The article “How Trend Following Strategies Shape Return Distributions” first appeared on Alpha Architect Blog. See an excerpt below.

Some Observations on Trend Following: A Binomial Perspective

- David M. Modest

- Working Paper, QLS Partners LP

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Crisis Alpha is on everyone’s mind right now, maybe due to a bit of recency bias, but regardless of the reason thinking of and preparing for “tail-risk” is best done before it’s needed. Trend following is one such strategy that is rooted in academic research and is an enticing way to manage large drawdown risk, though not without the occasional trip on the “Pain Train.” The author, David Modest, uses a stationary binomial framework, resembling a “coin-flip”, within an efficient market context to simplify markets and explore the features of a simple trend-following (TF) strategy. The methodology of the binomial framework is that a long/short signal is generated from a coin-flip: if heads, the strategy goes long, if the following flip comes up heads again, the strategy makes money. If the flip is tails, the strategy goes short and if the next flip is again tails, the strategy makes money. Profits are governed by a random walk with a constant variance. Two scenarios are examined including (1) heads and tails are equally likely; and (2) heads more likely than tails. In the four-period binomial framework used in this experiment, as table 1 below exhibits, there are sixteen-possible price/profit paths to analyze.

Five observations regarding the behavior of a trend following strategy derived from the coin-flip experiment are discussed.

What are the Academic Insights?

Observation #1: Trend following and the long-only investment strategy have the same expected profits (returns) and variance of profits (returns). They differ in that TF dramatically changes the shape of the distribution of returns and the timing of returns. See Table 1 below.

Observation #2: In spite of the lack of predictability in prices, but building on observation #1, TF is able to generate alpha during crisis periods when the long only strategy suffers the most.

Observation #3: Option strategies have a similar impact on the shape of the distribution of returns in terms of timing when profits occur, despite the fact that the mean and variance of the distribution are not affected. 1 Using the binomial framework again, but comparing a long call option strategy to the long-only strategy results in the same expected profit and variance, but a different distribution of outcomes. The long call produces a profit 31.25% of the time (with a loss of the call premium 68.75% of the time). More importantly, it exhibits a strong positive skew and produces crisis alpha of $35.625. The long-only strategy produces a loss only 31.25% of the time with a skew of zero at the same point in time.

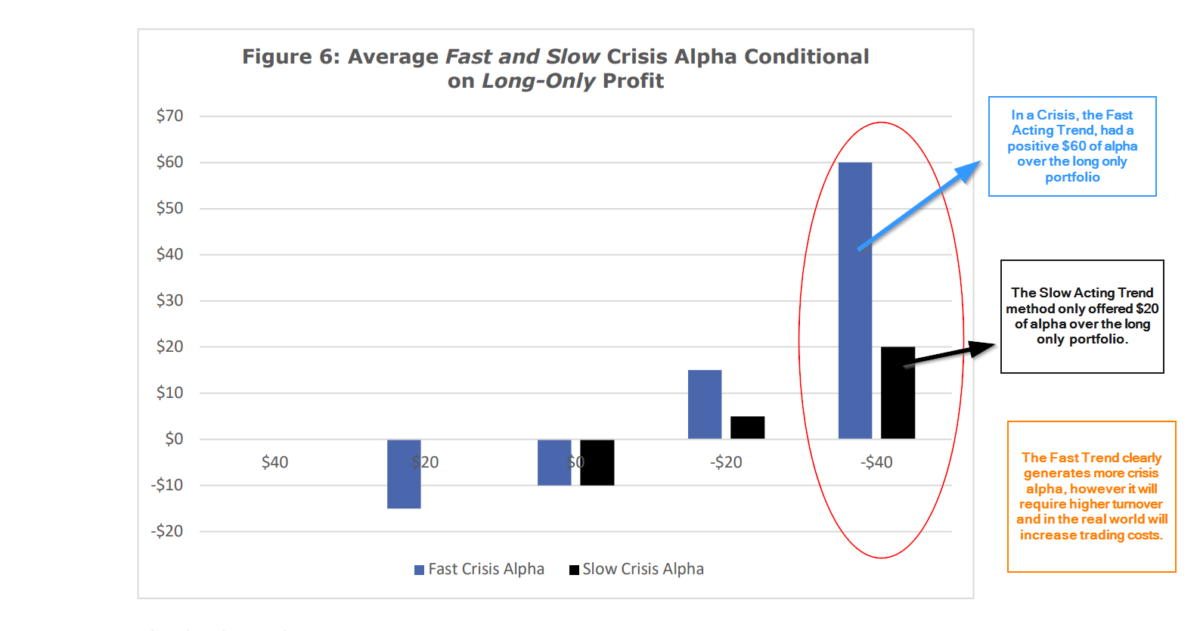

Observation #4: The ability to generate crisis alpha is dependent on the shortness of the period of time used to calculate the trend signal. A shorter period leads to a faster response to a change in market conditions, although accompanied by higher turnover and trading costs.

Observation #5: TF will generate profits (losses) under the condition that markets exhibit a consistently positive (negative) trend, even if markets are efficient, and given there is a sufficient period of time for the trend to play itself out. While the range of outcomes for the long only and fast TF are the same, the TF exhibits a higher variance relative to the long only strategy and the timing of when profits or losses occur is again different.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)