With long positions in London cocoa futures recently reaching record levels, it appears traders are generally hoping for even higher prices of the staple commodity – which have already pushed up confectionery costs for consumers across the globe. Is it a case of mass heartbreak or something more? Find out what’s driving these cocoa highs, as Sean McGovern, vice president of research at McAlinden Research Partners, and IBKR’s Jeff Praissman and Claire Baxter join host Steven Levine for a lively look at chocolate, as our agricultural commodity series continues….

Note: Any performance figures mentioned in this podcast are as of the date of recording (May 10, 2023).

Summary – IBKR Podcasts Ep. 78

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to another episode from our agricultural commodities vault! Sean McGovern, vice president of research at McAlinden Research Partners – he’s here with us, again, along with Jeff Praissman, IBKR’s senior trading education specialist, and, for the first time, Claire Baxter – she’s a content creator for us here at the IBKR Campus, and we’re all going to talk about cocoa futures.

So, exciting topic. This one just might dispel the whole illusion that I have a picture-perfect dietary habit. It’s not true. I do eat chocolate, but we’ll get into that….

Cocoa. It’s the mainstay ingredient of chocolate, which for breakfast foods you might think: chocolate croissants or chocolate milk or hot chocolate, or maybe even chocolate cake, who knows? There are holidays. There are several holidays that are basically synonymous with chocolate. Obviously, Valentine’s Day, Halloween, we have Mother’s Day … that’s coming up. Also, chocolate Easter eggs, and chocolate Easter bunnies, and Advent calendars, and the list goes on and on.

And there are other products like chocolate scented candles, and cocoa butter, and cocoa oil, which can be used in fragrances, and skin care, and even some studies done that attribute certain chemicals – like phenylethylamine – to the feeling of love that one might get when eating chocolate. You get your heart broken, you eat a pint of chocolate ice cream, and I think that’s how it goes.

Dark chocolate has its own special properties, it seems. From what I understand – serotonin, dopamine, endorphins – apparently, it has mood-lifting attributes, as well as antioxidants that are said to improve cognitive functioning … it might be why Hershey calls it ‘Special Dark’?

I mean, chocolate is so celebrated that at the turn of the 20th century, Milton Hershey, founder of the Hershey Chocolate Company, built an entire amusement park for his employees. It’s called Hersheypark. It’s still there. It’s in Hershey, PA. It’s a whole city named ‘Hershey’, and it seems to be still thriving.

So, with all that, let’s talk about cocoa futures and chocolate, how it’s traded, where it’s produced, [and] some companies that largely depend on cocoa for their growth in sales: some famous names like Hershey, Mondelez, Mars Wrigley, Nestle, Lindt & Sprüngli….

So, before we look at the [IBKR] Trader Workstation – before, we look at how cocoa futures are doing – what do you say we get some background from Sean on what cocoa futures traded on the exchange are, and some background into some of the catalysts that investors should look for when deciding to trade these?

Weighing a Cocoa Futures Contract

Sean McGovern

Cocoa futures are going to be traded most widely on the New York Mercantile Exchange – what most people call the ‘Nymex’, and the Intercontinental Exchange (ICE) – ‘I’-‘C’-‘E’ – usually – that trades in London and New York hours, and each of those are priced in their respective nation’s currencies. I guess my preference for price is going to be ICE’s U.S. dollar contract. That’s the one I see most commonly, but it’s normally not too far away from the Nymex anyway. Delivery months for cocoa are March, May, July, September, and December. The 9th of this month was the first delivery for May’s contract. So, the front month is now … it’s July. That’s the price that’s being quoted. And, lastly, a single contract is going to be worth 10 metric tons of product, but the price is still usually going to be quoted on a per ton basis. As for catalysts, like any agricultural commodity, you’re going to be looking at stockpiles, weather, and demand most closely, but there are a number of other factors that are broadly influenced by those three variables, and one can examine those as well.

Steven Levine

How many metric tons is a contract?

Sean McGovern

Ten. Ten metric tons. So, don’t miss the expiration date or you’re going to have to find somewhere to put all that cocoa. I don’t know where.

Steven Levine

I don’t know, I feel like that’s probably just the bag of M&M’s that I just had – might have been equivalent to one of those contracts. Jeff, what’s the performance like on these contracts on TWS?

