The article “Backtesting: How to Backtest, Analysis, Strategy, and More” first appeared on QuantInsti Blog.

Excerpt

In the dynamic world of financial markets, we all know how crucial it is to gain that competitive edge. We’re constantly looking for ways to enhance our trading skills and boost our returns. Backtesting is yet another integral skill required for your trading journey.

So, what exactly is backtesting?

It’s a powerful tool that lets you simulate your trading strategy using historical market data. By testing your strategies against past price movements, you can gain incredible insights into how they would have performed and whether they have the potential for profitability. In other words, it’s like a crystal ball that helps you fine-tune your approach, spot weaknesses, and optimise your decisions before you even risk a single dollar.

In this blog, we’re going to dive headfirst into the world of backtesting and show you how it can completely revolutionise your trading journey. Whether you’re a seasoned trader or just starting out, this guide will give you the knowledge and tools to harness the full power of backtesting.

All the concepts covered in this blog are taken from this Quantra course on Backtesting Trading Strategies. You can take a Free Preview of the course.

It’s time to embrace backtesting and take your trading strategy to a new level. Let’s dive in and explore more with this blog that covers:

- What is backtesting?

- Why is it important to backtest?

- Prerequisites for backtesting

- Steps to backtest

- Backtesting with Python

- What should be the time period for backtesting a trading strategy?

- Various performance metrics used for backtesting

- Interpreting and analysing backtesting results

- Backtesting vs walk forward trading testing

- Backtesting vs Scenario analysis

- Common mistakes while backtesting

- Backtesting software

- Steps after backtesting – Paper trade or Live trade

What is backtesting?

Backtesting is a technique used in trading and investing to evaluate the performance of a trading strategy or investment approach using historical market data. It involves applying predetermined rules and parameters to past price data to simulate how the strategy would have performed in the past.

By going through the backtesting process, you can gain valuable insights. You’ll see how profitable your strategy could have been, what risks you might face, and how it compares to other approaches. It helps you make more informed decisions and increases your chances of success when you start trading with real money.

In short, backtesting aims to evaluate the strategy’s performance, understand its strengths and weaknesses, and make improvements. It’s a way to learn from historical data and fine-tune your approach before risking your hard-earned cash in the live markets.

Why is it important to backtest?

The first and main reasons to backtest is that it empowers traders to:

Make informed decisions

Gathering and analysing relevant information helps you make decisions based on facts, reducing reliance on emotions or speculation. Conduct thorough research, understand market trends, evaluate financial statements, and stay updated on events that impact the markets.

Increase the chances of better returns

To maximise returns, diversify investments across asset classes, sectors, and regions. Conduct research, analyse performance, and understand underlying factors. Seek professional advice, stay disciplined, and maintain a long-term investment horizon.

Navigate the complex world of financial markets with greater precision

Understand investment instruments, market forces, and economic indicators. Stay updated with financial news, market trends, and regulations. Build financial literacy, utilise technology and analytical tools, and access reliable information sources.

The other reasons why backtesting is important are:

Helps with strategy evaluation

Backtesting allows traders to assess the performance and viability of their trading strategies objectively. By simulating trades using historical data, traders can gain insights into profitability, risk-adjusted returns, and other metrics. This evaluation helps identify strengths and weaknesses in strategies, facilitating informed decision-making.

Risk management is better with backtesting

Backtesting aids in effective risk management by providing a realistic assessment of strategy risks. By evaluating drawdowns, volatility, and potential losses based on historical data, traders can establish suitable risk parameters and position sizes. This analysis supports the design of robust risk management techniques and optimal risk-reward ratios.

Confidence building

Backtesting instils confidence in traders before engaging in live trading. By observing a strategy’s performance in various market conditions and scenarios, traders develop a deeper understanding of its potential and build trust in its ability to generate profits. This confidence strengthens discipline and decision-making during live trading.

