In today’s post, The Alpha Scientist walks us through how to set up Talos and Numerox.

Looking inside of one of these dataframes, you’ll note a few things:

- The last several columns are named ‘bernie’, ‘elizabeth’ etc… These are code names for different outcome variables the data can be used to generate. The key point is that each of these outcomes is independent of each other (not a multi-class problem, instead several one-class problems).

- The features are labeled as only x1 to x50, not with names that provide any hint to what they represent. This is by design – part of numerai’s approach to abstracting real financial market data into 100% data science, 0% market knowledge.

- The

features have already been scaled and standardized. Allegedly, the data has

also been carefully cleansed as well.

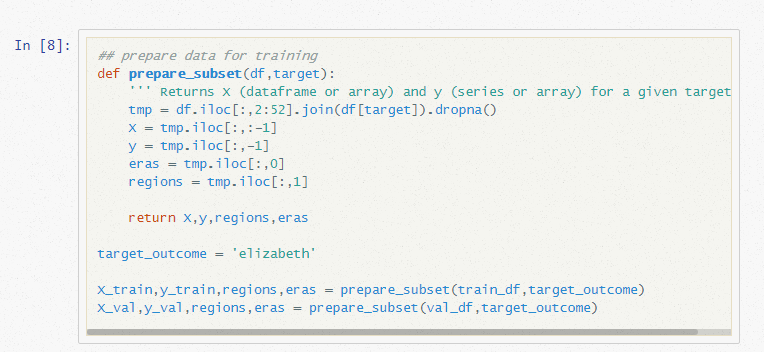

Next, we’ll define a simple function to split each dataframe into features (X), labels (y), and two other series regions and eras, which we will discard (they are not available on the out of sample data, so we definitely don’t want to train models using them!)

We’ll choose one target variable to use as our target label. Here, I’ll choose elizabeth.

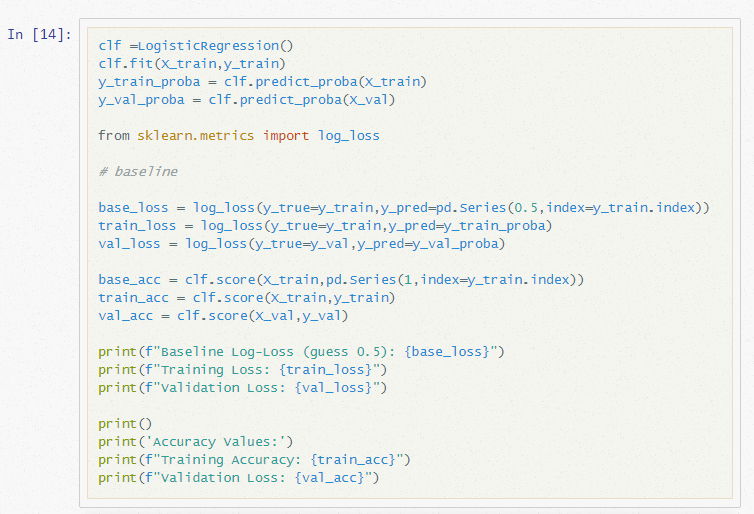

Now that we have data, I’ll train a very basic logistic regression model to serve as baseline:

I’ve calculated the log-loss values and class accuracies for training and validation sets, as well as for a naive strategy of always guessing 50%. You’ll note that the model has learned something but not all that much.

This is the unfortunate reality of using machine learning to form likely outcomes in the financial markets. Edge exists, but it is very, very slight. There is also an upside in this reality.

Achieving a

model, which truly offers 51% (or better yet, 52/53/54%) accuracy out of a sample

can potentially be extraordinarily profitable, given highly liquid markets and

careful attention to transaction costs. And the reward for moving from 51/49

advantage to 52/48 is a doubling in potential profit.

_ actually more than double, when considering transaction costs_

If we wanted to improve upon this result with a “representation” model, there would be any number of tactics to employ. However, since the purpose of this post is to explore hyperparameter optimization of keras models, I won’t bother.

Enter, Talos…

At this point, you may want to take a minute or two to read the talos docs and example notebooks.

TL;DR: essentially a talos workflow, involves (1) creating a dict of parameter values to evaluate, (2) defining your keras model within a buildmodel as you may already do, but with a few small modifications in format, and (3) running a “Scan” method.

In the next installment, the Alpha Scientist will continue with the demonstration of Talos.

I’m Chad, aka The Alpha Scientist. I’ve created The Alpha Scientist blog to explore the intersection of my two professional passions: locating “alpha” in market inefficiencies and applying data science methods. If you’ve found this post useful, please follow @data2alpha on Twitter and forward to a friend or colleague who may also find this topic interesting. https://alphascientist.com/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Alpha Scientist and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Alpha Scientist and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)