The post “Employing Human Order in pandas DataFrame Sorting: Risk Factors and Tenors” first appeared on Quant at Risk blog.

There are various Python projects which require sorting but not the ones that employ a default alphanumeric functionality. We talk about manually specified order or human-order, in short. One of such examples is the case study presented below.

Imagine that your risk system provides you with a list of various risk factors and the corresponding risk tenors. The latter may differ among risk factors and your task is to quickly convert an input data row into a matrix of tenor-series assuming that all your tenors follow a human-order defined as:

1W, 2W, 3W, 1M, 2M, 3M, …, 11M, 1Y, 2Y, 3Y, …, 49Y, 50Y

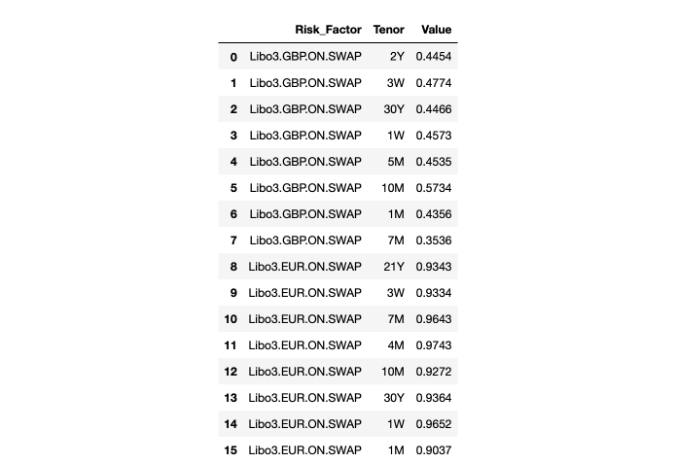

Let’s analyse an exemplary input dataset:

# Employing Human-Order in pandas DataFrame Sorting: Risk Factors and Tenors

# (c) 2019 by QuantAtRisk.com

import numpy as np

import pandas as pd

data = pd.read_csv('Libo3.csv', header=0)

display(data)

The trouble with standard sorting order is that usually it will end up with 10Y placed before 1Y or week-tenors (W) will follow monthly tenors since M appears before W, and… we don’t want the outcome to be that way. We can see that if we attempt to perform:

for risk_factor in data.Risk_Factor.unique():

print(risk_factor)

lst = data[data.Risk_Factor == risk_factor].Tenor.tolist()

print(sorted(lst))

print()

Libo3.GBP.ON.SWAP

[’10M’, ‘1M’, ‘1W’, ‘2Y’, ’30Y’, ‘3W’, ‘5M’, ‘7M’]

Libo3.EUR.ON.SWAP

[’10M’, ‘1M’, ‘1W’, ’21Y’, ’30Y’, ‘3W’, ‘4M’, ‘7M’]

Solution

First we need to specify a human-order sorting key:

ho = ['ON'] # overnight ho.extend([str(i) + 'W' for i in range(1,4)]) # weekly tenors ho.extend([str(i) + 'M' for i in range(1,12)]) # monthly tenors ho.extend([str(i) + 'Y' for i in range(1,51)]) # yearly tenors

what will store:

print(ho)

[‘ON’, ‘1W’, ‘2W’, ‘3W’, ‘1M’, ‘2M’, ‘3M’, ‘4M’, ‘5M’, ‘6M’, ‘7M’, ‘8M’, ‘9M’, ’10M’,

’11M’, ‘1Y’, ‘2Y’, ‘3Y’, ‘4Y’, ‘5Y’, ‘6Y’, ‘7Y’, ‘8Y’, ‘9Y’, ’10Y’, ’11Y’, ’12Y’,

’13Y’, ’14Y’, ’15Y’, ’16Y’, ’17Y’, ’18Y’, ’19Y’, ’20Y’, ’21Y’, ’22Y’, ’23Y’, ’24Y’,

’25Y’, ’26Y’, ’27Y’, ’28Y’, ’29Y’, ’30Y’, ’31Y’, ’32Y’, ’33Y’, ’34Y’, ’35Y’, ’36Y’,

’37Y’, ’38Y’, ’39Y’, ’40Y’, ’41Y’, ’42Y’, ’43Y’, ’44Y’, ’45Y’, ’46Y’, ’47Y’, ’48Y’,

’49Y’, ’50Y’]

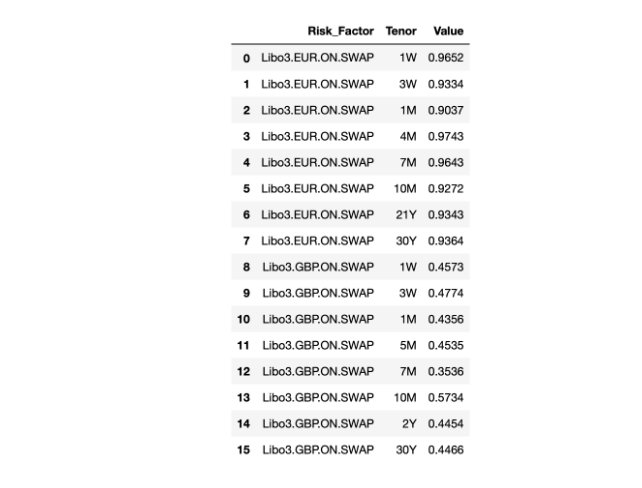

Next, we need to set Tenors as “category” type (line #23-24) and sort values according to requested order (line #25). Have a look:

data.Tenor = data.Tenor.astype('category')

data.Tenor.cat.set_categories(ho, inplace=True)

data = data.sort_values(["Risk_Factor", "Tenor"])

data.reset_index(inplace=True, drop=True)

display(data) # let's inspect the result

That accomplishes our task. From now on, you can manipulate the data in any way, for example:

fi = True # first iteration

for risk_factor in data.Risk_Factor.unique():

tmp = data[data.Risk_Factor == risk_factor]

tmp.set_index('Tenor', drop=True, inplace=True)

tmp = tmp.rename(columns={tmp.columns[1] : risk_factor})

del tmp[tmp.columns[0]]

if fi:

df = tmp

fi = False

else:

df = df.join(tmp, how='outer', sort=True) # applying 'sort' keyword

# here preserves a correct

# human-order

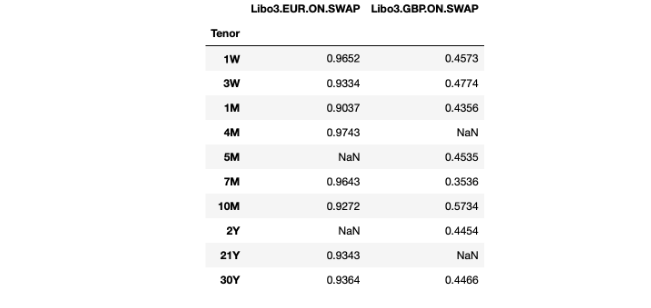

display(df)

will allow you for every risk factor to join the data using all available Tenors set as a common index:

Disclaimer: The input data were randomly generated.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quant at Risk and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quant at Risk and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.