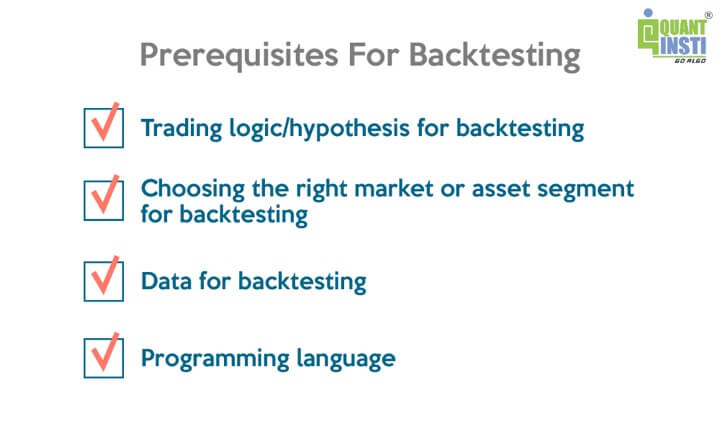

Prerequisites for backtesting

Before you start backtesting a trading strategy, you need to consider some of the factors:

Let us look at each of these factors in detail.

Trading logic/hypothesis for backtesting

You decided to backtest a trading strategy, but before you backtest, you need to have a clear picture in your mind of what you are going to backtest. That is what is the trading logic or hypothesis of this backtest.

If you are clear with the trading logic, then only you can backtest the trading strategy, and therefore this is the most crucial step in backtesting.

For example, in a moving average-based trading strategy, we will have buy signal and sell signal. We will use two moving averages: a short-term moving average (e.g., 50-day moving average) and a long-term moving average (e.g., 200-day moving average).

Now, according to the trading logic:

- Buy signal – When the short-term moving average (e.g., 50-day moving average) crosses above the long-term moving average (e.g., 200-day moving average).

- Sell signal – When the short-term moving average crosses below the long-term moving average. It implies that it might be a good time to exit a long position or consider taking a short position in security.

Choosing the right market or asset segment for backtesting

There are various factors that you can look at to decide which market or assets will be best for the kind of trading you are looking to conduct.

The factors can be risks you are willing to take, the profits you are looking to earn, and the time you will be investing, whether long-term or short-term.

Data for backtesting

Once you have shortlisted the assets, you would want to backtest your trading strategy. The next step is to choose historical data of the asset. You can get the data from the data vendor or from your broker.

It is important to select high-quality data, that is, data without any errors. If you choose poor-quality data, then the output analysis from backtesting will be incorrect and misleading.

You can check out this free course on Quantra to get the market data for different asset classes.

Choosing the programming language for backtesting

You were clear with the trading logic, selected the right asset for the trading and got the required data of the asset.

The final step is to decide the programming language you will use to backtest a trading strategy. Actually, it is a matter of personal choice and the language you are comfortable with. There are a lot of programming languages available such as C, Python, R, etc.

It is important to note that if you are not comfortable with any programming languages for backtesting, that’s not an issue. It doesn’t hinder you from backtesting your trading strategy.

You can learn Python with ease if you stay determined and dedicated to learning. It is not that difficult if you persevere.

