This post demonstrates the application of Differential Evolution (DE) to estimate Nelson-Siegel parameters using the NMOF R package.

Differential Evolution (DE)

Gilli et al. (2010) applied the Differential Evolution algorithm to the Nelson-Siegel (NS) or Nelson-Siegel-Svensson (NSS) model. The authors implemented and tested this optimization and showed that it is capable of reliably solving the numerical problem of the NS or NSS model.

This DE optimization algorithm can be used from the R package, NMOF, and the authors kindly provided the R code in the appendix of their working paper. This allowed me to apply this code to some data and verify that the estimation results match those obtained using existing algorithms such as the Nelder-Mead.

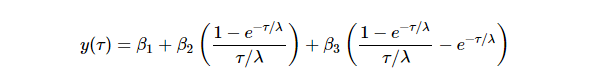

Following Gilli et al. (2010), there are two notational differences from what I have been accustomed to. First, maturity is expressed in years. Second, the time decay parameter is in reciprocal form, denoted as ![]() . Therefore, the NS model is represented as follow.

. Therefore, the NS model is represented as follow.

R code

The following R code estimates the Nelson-Siegel parameters by using the DE.

#========================================================#

# Quantitative Financial Econometrics & Derivatives

# ML/DL using R, Python, Tensorflow by Sang-Heon Lee

#

# https://shleeai.blogspot.com

#--------------------------------------------------------#

# Estimating the Nelson-Siegel model

# using Differential Evolution (DE)

#========================================================#

graphics.off(); rm(list = ls())

library(NMOF) # Differential Evolution

#-----------------------------------------------

# Objective function

#-----------------------------------------------

OF <- function(param, data) {

y <- data$model(param, data$tm)

maxdiff <- y - data$yM

# max absolute error

# maxdiff <- max(abs(maxdiff))

# Sum of Squares

maxdiff <- sum(maxdiff^2)

if (is.na(maxdiff))

maxdiff <- 1e10

maxdiff

}

#=======================================================

# 1. Read data

#=======================================================

# b1, b2, b3, lambda, RMSE for comparisons

ns_reg_para_rmse1 <- c(

4.26219396, -4.08609206, -4.90893865,

3.060792, 0.04883786)

ns_reg_para_rmse2 <- c(

4.97628654, -4.75365297, -6.40263059,

1.651215, 0.04157326)

str.zero <- "

mat rate1 rate2

3 0.0781 0.0591

6 0.1192 0.0931

9 0.1579 0.1270

12 0.1893 0.1654

24 0.2669 0.3919

36 0.3831 0.8192

48 0.5489 1.3242

60 0.7371 1.7623

72 0.9523 2.1495

84 1.1936 2.4994

96 1.4275 2.7740

108 1.6424 2.9798

120 1.8326 3.1662

144 2.1715 3.4829

180 2.5489 3.7827

240 2.8093 3.9696"

df <- read.table(text = str.zero, header=TRUE)

m <- df$mat

y1 <- df$rate1; y2 <- df$rate2

#=======================================================

# 2. Estimation

#=======================================================

#-------------------------------------------------------

# NS estimation with 1st data

#-------------------------------------------------------

data <- list(yM = y1, # percent

tm = m/12, # in years

model = NS,

ww = 0.1,

min = c( 0,-15,-30, 0),

max = c(15, 30, 30,10)

)

f_penalty <- function(mP, data) {

minV <- data$min

maxV <- data$max

ww <- data$ww

## if larger than maxV, element in A is positiv

A <- mP - as.vector(maxV)

A <- A + abs(A)

## if smaller than minV, element in B is positiv

B <- as.vector(minV) - mP

B <- B + abs(B)

# ## beta 1 + beta2 > 0

C <- ww*((mP[1L, ] + mP[2L, ]) - abs(mP[1L, ] + mP[2L, ]))

A <- ww * colSums(A + B) - C

A

}

algo <- list(nP = 100L, ## population size

nG = 500L, ## number of generations

F = 0.50, ## step size

CR = 0.99, ## prob. of crossover

min = c( 0,-15,-30, 0),

max = c(15, 30, 30,10),

pen = f_penalty,

repair = NULL,

loopOF = TRUE, ## loop over popuation? yes

loopPen = FALSE, ## loop over popuation? no

loopRepair = TRUE, ## loop over popuation? yes

printBar = FALSE)

set.seed(90)

deopt <- DEopt(OF = OF, algo = algo, data = data)

nsdtim_out1 <- c(deopt$xbest,

sqrt(deopt$OFvalue/length(m)))

#-------------------------------------------------------

# NS estimation with 2nd data

#-------------------------------------------------------

data$yM <- y2

f_penalty <- function(mP, data) {

minV <- data$min

maxV <- data$max

ww <- data$ww

## if larger than maxV, element in A is positiv

A <- mP - as.vector(maxV)

A <- A + abs(A)

## if smaller than minV, element in B is positiv

B <- as.vector(minV) - mP

B <- B + abs(B)

# beta 1 + beta2 > 0 is not applied

A <- ww * colSums(A + B)

A

}

# new penalty without beta 1 + beta2 > 0

algo$pen <- f_penalty

set.seed(90)

deopt <- DEopt(OF = OF, algo = algo, data = data)

nsdtim_out2 <- c(deopt$xbest,

sqrt(deopt$OFvalue/length(m)))

#=======================================================

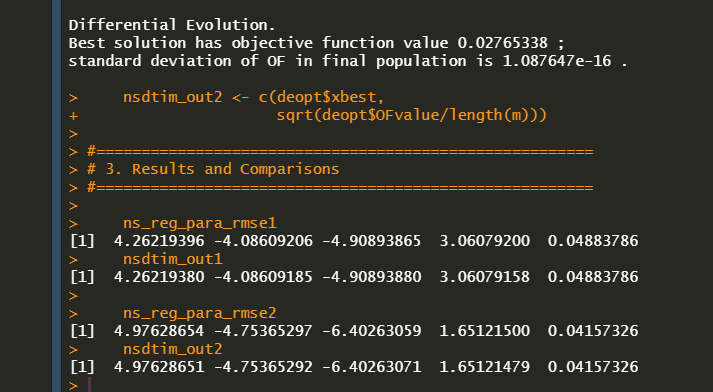

# 3. Results and Comparisons

#=======================================================

ns_reg_para_rmse1

nsdtim_out1

ns_reg_para_rmse2

nsdtim_out2

As can be seen in the following results, It seems that parameter estimates from the DE algorithm are the same as the benchmark results.

I believe this approach is highly effective in terms of avoiding local minima and achieving fast convergence.

Reference

Gilli, M., S. Große, and E. Schumann (2010). Calibrating the Nelson–Siegel–Svensson model. COMISEF Working Paper Series No. 31.

Originally posted on SHLee AI Financial Model blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SHLee AI Financial Model and is being posted with its permission. The views expressed in this material are solely those of the author and/or SHLee AI Financial Model and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.