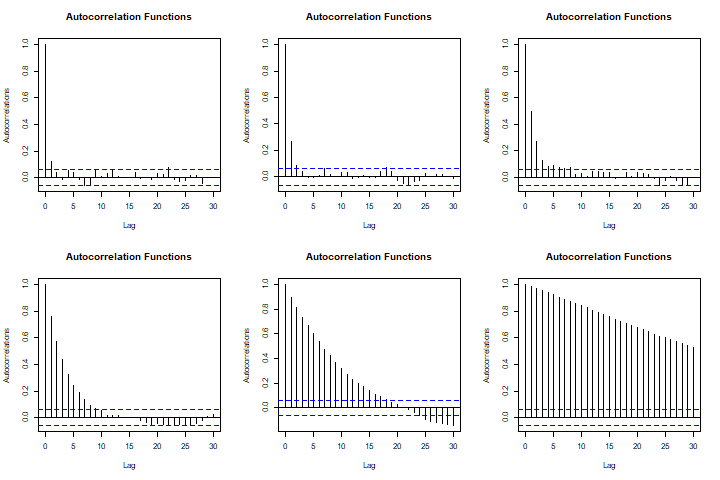

Last but not least, this time we’re going to plot the Autocorrelation function (ACF) and Partial Autocorrelation Function (PACF) of only the Autoregressive (AR) models.

Create a plot object with 2x3 dimensions

p <- par(mfrow=c(2,3))

# Set the each plot margin sizes

p.par(mar=c(1,1,1,1))

# Create a loop to plot each AR(p) autocorrelation plot

for (i in 1:6) {

# Create the string version of the parameter value

param_string <- as.character(params[i])

# Plot the autocorrelation function

acf(df[,paste0("ARMA_1_0_0",substr(param_string,3,nchar(param_string)),"_0")],plot= TRUE, xlab = "Lag", ylab = 'Autocorrelations',main = "Autocorrelation Functions", font.main=70) }

par(p)

dev.off()

# Create a plot object with 2x3 dimensions

p <- par(mfrow=c(2,3))

# Set the each plot margin sizes

p.par(mar=c(1,1,1,1))

# Create a loop to plot each ARMA autocorrelation plot

for (i in 1:6) {

# Create the string version of the parameter value

param_string <- as.character(params[i])

# Plot the autocorrelation function

acf(df[,paste0("ARMA_1_0_0_0",substr(param_string,3,nchar(param_string)))],plot= TRUE, type = 'partial', xlab = "Lag", ylab = 'Autocorrelations',main = "Autocorrelation Functions", font.main=70) }

par(p)

dev.off()

acf_and_pacf_of_ar_models.R hosted with ❤ by GitHub

Check the plots

We leave it as an exercise to plot the same graphs for the MA processes.

Stay tuned for the next installment for estimation of the best ARMA model with real-world data in R.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.