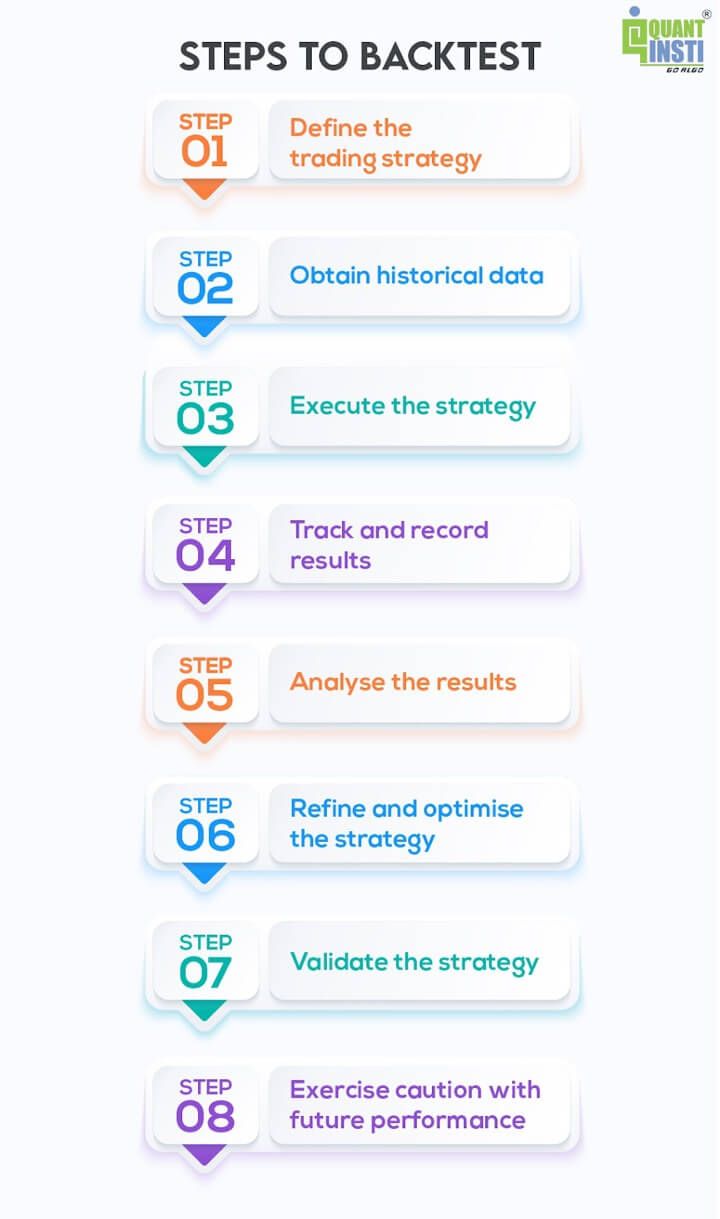

Steps to backtest

Let us now see the general steps to backtest below.

Step 1: Define the trading strategy

Clearly articulate the rules and criteria that will govern your trading strategy. Specify the entry and exit conditions, position sizing, risk management rules, and other relevant parameters.

Step 2: Obtain historical data

Gather accurate and reliable historical data for the financial instruments or markets you intend to backtest. This data should include relevant price, volume, and other necessary information.

Set the testing periodDetermine the time period you want to use for the backtesting analysis. This can range from a few months to several years, depending on the strategy and desired level of confidence.

Step 3: Execute the strategy

Apply the defined trading strategy to the historical data, simulating the trades as if they were executed in real-time. Follow the specified entry and exit rules to determine the hypothetical trade outcomes.

Step 4: Track and record results

Keep track of the trades executed during the backtesting process, including entry and exit points, trade duration, profit or loss, and other relevant metrics. This data will be crucial for evaluating the strategy’s performance.

Step 5: Analyse the results

Evaluate the performance of the trading strategy based on the recorded results. Calculate key performance metrics such as profitability, risk-adjusted returns, win rate, drawdowns, and any other relevant statistics.

Step 6: Refine and optimise the strategy

Identify areas for improvement and optimisation based on the analysis of the backtesting results. Adjust the strategy parameters, rules, or risk management techniques as necessary to enhance its performance.

Step 7: Validate the strategy

Once the necessary adjustments have been made, validate the strategy by conducting additional tests on different data sets or time periods to ensure its robustness and consistency.

Iterate and repeat: Backtesting is an iterative process, and it may require multiple rounds of refinement, testing, and validation. Continuously refine and iterate on the strategy based on new insights and market conditions.

Step 8: Exercise caution with future performance

While backtesting provides valuable insights, it does not guarantee future performance. Be mindful that market conditions and dynamics may change, and live trading involves additional factors such as slippage, liquidity, and execution delays that can impact results.

Visit the QuantInsti Blog to read the full article and learn how to backtest with Python.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.