KEY TAKEAWAYS

- Lithium is among the most important metals required for electric vehicles and energy storage; as a transition to a low-carbon economy accelerates, demand is expected to increase exponentially, and companies involved may benefit.1

- The supply of lithium is constrained, given the complex extraction process and concentration of large deposits in South America, Asia, and Australia.

- Investors looking to gain exposure to lithium may want to consider ETFs that offer exposure to the entire value chain, including exploration, mining, processing, and compound manufacturing.

HOW TO INVEST IN LITHIUM

As a transition to a low-carbon economy accelerates one metal stands out: Lithium. Lithium batteries are the default choice in electric vehicles (EVs), energy storage for solar and wind power, and consumer electronics, each of which present long-term growth opportunities. By the end of the decade, 95% of lithium demand will stem from batteries, up from just 30% in 2015.1 However, expanding lithium supply is a complicated endeavor, leading to investment opportunities for companies that can meet the world’s growing demand.

3 REASONS LITHIUM DEMAND IS GROWING

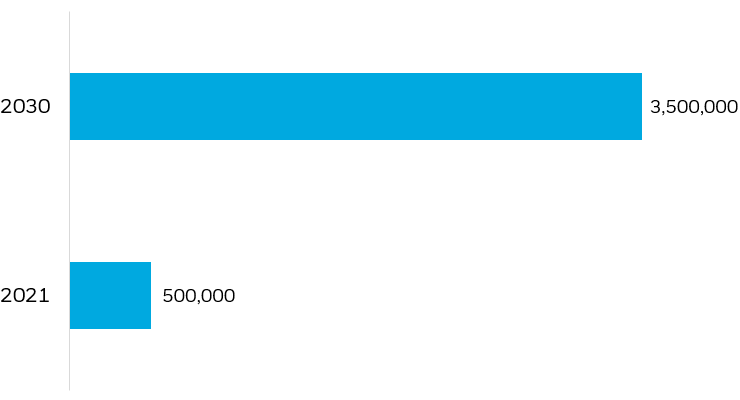

Lithium demand is expected to grow 7x between 2021 and 2030, driven by three key factors1: the growth of EVs, rising demand for renewable energy, and lithium’s use in consumer electronics.

Lithium Demand (Metric Tons)

Source: McKinsey & Company. Lithium Mining: How New Production Technologies Could Fuel the Global EV Revolution, 4/12/22.

Chart description: Bar chart showing approximate global lithium demand in 2021 and projected global lithium demand in 2030.

EV Growth

Electric vehicles comprised 14% of automobile sales in 2022, up from just 5% in 2020.2 Automotive lithium-ion battery demand increased by about 65% in 2022, primarily due to growth in passenger EV sales.2 Lithium-ion batteries have become the default type of battery used in EVs because they have high energy density, long lifespans and require low maintenance. (Read more about the latest in EV innovation)

Growth of solar and wind power generation

The second key driver of lithium demand is the ongoing growth of solar and wind energy, with the IEA projecting that additional solar and wind capacity additions will triple by 2030 in the U.S. alone.3 Batteries are often paired with renewable energy generation to smooth out supply and demand fluctuations. They absorb excess solar or wind power when demand is low and discharge the stored energy when demand is high. Grid-scale battery storage capacity could expand as much as 44-fold between 2021 and 2030 under the IEA’s scenario where the world achieves net-zero carbon emissions by 2050.4

Compared to lead-acid batteries, which is an older technology, lithium-ion batteries offer several advantages. Lithium-ion batteries typically have up to 6x higher energy density, nearly 2x longer charge and perform better in cold weather environments,5 making them ideal energy storage solutions.

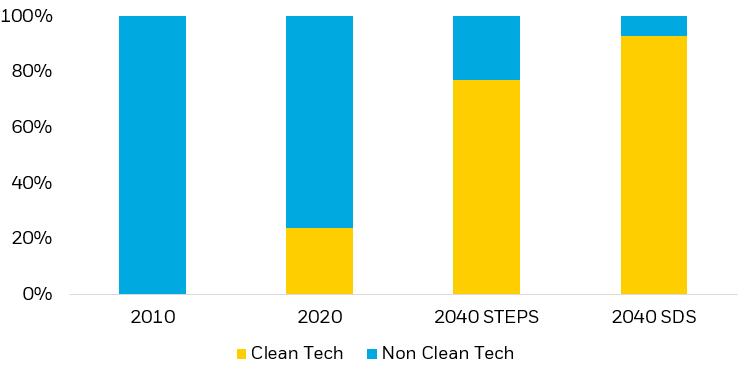

Share of clean energy technology in lithium total demand

Source: International Energy Agency, “The role of critical minerals in clean energy transitions”

Chart description: Bar chart showing the share of lithium demand that stems from clean energy technologies. 2040 numbers are projections. The 2040 STEPS scenario is the stated policies scenario, an indication of where the energy system is heading based on a sector-by-sector analysis of today’s policies and policy announcements. The 2040 SDS scenario is the sustainable development scenario, indicating what would be required in a trajectory consistent with meeting the Paris Agreement goals.