Cocoa Highs

Jeff Praissman

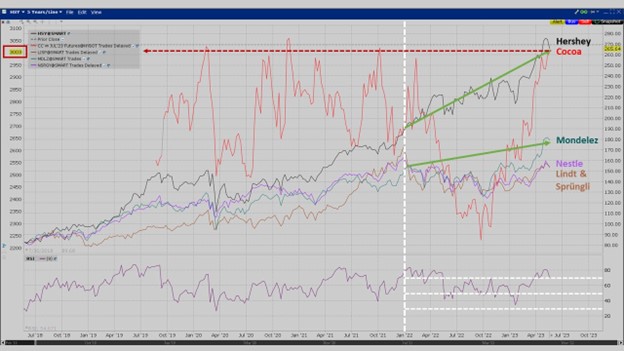

Oh, the cocoa futures are definitely up for the year by far – trading around $3,000, or so. That’s actually the last 12-month high by a long shot. However, if you go back a little bit further, maybe toward the beginning of January 2022, they were trading at a similar level before they sort of cratered downward – all the way down to, say, around $2,200, $2,250, and then have been just roaring back over the last 12 months as well. And over the last five years or so, around the $3,000 mark is sort of the peak in different times. It kind of hit this back in 2021, toward the end of 2020 and then sort of in the beginning of 2020 as well.

Source: IBKR Trader Workstation (May 17, 2023)

Steven Levine

I understand that they’re fairly expensive at this point, at least fairly recently. But what’s driving that? So, what’s driving this, Sean?

A Tower of Ivory Chocolate

Sean McGovern

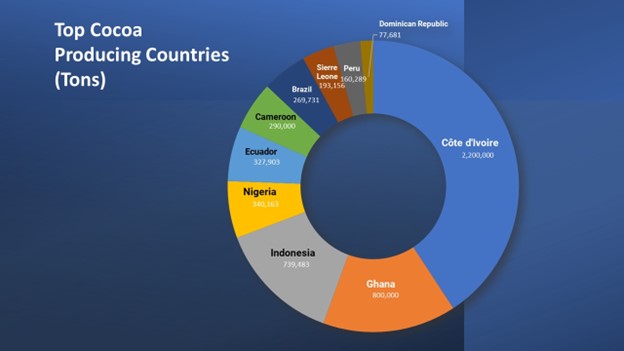

This ongoing breakout is coming mostly from the supply-side, and like many of the big upticks we see in commodity prices, it’s going to result from the natural concentration of resources in certain places that we see with pretty much all commodities. In some of our recent discussions, we’ve seen this kind of thing with the coffee markets, heavy dependence on the Brazilian arabica harvest; the grain markets’ reliance on Eastern Europe, and its connection to the Black Sea; so on, and so forth. As for cocoa, the world’s supply is most heavily concentrated in just one region of Western Africa, and the largest producer is the Ivory Coast. They’re usually producing more than two million metric tons of cocoa per year, whereas no one else is even getting close to 1,000,000 … or maybe close, but no one’s touching a million. Their neighbor, Ghana, follows in second place, although it’s really not particularly close. Nigeria and Cameroon are all nearby. They play a meaningful role in the cocoa as well, but Ivory Coast, as I said, has more production than them, and actually more production than all three of those other regional producers put together. So, if you take a look at the chart on cocoa prices, you see them really start to take off around September to October of last year. That’s when the Ivory Coast [had] begun selling their cocoa export contracts for the 2023 to 2024 harvest at a non-negative origin differential premium for the first time in three years. That origin differential – that’s just a premium that’s paid for cocoa that comes from a country that’s known to have a certain quality and reliability to it. And that premium, specifically for supplies from the Ivory Coast and Ghana, actually fell as much as 150% throughout the two years prior to 2023 – mostly related to the COVID pandemic, but recovered some lost ground in the final quarter of last year, which is what got it out of negative territory.

