Originally posted on Quantpedia Blog.

Excerpt

Bearish trends or deep corrections in international equity markets starting in 2022 and rising interest rates worldwide brought investors’ attention back to not only once-proclaimed dead factor investing. When there’s again competition between risk-free assets and the proposition of uncertain returns, we often see flight to value and quality. Speculative (and even growth) investments yielding little to no positive cash flow without attractive steady earnings/revenue are often left behind as capital hides into stable names, which are often omitted when there are a lot of economic stimuli, such as during ZIRP or even QE. What’s puzzling is how to time those switches in regimes to take advantage to allocate funds to the best factors over the time.

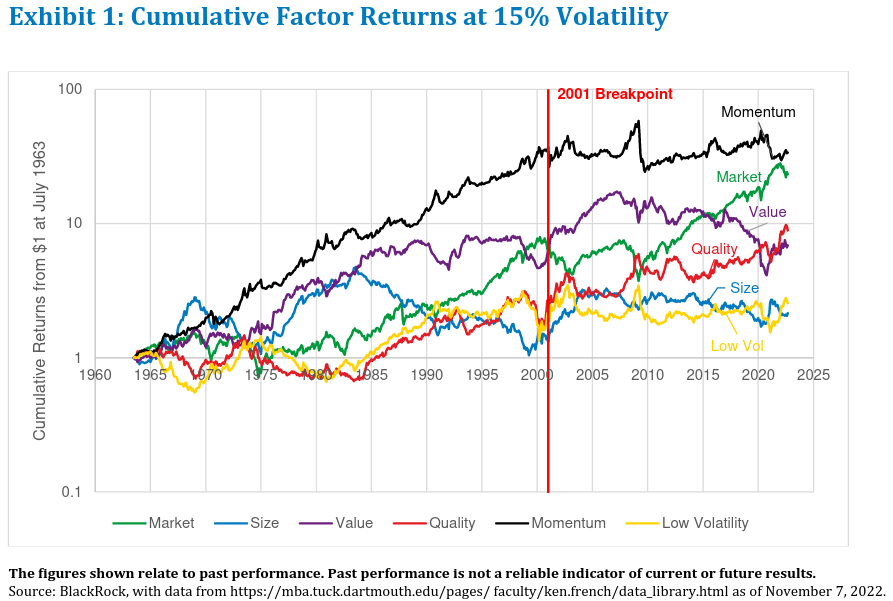

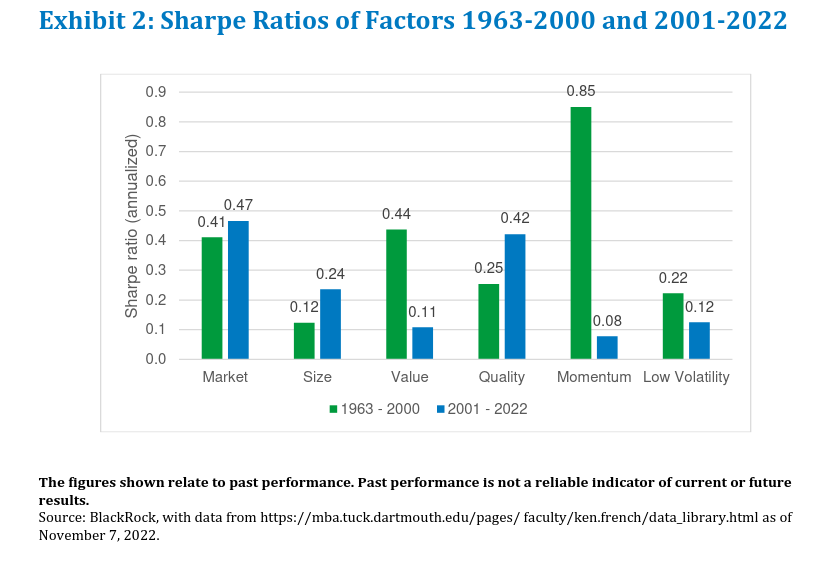

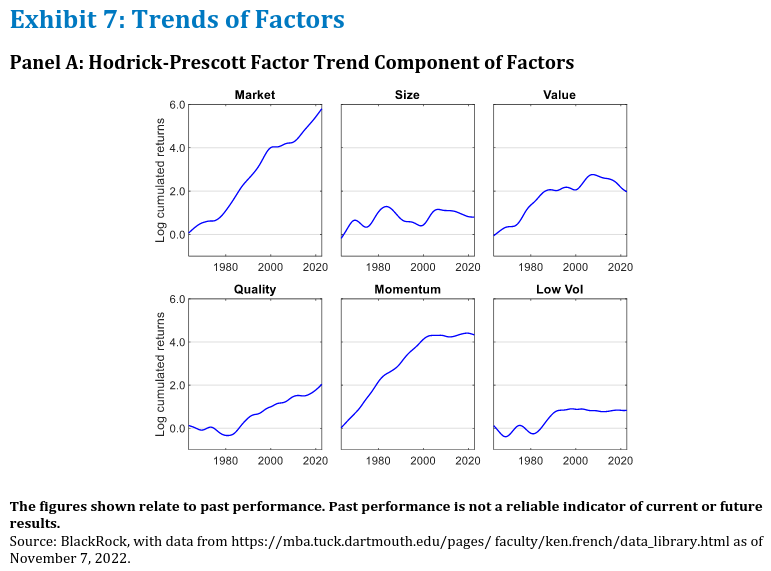

From long-run and short run, during different market cycles, different factors behave differently. What’s fortunate is that it is pretty predictable to some extent. Andrew Ang, Head of Factor Investing Strategies at BlackRock, in his Trends and Cycles of Style Factors in the 20th and 21st Centuries (2022), used Hodrick-Prescott (HP) filter and spectral analysis to investigate different models to draw some general conclusions on most-widely used factors. We will take a look at a few of quite the most interesting ones of them. We would like to pick out some points especially interesting in the current market contest. Value factor was a very well-perceived factor during its initial discovery and inclusion into the famous Fama and French (1993) three-factor model but is still in decline after the 2000s, probably due to its overcrowded use and losing its edge. Conversely, the momentum factor is still enjoying decreased but draft presence, mainly from the trend-following (and, of course, MOMO) crowds. Still, on the other hand, it has the sharpest drawdowns during the high-volatility period, which is not weathered well by some PMs.

Andrew likes to distinguish the year 2001 as the breakpoint between the 20th and 21st centuries in case of a shift in perceiving how factors behave. So, what is gaining traction at current market conditions? The size and quality factor trends have increased in the 21st century. Low-volatility stocks have continued to reduce risk by approximately half to a third of that from the previous century. They seem to be a good choice for risk-averse investors today, which can be associated with decreasing long-term trends and negative short-term cyclical shocks.

