Nowadays, gold is a hot topic, but that is not a surprise given the worldwide situation. The gold is by the majority considered as a hedge, safe haven and often recognized for its ability to preserve the value in the long term. However, gold itself is not the only gold-related investable asset. There are numerous gold-related stocks – producers, explorers and developers. Common sense might suggest that the price of such stocks should reflect the gold prices, but the novel research by Baur and Trench (2020) shows that this logic is not always correct. Results suggest that gold equities cannot be considered as safe havens and investors differentiate between producers, explorers and developers during regular times. On the other hand, during the recent (and lasting) stressful COVID period, all types of gold stocks moved similarly to gold.

Authors: Dirk G. Baur and Allan Trench

Title: Not all Gold Shines in Crisis Times – COVID-19 Evidence

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3677925

Abstract:

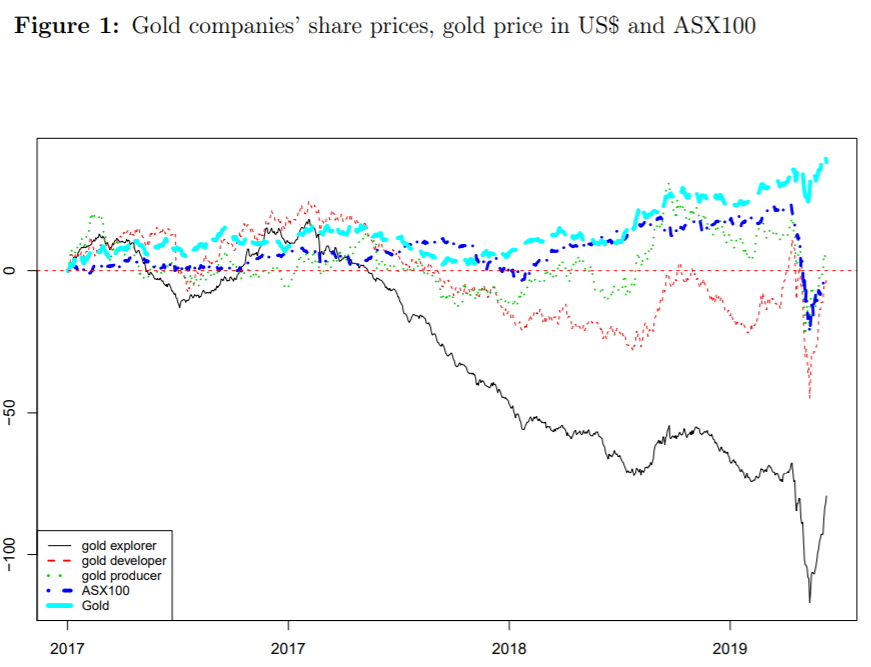

This paper analyses the impact of the coronavirus pandemic on the share prices of gold firms, whose activities are spread across gold exploration, project development and gold mining with markedly different risk characteristics. We find evidence for COVID-induced stock market contagion leading to a decoupling of gold companies from the price of gold illustrating that gold shares are not a safe haven. The equity market and gold exposures differ significantly between explorers, developers and producers in normal times and are higher and more similar in crisis times. Our findings demonstrate that investors treat different firms differently in normal times and more equally in crisis times leading to mispricing and profit opportunities.

The relationship of various gold equities and gold can be observed from the following figure from the academic paper:

Notable quotations from the academic research paper:

“The econometric analysis uncovers the following relationships: gold firms are differently exposed to the market and the gold price in normal times (producers more to gold and less to the market and explorers less to gold and more to the market consistent with the higher risk of these companies) but much more exposed and more similarly exposed during the pandemic. The “normal” or pre-COVID betas based on gold prices in A$ are generally larger than the betas based on gold prices in US$.

The results indicate that investors distinguish between explorers, developers and producers in normal times but less so in crisis times. In crisis times, the market dominates, not because the exposure (beta) is much larger but because the magnitude of the market shock is much larger (e.g. -20%) than the magnitude of the gold shock (e.g. +5%). As a consequence, gold equities were far from immune to the COVID-19 market shock.

The decoupling of gold shares from the price of gold is bad news for gold mining companies and shows that the market exposure can be contagious if the shock is too large. The decoupling of gold shares from the price of gold also means that there is an expected recoupling to realign valuations with the price of gold in the future. The contagious impact of the market on all different types of gold shares is bad news for investors because diversification did not work when needed the most.

Since the price of gold and thus the core revenue source of gold firms increased during the crisis, the lower stock valuations suggest an undervaluation of gold firms, particularly gold producers with the most direct link to gold, and a reaction to theCOVID-19 shock that is not related to the fundamentals or core revenue stream gold. This is why gold shares are particularly interesting and why they offer a perspective that is rarely offered by other stocks as it is hard to disentangle changes in fundamentals from changes in market sentiment. In this case, whilst the sentiment has changed the fundamentals with respect to gold have not. If anything, the fundamentals have improved for gold producers given the increased price of gold.”

Visit Quantpedia to learn more about this paper:

https://quantpedia.com/not-all-gold-shines-in-crisis-times-covid-19-evidence/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.