The premium itself isn’t really all that significant, but a return to governments enforcing the premium as opposed to offering a discount on their exports –that sort of signals these two countries, with an outsized share of the cocoa trade, are getting more serious about trying to manage the flow of the market and leverage their weight to get more out of it – for the first time in several years. That’s probably going to include a tightening of supply at some point. [The] Ivory Coast coffee and cocoa regulator had been targeting a price of $2,600 per ton, since that’s the threshold where their farmers are able to earn a living wage, and that was the floor they were aiming for, and we’ve reached that early this year. Around that same time, however, the Ivory Coast government also continued to get more actively involved in markets by restricting several major traders from continuing to buy cocoa. That took place in February, when those traders reached certain purchase limits that were introduced by the country, and the Ivory Coast didn’t want those big guys building up stockpiles and strangling the availability of cocoa for the country’s local firms. So, some of the traders that were blocked out are actually household names – like Cargill – which gives you an idea of the scale we’re talking about here. I mean, these are huge international traders that were essentially pushed aside so that smaller exporters could be saved from what would probably end up being a default if they didn’t get the beans they needed. So, you’ve got plenty of demand coming in internationally, but it seems like there are definitely issues in rationing out the available supplies that this nation has – by far, the top cocoa producer. Those purchase restrictions are still in place today, and it’s continued to ignite concerns about potential shortages of cocoa in the future.

Source (data): World Atlas

Steven Levine

It’s a real geographic concentration that’s happening here. I mean, it seems that the U.S. and Europe, which produces something like 30-35% of the world’s chocolate [*each], takes its supply only from this particular region, or very limited from other regions, I suppose, like maybe Brazil or Mexico. I suppose there are certain other countries that do produce cocoa, but yes, I mean by and large Ivory Coast … Ghana … really provides these constraints in terms of the risk for their manufacturing.

But that just brings us to these anecdotal stories of ‘what is it that we’re paying, when we pay for chocolate at our retailer’ [costs will vary depending on source]? I mean, I just have to say I just I just showed Jeff … last week, I needed some kind of comfort food. I just wanted a bag of M&M’s. I ended up getting like a family-size – I guess that was the only thing that was available from Instacart – and it cost me $16.99 for that bag of M&M’s, and I just thought that was absolutely crazy. I mean, there’s others as well, but I’d love to hear from y’all. I’d love to know what it is you’re paying, and whether or not it’s more or less than what you paid last year.

Very Rich Chocolate

Sean McGovern

Well, I do enjoy dark chocolate, but I don’t eat it that much. I don’t mean to say I don’t like it. I think it’s the opposite actually. Chocolate is … it’s just one of those things that I can’t keep it around too much or it won’t last long. But one thing I do have, though, it’s called ‘cacao’, if you’ve ever heard of that. You could see it in a lot of grocery stores, usually in a powder form. That’s what I get it in. It’s from the same bean as cocoa. They’re the same thing. I think the name is interchangeable from the way that I understand it. But cacao powder’s made from grinding the unroasted bean as opposed to cocoa coming from the beans that were roasted at really high temperatures. So, essentially, it’s a mostly unprocessed, raw version of cocoa. I can’t say it tastes the same. it’s more bitter, but it’s higher in antioxidants, flavonoids, all those big words that make you feel like something’s healthier when you put it into a protein shake or whatever else. And the best part is – it’s so expensive already, that no matter how much the price goes up, it’s equally outrageous. It lasts a long time, so I can’t complain too much. I think that’s probably the biggest cocoa or cacao product that I’m consuming mostly.

Steven Levine

That sounds really good. I might just look into that, because I do like to stay somewhat healthy. All my chocolate is somewhat healthy, but…. Jeff, what do you think?

Jeff Praissman

I’m the opposite of Sean. I have zero willpower. I literally ate half-a-sleeve of Girl Scout thin mints on my way over here to the podcast studio. So, I go anywhere from over-the-counter candy bars like Whatchamacallits or Hershey’s Take Fives or Reese’s Peanut Butter Cups to … I definitely enjoy a higher-end chocolate like Godiva or Jacques Torres, or we have something near me called Bridgeport Chocolate. So, I’ll never turn down a piece of chocolate from anyone. I can’t help myself. You know, give me those Halloween bite-sized candies, I’ll eat a whole family bag of them. You know, just love it, and can’t get enough of it, and that’s why I have to hit the Peloton every morning.

Steven Levine

Are they more expensive now than what you remember them being, say, last year, or…?

Jeff Praissman

Yeah, definitely. I mean, I think, judging by candy bars, if you’re at the gas station, or the drug store picking something up, and you’re at the counter… or the supermarket, you make an impulse buy … yeah, it used to be probably $1.25 or so. Now they’re probably coasting more toward $2.00.

Steven Levine

Yeah, that’s crazy. I mean, I remember when candy bars used to be a quarter, but that’s like one of those stories where, you know, ‘I walked five miles in the snow to school’. Claire, what are you spending on chocolate? I know you eat chocolate.

