Jared Broad began his career as a software engineer with twin passions: quantitative data and the financial markets.

“In 2010, I was in my 20’s and living in Chile after a period of humanitarian work. I had low rent, no family obligations, and enough savings to hold me over so decided to start trading. I quickly realized I’d be better off with automation and began my two-year journey to building and deploying hundreds of algorithmic trading strategies.”

But when Broad tried to find existing quant technologies to build from and online communities to learn from, he found that nearly all platforms and ideas were private. This created a massive barrier to entry for the millions of others around the world who had similar passions, but day jobs and families and not enough time.

“I understood those people because I’d been one of them.”

By 2012, his engine was up and running and his mission had changed.

“I decided to make quantitative trading accessible. I wanted to create an open-source platform where people could do their work without worrying about hardware or data collection. Our platform would take care of the boring stuff – API connectivity, back-office plumbing and so on — so they could jump right into the fun part: creating strategies, backtesting, experimenting, using strategies we or others had created, and trading pretty much as soon as they chose to.”

QuantConnect (QC) was born.

“Our core mission is to make quantitative finance accessible by dramatically lowering the barriers to entry through open-source, a collaborative community, and a powerful platform.”

The engine that was born in Broad’s apartment grew into an open-source project now called LEAN.

LEAN executes the requests made by the Python and C# algorithms written by the QC community, processing data, managing trades and ingesting more than 100 data sources; from the basics like US equities and Morningstar fundamentals, to alternative data like news, sentiment, and macro-economics.

“Alternative data like Quiver Wall Street Bets and Congress Trading are fun — information you might think is only tangentially connected with trading that our system packages to make useful to clients.”

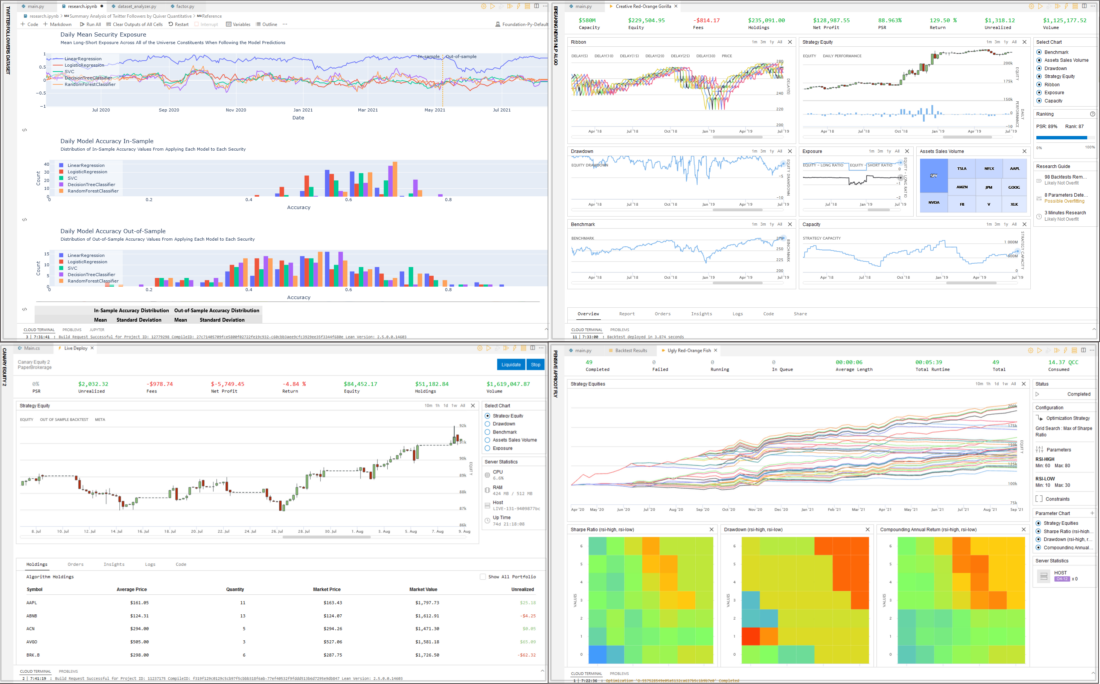

Clockwise from upper left: Research: Importing Twitter followers of various companies and testing various machine learning models to explore their effectiveness at forecasting future performance. Backtest: Importing a live streaming news feed and applying NLP techniques to forecast future performance based on news sentiment. Optimization: Parameter sensitivity testing of RSI method arguments on performance. Live Trading: Live deployment of a portfolio of US equities stocks.

According to Broad, it took years of engineering and thousands of hours of programming to build a robust algorithmic trading infrastructure. With open-source additions from roughly 160 contributors around the world, LEAN is now connected to Interactive Brokers and 16 other firms. QC hosts the IB Gateway Java app for each IBKR client. When they run their algos, LEAN routs them through the Gateway and directly into TWS. Broad says QC now drives a significant number of trades to IBKR.

About three years ago, QC introduced an institutional tier. Now, in addition to their individual and team clients, they support large trading desks — for one example, a $5B NYC hedge fund with a $100 million trading allocation that uses the platform for research and trading.

QC’s largest single client is an ETF provider that builds their models on LEAN, the core QC engine, and uses the platform for research. The ETF firm began with just three people and a complex math problem: building downside hedges to the world’s most popular indexes. Their insights allowed option hedges to protect against volatile crashes, as in March 2020 when the impact of the Covid pandemic first hit the markets.

One of the project’s challenges was that no platform in the world existed that could accurately model historical options trading. In collaboration with their client, QuantConnect built what Broad calls “a dynamic options margin-solving engine” to allow point-in-time backtesting of complex derivative portfolios. When the work was finished, the ETF could do their research, build their strategy and backtest it with all the historical data they needed. And because the code is all open source, anyone who signs up on QC can now work on option-hedging strategies of their own.

“When the regulators gave the ETF the green light to launch, what began as just one of hundreds of startup clients became an innovative enterprise handling upwards of USD 2 Billion. That’s one of the fun parts of our work: we never know which clients will take off.”

LEAN is cloud-hosted, so spinning up servers takes little effort.

“We sometimes think of ourselves as AWS for quants. It is ridiculously easy for firms to scale up, while we handle all the infrastructure and scaling challenges.”

Entry-level sign-up is free. The platform provides API documentation and a number of video tutorials. If a client has an IBKR account and just wants to use QC’s algorithms for trading, Broad says they can get started in roughly 30 seconds with just two clicks. They can begin with a paper trading account and experiment with algos without risking real money until they are ready.

“Click a button to backtest, wait about 10 seconds and LEAN gives you all the historical trades, orders and statistics. When the client is satisfied, they enter their IBKR ID and password and click deploy. That’s all it takes.”

Of course, that’s not all it takes for LEAN. Behind the scenes, professionally racked servers run non-stop, fueled by low-latency data feeds and fully-redundant high-speed internet.

“We’ve built a professional-grade environment that’s available to everyone who signs up.”

With its data sources, LEAN engine and educational material, the QC platform aims to offer value to every tier, from individuals who are just learning to sophisticated organizations.

Interested parties can subscribe to QC directly at www.quantconnect.com or through IBKR’s Investors Marketplace.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.