Consumer electronics

The final component of growing lithium demand is its use in consumer electronics such as laptops and cellphones. While smart phones are ubiquitous in the U.S. with 82% penetration,6 they still have significant room to grow in countries like China and India, with 68% and 46% penetration respectively, and a combined 2.8 billion people.6 As the digitization of the global economy continues, the lithium battery industry will have yet another tailwind from the continued growth of consumer electronics driven by the megatrend of growing wealth in emerging markets.

LITHIUM SUPPLY

We think it is important for investors to understand the complexities of the lithium supply chain as they consider potential investments. That is because demand for the metal is expected to significantly outpace supply in the coming years.7

Lithium is a soft, silver-white metal that is extremely light; it is typically extracted from lithium brine (accumulations of saline groundwater) or from spodumene ore (gemstone). Lithium supply is geographically concentrated, with 98% of lithium production in South America, Asia, and Australia.1 Given the concentration of the metal, geopolitical tensions have arisen which could constrain future access to lithium. For example, in the past two years, we have seen governments in Mexico and Chile initiate steps to nationalize lithium deposits.8 Additionally, government regulations around the globe that are designed to limit the environmental impact of mining limits companies’ ability to rapidly expand production, with the typical lithium project needing 3-7 years to finance and build.7

Despite these constraints, there are new technologies such as direct lithium extraction (DLE) which can bolster supply in the years to come. DLE is designed to skip the energy intensive mining process and directly extract lithium from brines, which can reduce both processing time and environmental impact. As a result of technologies like DLE, lithium supply is expected to grow 20% per year through 2030.1

HOW TO INVEST IN LITHIUM

While we have extensively covered the supply and demand situation for lithium, it is important to note that raw lithium must go through several steps before it winds up inside a battery for an EV, solar storage, or other use case. Raw lithium from ores and brines gets processed and refined into lithium compounds, which become inputs for manufacturing batteries. The processing and refining are performed by lithium compound manufacturers, which are positioned to benefit as demand for lithium increases and more raw lithium needs refining.

Investors seeking to capture the lithium theme may want to consider ETFs that offer exposure to the full lithium value chain including:

- Companies involved in mining of lithium

- Companies involved in lithium compound manufacturing

CONCLUSION

We expect higher demand for lithium over the coming decade, as demand for EV batteries and renewable technologies continues to grow. Supportive government policies, growing consumer demand and constrained supply of the metal could help bolster companies involved with the lithium supply chain. Investors focused on electrifying their portfolios for the coming transition to a low-carbon economy may want to consider a diversified, ETF approach to lithium companies.

—

Originally Posted June 23, 2023 – Investing in lithium: Why now could be the right time

© 2023 BlackRock, Inc. All rights reserved.

1 McKinsey & Company. Lithium Mining: How New Production Technologies Could Fuel the Global EV Revolution, 4/12/22.

2 Global EV Outlook 2023 – Analysis – IEA.

3 IEA, “World Energy Outlook 2022,” Nov 2022.

4 Grid-Scale Storage – Analysis – IEA.

5 Autozone.com, “Lead acid vs. Lithium-ion jump starters”, accessed on 6/6/23.

6 Statista, “Penetration rate of smartphones in selected countries”, accessed on 5/18/23.

7 S&P Global, “Lithium project pipeline insufficient to meet looming major deficit”, 10/12/22.

8 Reuters, “Chile plans to nationalize its vast lithium industry”, 4/21/23.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Technology companies may be subject to severe competition and product obsolescence.

Negative changes in commodity markets could have an adverse impact on companies the Fund invests in. The price of the equity securities of companies engaged in mining and the price of the mined metals may not always be closely linked. Worldwide metal prices may fluctuate substantially over short periods of time, so the Fund’s share price may be more volatile than other types of investments.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0623U/S-2952159

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.