Claire Baxter

I think I definitely align closer to Jeff, there, on that one, but I’ll usually eat just about anything chocolate. I will say one of my favorites are these like dark chocolate caramels that come from this local bakery near me. A few years ago, they were probably like $9-$10, still expensive, but doable versus now. Most recently I bought them for Easter, and they were like $17.00 for these eight tiny, albeit very, very delicious caramels. But definitely save those for special occasions and fill that chocolate craving with a regular Twix bar or Hershey’s bar.

Steven Levine

Oh, those are so good. Those are so good. I love all that stuff. It’s really, really difficult. It’s the same – I need some kind of something to hold me back from eating chocolate. And … it’s tough. I like the Lindt bars … like the chili Lindt bars. I think those are pretty good. I tried these vegan Hu bars. They were alright, but they’re very expensive. Mrs. Fields’ brownies are just something that I absolutely love. But the Lindt bars are about $4.00 and the Hu bars close to $8, I mean, depending on where you buy them. And I think you really need to draw some kind of line in the sand – just on principle – for how much this stuff costs. I know that Hershey passed on a lot of its costs to consumers. Demand is still really, really ripe for this stuff….

Sean McGovern

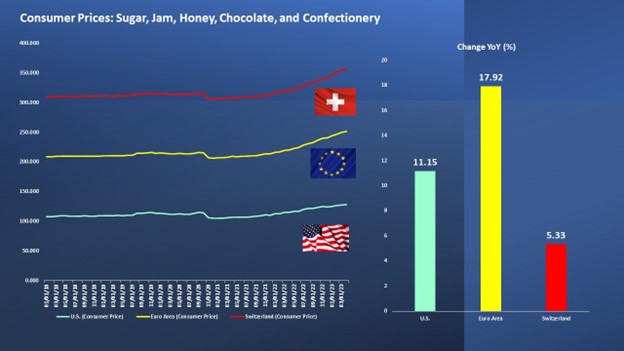

You know, Steven, you mentioned the inflation of all this stuff, which has really played a big role in all food, all food products, food stuff, snacks, anything like that. Inflation has been a big deal. And you mentioned two key regions a couple minutes ago – you mentioned the eurozone, and the U.S., which are really takers from this very small, very commodity-rich area. They’re takers from this area, and then they bring the raw stuff over, and then they make it here. And, so, we can see the consumer prices in the eurozone, for instance – prices for chocolate, and confectionery products, along with jam, sugar, honey, all that sweet stuff – that’s rising by about 17% year-over-year as of the most recent date, I think it’s through March.

Steven Levine

17%?

Sean McGovern

And you also have Switzerland, too. It’s outside the eurozone, obviously, but it’s famously known for its chocolate, and price increases on those goods, those same goods we just talked about — those have jumped out to an almost 15-year high. If we come over to the U.S., rising producer prices for products from cocoa have already passed their peak, or, at least, that’s what it looks like for now. They peaked at about 25%, according to data from the Fed, and they’re coming down around 20% now on the producer side. It seemed like that might be a burden on the chocolate producers, but recent earnings from Hershey and Mondelez suggest that increases in the prices of their goods, passing that on to the consumers, those have been sustained pretty well by resilient consumer demand. You know, Hershey’s North American confectionery sales were up by 10%, annually in Q1; Mondelez reported that their chocolate business grew by 18%…. Both those stocks have bounced pretty strongly since putting out those results at the end of April.

Source (data): Federal Reserve Bank of St. Louis (FRED)

Steven Levine

It’s a lot like Coca-Cola in terms of demand for its products…. What does it look like on Trader Workstation, Jeff? Because I think these companies’ shares are just going north, north, north….

Golden Tickets?

Jeff Praissman

To Sean’s point, Hershey’s outperformed the market 23.3% versus the SPX 1.7%. This is over the last 52-week period. And Mondelez has outperformed at 21%, basically. So, you know, to Sean’s point, both these companies, and this industry and sector, in general, is really doing well.

Steven Levine

Have you seen something on Nestle’s ADRs? That’s the Swiss angle on all this, I suppose.

Jeff Praissman

Yeah, they’re a little bit off their 52-week high, where the other two are much, much closer to it – but still right up there next to it.

Source: IBKR Trader Workstation (May 17, 2023)

Steven Levine

Yeah, it’s amazing. I know Switzerland’s big for … I know Nestle, but also for Lindt [&] Sprüngli. A lot of that’s sold here as well. I think they’re also doing really, really well in terms of their stock – about 18% year-to-date – and I believe that’s ‘LDSVF’ [OTC: LDSVF].

