June Hogs experienced a key reversal on Friday, which suggests a short-term low may be in place. With stochastics readings at 18.4 and 19.2, the market is extremely oversold. A key momentum indicator, the Relative Strength Index (RSI) is suggesting a bottom is close at hand. When the market posted a new contract low on March 23, RSI was at 14.6; when it posted another new low on April 6, RSI was at 25.3; and when it posted another one on Friday, RSI was at 32.8. The triple divergence indicates a loss in downside momentum.

Source: USDA

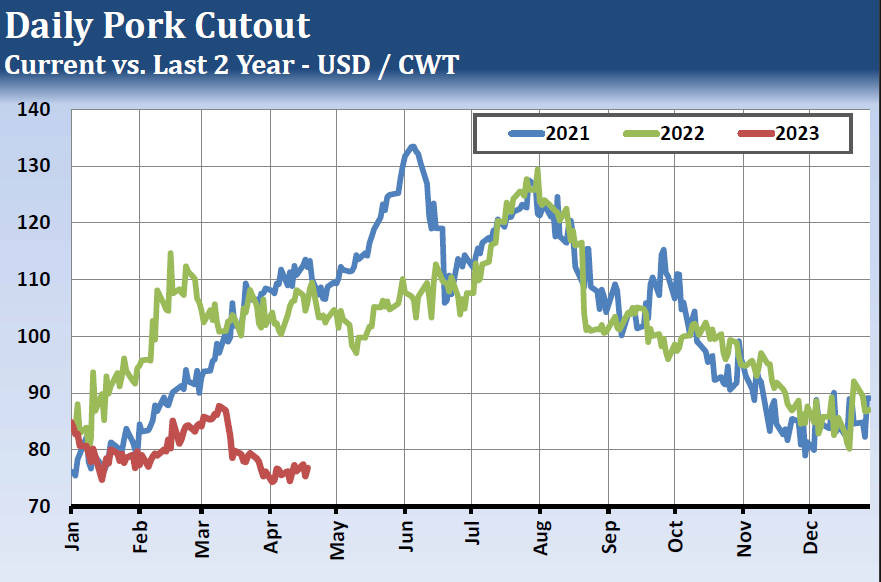

There is a seasonal tendency for pork prices to increase during the spring, but so far this year, values have only stabilized. This could mean that there is plenty of upside potential ahead.

Source: CME

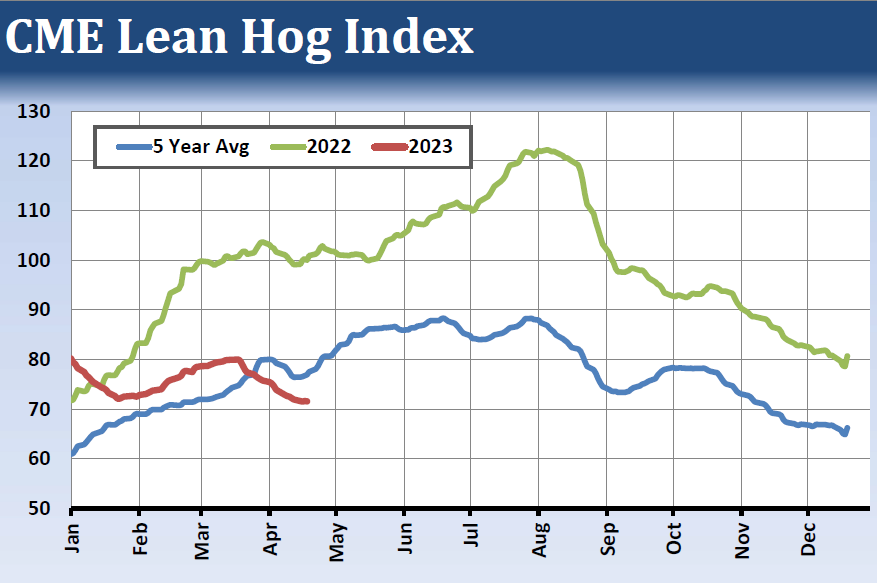

The CME Lean Hog Index has continued to drift lower this month, but a chart of the five-year average shows a seasonal tendency for the Index to move higher from mid-April through mid-June.

