If you’ve been curious about leveraging Machine Learning for algorithmic trading with Python, you’re joining a growing trend in the financial industry. Machine learning has gained significant popularity among quant firms and hedge funds in recent years. These entities have recognised the potential of machine learning for algorithmic trading.

While specific algorithmic trading strategies employed by quant hedge funds are typically proprietary and kept confidential, it is widely acknowledged that many top funds heavily rely on machine learning techniques.

For instance, Man Group’s AHL Dimension program, a hedge fund managing over $5.1 billion, incorporates AI and machine learning in its trading operations. Taaffeite Capital, another notable example, proudly claims to trade fully systematically and automatically using proprietary machine learning systems.

In this Python machine learning tutorial, we aim to explore how machine learning has transformed the world of trading. We can develop machine-learning algorithms to make predictions and inform trading decisions by harnessing the power of Python and its diverse libraries. While the tutorial will not reveal specific hedge fund strategies, it will guide you through the process of creating a simple Python machine-learning algorithm to predict the closing price of a stock for the following day.

By understanding the fundamentals of machine learning, Python programming, financial markets, and statistical concepts, you can unlock opportunities for algorithmic trading using machine learning in Python. From acquiring and preprocessing data to creating hyperparameters, splitting data for evaluation, optimising model parameters, making predictions, and assessing performance, you will gain insights into the entire process.

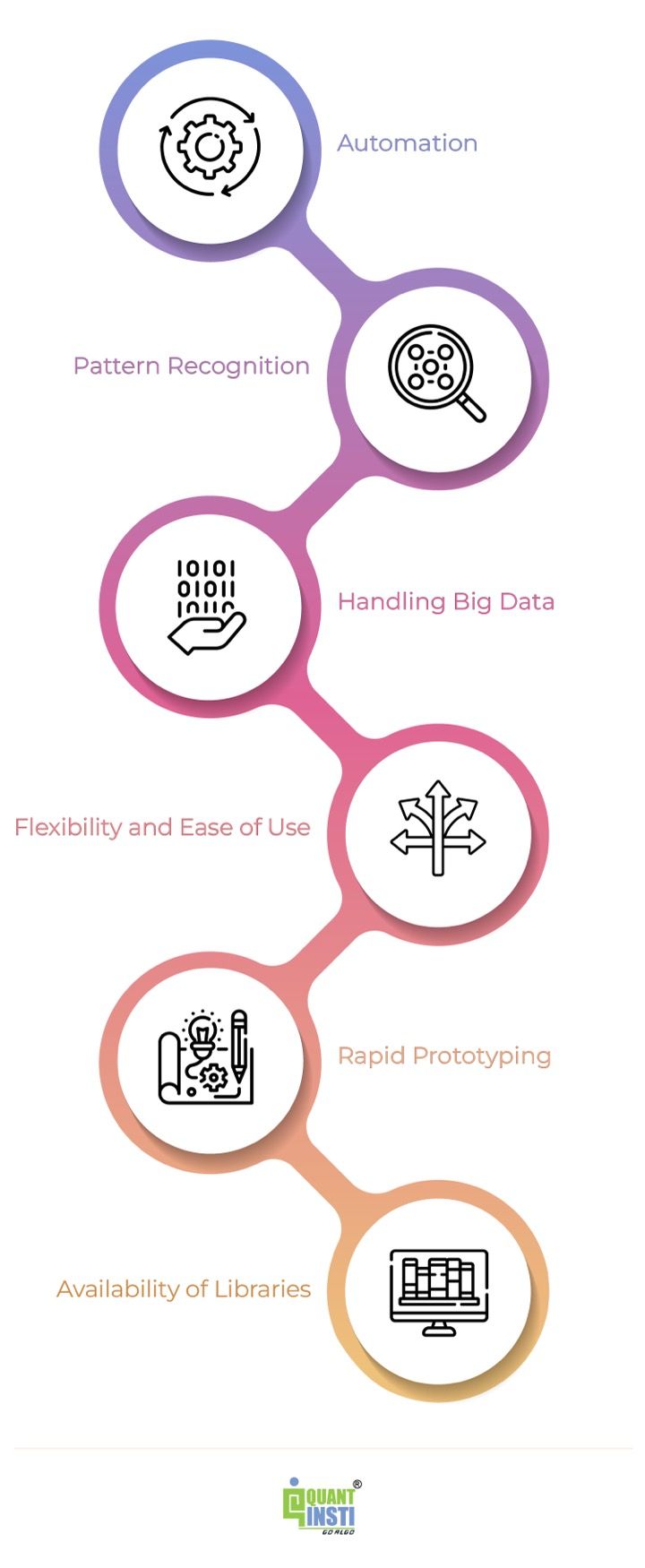

It’s important to note that using machine learning in algorithmic trading has its pros and cons.

On the positive side, it offers automation, pattern recognition, and the ability to handle large and complex datasets. However, challenges such as model complexity, the risk of overfitting, and the need to adapt to dynamic market conditions should be taken into account.

By embarking on this journey of using machine learning in Python for algorithmic trading, you will gain valuable knowledge and skills to apply in finance and explore the exciting intersection of data science and trading.

All the concepts covered in this blog are taken from this Quantra course on Python for Machine Learning in Finance.

This blog covers:

- How machine learning gained popularity?

- Why use machine learning with Python in algorithmic trading?

- Prerequisites for creating machine learning algorithms for trading using Python

- How to use algorithmic trading with machine learning in Python?

- Getting the data and making it usable for machine learning algorithm

- Creating hyperparameters

- Splitting the data into test and train sets

- Getting the best-fit parameters to create a new function

- Making the predictions and checking the performance

- Comparing pros and cons of using machine learning with Python for algorithmic trading

- FAQs

How machine learning gained popularity?

Machine learning packages and libraries are developed either in-house by firms for proprietary use or by third-party developers who make them freely available to the user community. The availability of these packages has significantly increased in recent years, empowering developers to access a wide range of machine-learning techniques for their trading needs.

There are numerous machine learning algorithms, each classified based on its functionality. For example, regression algorithms model the relationship between variables, while decision tree algorithms construct decision models for classification or regression problems. Among quants, certain algorithms have gained popularity, such as

- Linear Regression

- Logistic Regression

- Random Forests (RM)

- Support Vector Machine (SVM)

- K-Nearest Neighbor (kNN) Classification and

- Regression Tree (CART) Deep Learning

These Machine Learning algorithms for trading are used by trading firms for various purposes including:

- Analysing historical market behaviour using large data sets

- Determine optimal inputs (predictors) to a strategy

- Determining the optimal set of strategy parameters

- Making trade predictions etc.

Why use machine learning with Python in algorithmic trading?

Thanks to its active and supportive community, Python for trading has gained immense popularity among programmers. According to Stack Overflow’s 2020 Developer Survey, Python ranked as the top language for the fourth consecutive year, with developers expressing a strong desire to learn it. Python’s dominance in the developer community makes it a natural choice for trading, particularly in the quantitative finance field.

Python’s success in trading is attributed to its scientific libraries like Pandas, NumPy, PyAlgoTrade, and Pybacktest, which enable the creation of sophisticated statistical models with ease. The continuous updates and contributions from the developer community ensure that Python trading libraries remain relevant and cutting-edge. Additionally, there is the availability of libraries like

- Pandas

- NumPy

- PyAlgoTrade and more.

Coming to machine learning with python, there are several reasons why machine learning with Python is widely used in algorithmic trading:

Stay tuned for Part II to learn about prerequisites for creating machine learning algorithms for trading using Python.

Originally posted on QuantInsti Blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.