Sean, what’s the dollar’s role in all of this? Because agricultural commodities, in general, yes, are all going north. Since the Fed’s been hiking rates, I mean, they’ve been doing it for quite a while now, what impact has the dollar been having on these agricultural commodities like cocoa … and others like coffee, and wheat, etc.?

Sean McGovern

I mean, typically, what you see is a stronger dollar does depress global trade growth, but we just haven’t seen that in cocoa. So, that’s the real take away from the dollar – is that usually we do see the strong dollar depressing global trade growth, but that hasn’t been the case for cocoa. In fact, the supply constraints are so tight on cocoa, that big, big, big trading companies can’t get enough of it.

Steven Levine

That sounds like it’s just a pure economic supply-demand equation. That makes a lot of sense to me. I thought we’d do something kind of fun. Jeff’s been looking at certain virtual securities. You can do that on Trader Workstation. We have a classic platform, where you can create virtual securities – one financial product and its relative value to another. And, so, I thought we’d do them with cocoa futures and certain chocolate companies like we’ve been mentioning, like Hershey and Mondelez, or other companies. So, what are you seeing, Jeff, there?

Jeff Praissman

Yeah. So, just looking at Hershey’s and cocoa futures over the last 12 months, it looks like kind of the beginning is, say, from June till kind of mid-October, where cocoa futures really took off. Hershey’s was a little bit outperforming the cocoa futures, and then it sort of leveled out, I think, once the futures really started taking off, and Hershey’s kind of went with them, but wasn’t leaping ahead at that point … and kind of the same with Mondelez, where it got a little bit more corrected – with that percentage spread, [it] got a lot less between the two of them once the cocoa futures really, you know, exploded in October ’22, and going forward ….

Source: IBKR Trader Workstation (May 17, 2023)

Steven Levine

I think this might tell us something, also, about where these companies might go, now that we know that they have this kind of relationship; it looks like they’re kind of tracking each other quite a bit. Sean, what would you say is your outlook on cocoa futures?

Outlook

Sean McGovern

We’re going to be watching Africa. As we’ve said, in West Africa, you’ve got 75% of the supply coming out of just four countries over there. I mean, you do have Indonesia and Ecuador, as well, putting out pretty decent crops, but it’s nowhere close to what we’re seeing out of the West African region. If we go back to the Ivory Coast, there’s a few issues this year, in addition to the government directives we talked about, that we’ll be watching closely. I mean, you always have weather, which played a large role in reducing the 2021 to 2022 harvest by about 8%. The Ivory Coast government reported this week that farmers only sent a cumulative 1.97 million metric tons of cocoa to their ports for the 2022 to 2023 marketing year, which is not a great sign. That just ended on May 7th. It’s down 4.6% year-over-year. One of the concerns that may go overlooked by some has been what’s called ‘swollen shoot virus’. That’s put a damper on Ivory Coast exports and is now hitting Ghana as well. In this highly globalized, interconnected world, we see crop viruses, fungi, and pests spreading more widely and rapidly. I mean, we talked about the ‘coffee rust fungus’ not too long ago, which has left virtually no coffee growing region untouched at this point, and we can see a similar pattern with ailments like swollen shoot as well. The rust virus spreads through spores, but swollen shoot is actually carried by these small mealybugs that eat the sap of the cocoa trees and infect them that way. Well, the virus – initially it only reduces the yield of cocoa for, I think, a period of one or two years, but eventually kills the tree altogether. And the International Cocoa Organization has reported the swollen shoot virus was a major detriment to shipments between October and January. So, based on that, and many of the factors playing out today, it’s really no wonder cocoa prices have jumped up. But the final thing is that it’s going to just be difficult to assess what the supply situation is really like until we get a handle on what’s to expect from the Ivory Coast mid-crop harvest, which we’re in the early stages of now. That accounts for about 20% of the Ivorian and Ghanaian production – runs from April to September – and could bridge the gap in the supplies that many of the smaller regional exporters are dealing with. But it’s too early to tell. This dependency on smaller harvest is not ideal, and prices have likely run up on projections that the mid-crop could drop off by 25%.

Steven Levine

When do we get a clearer picture on that? I mean, as you get closer to September? I mean, is that like July or August or something?