Source: USDA

Source: CFTC

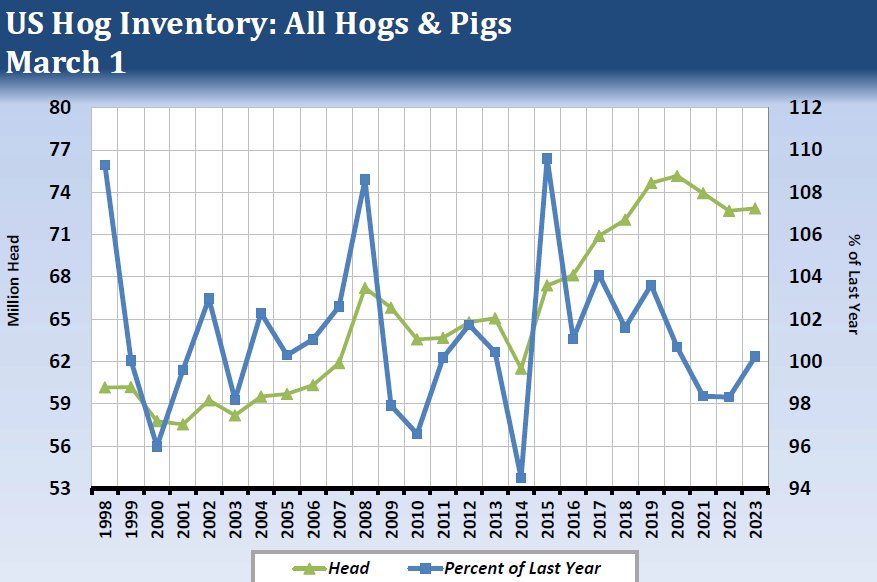

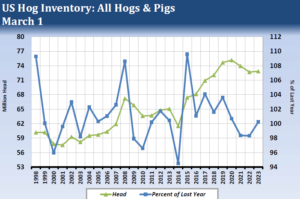

The US hog inventory as of March 1 was well off the highs of a few years ago, and it was only slightly higher than last year. If pork exports hold steady or at least are not down significantly from last year, the hog market may see higher trade over the near term. In the April USDA supply/demand update, US pork exports for 2022 were revised higher from the March report, and 2023 exports were forecast to be higher than 2022.

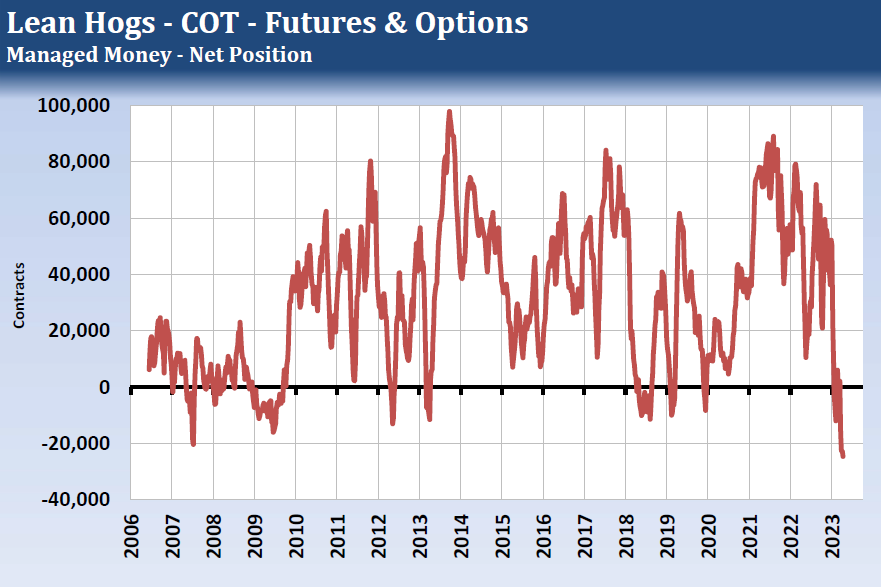

The recent Commitments of Traders report showed record net short positions in hogs for several speculator categories. This suggests that any minor improvement in the hog market fundamentals could spark increased buying once resistance levels are violated.

—

Originally Published April 21, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.