We would also like to point out that some factors may not be crucial in some traditional models (i.e., academic ones that may not be easily replicated in real-world settings). Even omitting them would not change their overall performance. In some non-traditional models (factor definitions are not quite the same: they have adjustments or even rough simplifications), they play a significant role. That is another example of how big the gap between academia and practical use is. These questions are open and widely discussed, and we cover them extensively; e.g., book-to-market ratios (B/M) have increasingly detached from alternative valuation ratios while becoming worse at forecasting returns and growth in an absolute and relative sense, or the value premium can be resurrected using a different set of value metrics, applying some essential risk management, and making more effective use of the breadth of the liquid universe of stocks. As always, practitioners should take care of this advice as there is a clear division between the needs and expected outcomes. Factor investing is clearly not dead and going anywhere soon.

Authors: Andrew Ang

Title: Trends and Cycles of Style Factors in the 20th and 21st Centuries

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4279022

Abstract:

Using filtering techniques, spectral analysis, and Markov chain models, I document trends and cycles of factors have significantly changed over the period to December 2000 compared to the period post-January 2001. The recent weaker performance of value in the 21st century, including the value drawdown over 2017 to 2022 which is the worst value drawdown ever experienced, can be attributed to both a decreasing trend component and downturns in cyclical components. Momentum performance has also declined in the post-2001 period due to decreasing trends, while the trends of the quality and size factors have increased. Low volatility portfolios still significantly reduce equity market risk in the 21st century, but the factor spends slightly longer durations in a low return regime.

As always, we present several interesting figures:

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.