Sean McGovern

Yeah, probably around then. We’re watching the rainfall, ‘cause it’s also the rainy season, and we’ve had below average rainfall, which would suggest that farmers were in a bad way, but it’s been offset by good soil moisture. That rebounded from really terrible levels not too long ago, but it’s looking pretty good now. All that’s just to say that it’s hard to tell what to expect from cocoa right now. The weather’s been pretty unpredictable, and it’s kind of sending mixed signals, but one thing I’ll note is that long positions in London cocoa futures actually just hit a record. So, as far as … yeah … as far as traders go, they’re betting big on higher prices from here on out. They’re not deterred by the higher soil moisture, apparently.

Steven Levine

So, the next time I get my bag of M&M’s, it will be like $20….

Sean McGovern

Well, I don’t know. I mean, it’s up to you, I guess. Are you getting it or are you not? Are you willing to pay the $20? It’s up to you.

Steven Levine

At any cost…. I’m one of those people, I think, that Hershey attributed their organic growth to, right?

Sean McGovern

Yeah, exactly.

Steven Levine

I mean, I’m surprised they just didn’t put my name.

Steven Levine

Claire, what would be your ideal chocolate thing if you were going to go buy something and said, ‘Okay, I’ve got $1,000,000, I’m going to go buy some chocolate’?

Claire Baxter

Ooh, a lava cake is what I would get.

Steven Levine

A lava cake?

Claire Baxter

Yeah, I love chocolate cake, but I mean, just this morning, I had a mocha cappuccino, so I would do anything chocolate.

Steven Levine

Well, you might need that $1,000,000, according to Sean.

Claire Baxter

I know.

Sean McGovern

Well, with the prices go in the way they are, I’d take the million, and I’d put a down payment on a chocolate factory, you know, start up a new business, maybe?

Steven Levine

There you go. You might bring Timothée Chalamet along with you…. That’s great!

I want to let our listeners know that you can read more commentary and market analysis at IBKR Traders’ Insight. It’s on our newly-launched IBKR Campus at ibkrcampus.com. You can keep abreast there about topics we’ve discussed today, and we’ve got a wide range of other news critical to your investment decisions. McAlinden Research Partners – they’re a terrific independent investment strategy group that focuses on identifying alpha-generating investment themes – and they’ve got a lot of commentary on our Traders’ Insight platform – from central banks and gold buying to issues involving cybersecurity. You can contact Rob Davis for more details at rob@mcalindenresearch.com. And for a full list of financial educational offerings, visit the IBKR Campus, where, as always, all of our educational material is provided to the public at no cost.

I want to thank everybody here: Sean, Claire, Jeff, thank you all so much!

Jeff Praissman

Our pleasure.

Sean McGovern

Absolutely

Steven Levine

Had a great time!

And until next time … and until our next agricultural commodity … I’m Steven Levine with Interactive Brokers.

If you enjoyed this podcast, please rate, review, and follow us on IBKR Podcasts, Podbean, Spotify, Apple Music, or wherever you listen to your podcasts!

—

LEARN MORE

WHAT’S FOR BREAKFAST – PODCAST SERIES

The War on Wheat – How Much Bread Is on the Table?

Eyepopping Corn Prices – Fueling Food Inflation

IBKR TRADERS’ INSIGHT

The Sweetest Debt on Earth? Bond Buyers Devour Hershey’s New Note Sale

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

MORE FROM McALINDEN RESEARCH PARTNERS

- Central Banks Embark on a Gold Buying Spree as Instability Threatens to Spark a Rally (11/4/22)

- CRISPR Closing in on First US Product Launch, Latest Data Shows Treatment 100% Effective After Three Years (7/11/22)

- Russia-Ukraine Tensions Put Global Food Trade at Risk, Mounting Headwinds Face Agriculture Industry (1/26/22)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Order Types / TWS

The order types available through Interactive Brokers LLC's Trader Workstation are designed to help you limit your loss and/or lock in a profit. Market conditions and other factors may affect execution. In general, orders guarantee a fill or guarantee a price, but not both. In extreme market conditions, an order may either be executed at a different price than anticipated or may not be filled in the marketplace.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

If you think $2 is “crazy” for a chocolate candy bar, you should see some of the fine chocolate brands like Dick Taylor, Amano or Pralus on websites like barandcocoa.com A whole other world of fine cocoa and commodity prices on that cacao is way more than $3K a ton.