AT A GLANCE

- As the Federal Reserve has raised interest rates, farmers are penciling in another variable to their operating costs

- Higher rates and lower crop prices are defining the ag economy ahead of the highly anticipated June 30 acreage report

Ben Rand, a corn and soybean farmer in southeast Nebraska, says this year is the first time he had to take interest rates into account as he prepared for spring planting.

“One of the things you have to look at is, how do I borrow the least amount of money,” Rand says.

As Rand compares CME Group futures prices versus cash prices, higher interest rates are another variable he must pencil in as he worked out potentially different break-evens between planting corn or soybeans.

For farmers who may have to borrow a lot of money, whether it’s to buy land, equipment or other inputs, loans will be much more costly than a year ago when the Federal Reserve started to raise interest rates.

“We’re talking about potentially having a situation where farmers are looking at double-digit interest rates for the first time in 30 years, 40 years. And that is very difficult for the heavily leveraged young farmer,” Rand says.

The Fed has raised interest rates ten times since it began its rate-hiking cycle in 2022, bringing the Federal Funds rate to a target rate of 5% to 5.25%. The Fed is battling stubborn inflation, which has lowered to under 5% year-over-year – still well above its 2% target.

Farmer Balance Sheets Solid

The good news is that overall U.S. farmers are in solid financial condition after two years of record net-cash farm income, says Rob Fox, director of agriculture lender CoBank’s Knowledge Exchange division.

“Their balance sheets are in pretty good shape. Loan delinquency rates have come down pretty dramatically over the past couple of years within the industry,” Fox says.

However, evidence is mounting that 2023 won’t be as bountiful to farmers as 2022 and 2021 have been. December 2022 corn futures prices traded at $8.27 a bushel in April of last year. As of early June, corn prices are hovering around $5.40 a bushel for December new-crop corn.

Soybean futures hit an all-time high of $17.84 in 2022, but in early June, November new-crop soybeans were trading around $11.79. Soft red winter wheat futures rose to their all-time high of $14.25 in 2022, but December wheat recently traded at $6.55.

With lowering prices has come a change in expectations for many ag producers. The Purdue University/CME Group Ag Economy Barometer, which surveys 400 producers monthly, in May fell to its lowest level since July 2022. 38% of respondents said they expect weaker financial performance for their farm this year, compared to 23% who expected the same in April.

Macroeconomic uncertainty has also dampened the overall outlook, Fox says. The impact of higher rates is starting to be felt in some parts of the agriculture economy, as tighter money has slowed the steep rise in farmland prices. Kansas City Fed data show the value of non-irrigated cropland increased by an average of 15% from the previous year across all Midwest Fed regions, following growth of more than 20% in early 2022.

In the Ag Barometer report, farmland value expectations fell to their weakest level since August 2020, with 59% of respondents saying they expect interest rates to rise during the upcoming year and 22% citing rates as a top concern over the next year.

Steve Georgy, president at Allendale, says with higher interest rates, farmers need to keep on top of their operating costs.

“It is so important for the farmer to understand their break-even, and make sure that they’re selling at a profit. It’s important to understand what you need to lock in from a cash side to keep those operating loans as low as you can,” he says.

Hedging Risk Around Planted Acreage

As usual, much will be riding on the data released with the USDA Planted Acreage report on June 30. As producers weigh the impact of interest rates and lower crop prices, the report will reveal just how many corn and soybean acres were planted this spring.

The report has the ability to move prices and create volatility in grain futures markets.

Given all the variables facing farmers today, it’s important for them to hedge their risk. Products such as short-term options lower the time value and the cost to hedge new-crop positions, Georgy says.

Short-dated and new crop weekly options help farmers come up with a more flexible marketing plan by dividing up price coverage in sections throughout the year, rather than locking it in at one time.

“It’s a great opportunity in order to protect the price, because we’ve seen such volatility in our markets,” Georgy says.

Oliver Sloup, vice president of Blue Line Futures, sees a particular benefit to using new crop options for reports like June Acreage, which is slated for release on a Friday. He says farmers can both sell a corn futures contract and hedge their upside risk with an option that expires that day.

“They don’t have to worry about that initial knee-jerk reaction from the market that could potentially stop them out or the market just ripping higher and not looking back. They’re protected with that new crop weekly option,” Sloup says.

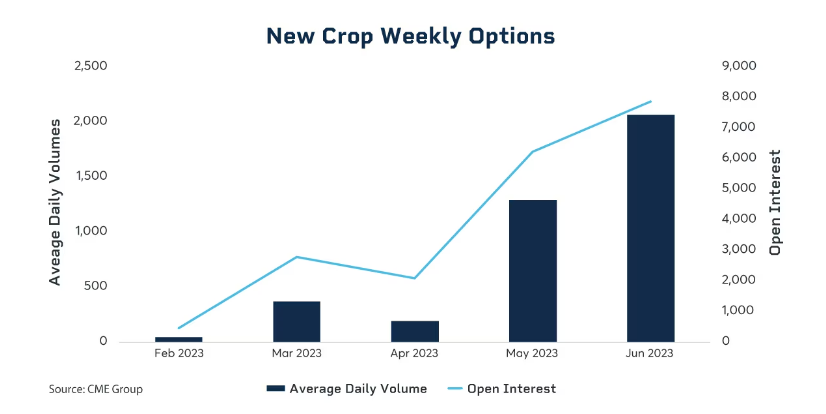

New crop weekly options in particular have surged in popularity. Through the first half of June, average daily trading volume nearly doubled from May. Open interest – or the number of outstanding futures contracts – soared to nearly 8,000.

Profit Potential

In their 2023 crop budget forecasts, Gary Schnitkey and Krista Swanson of the department of agricultural and consumer economics at University of Illinois, estimate Illinois farmers will break even on corn and soybean production, but lose money on wheat. Their budgets include all revenue and all financial non-land costs.

On average, Illinois farmers who plant corn after soybeans could see a return of $58 an acre, needing a breakeven price of $3.96 a bushel when figuring in non-land costs, but $5.33 if land costs are included. Farmers who plant soybeans after corn could see a return of $51 an acre. Their breakeven price for non-land costs is $7.98 a bushel, but $12.62 if land costs are included.

Another University of Illinois ag economist, Bradley Zwilling, writes that farmers need to keep an eye on their debt levels as rates increase. His research shows since 1990, agricultural debt increased an average of 4.4% per year. Using data from the Illinois Farm Bureau, Illinois farmer’s debt per tillable acre is $735 as of 2021.

Zwilling expects interest expenses will grow.

“A 1% increase in the average interest rate on all farm debt would lead to a 35% increase in interest expense per acre based on 2021 numbers,” he says.

A New Rates Environment

Older farmers are no strangers to higher rates, but Fox says analogies to the 1980s and today don’t stand up. There’s been significant industry consolidation and operations are larger, sophisticated and more financially stable as a whole. “Farming today versus the 1980s, for a variety of reasons, is radically different,” says Fox.

At the same time, younger farmers are dealing with an interest rate environment they’ve never experienced.

“If you’ve only been farming for 15 or 20 years, you’ve never seen interest rates at the farm level of, let’s say, 8%. To them, that’s completely foreign,” Fox says.

—

Originally Posted June 14, 2023 – Higher Interest Rates Present New Risks for Farmers

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance and economics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade. BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.. In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority. CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl). CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.