There is no sugar-coating it, 2022 was a pretty difficult year for investors. Equity markets posted their worst year since the financial crisis and one of the 10 worst years since the Great Depression. At the same time, fixed income markets (as proxied by the Bloomberg Aggregate) posted their worst year in history. The only place of refuge was in commodities, which posted double-digit returns, the second year in a row where commodities beat most, if not all, other asset classes.

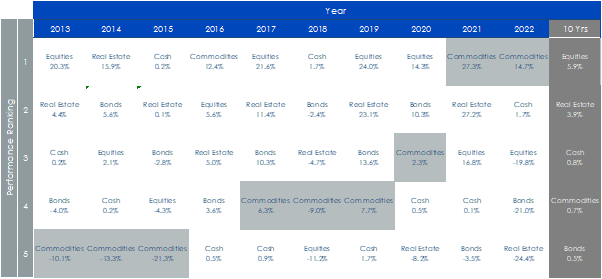

Figure 1: Asset class performance ranked – 2012-2022

Source: WisdomTree, Bloomberg. Data until December 31, 2022; All returns are in USD. 10 Yrs returns are annualised from 31 Dec 12 to 31 Dec 22. Data: Equity – MSCI World, Bond – Bloomberg Barclays Agg Sovereign TR Unhedged, Real Estate – EPRA/NAREIT Global, Commodity -Optimized Roll Commodity Total Return Index, Cash – US T-Bill 3 Mth.

Historical performance is not an indication of future performance and any investments may go down in value.

The last two years have shown, once again, why commodities are a staple component of many multi-asset portfolios. Over the long run, commodities have historically proven:

- A strong portfolio diversifier

- A recognised inflation hedge

- A powerful geopolitical risk hedge

- A cyclical asset which can grow and outperform over the long term while reacting to macroeconomic conditions in a unique manner

These characteristics make commodities a strong potential candidate for a strategic investment as part of the alternative sleeve of a portfolio.

The specifics of investing in commodities

Investing physically in most commodities is almost impossible due to operational constraints: they tend to be voluminous, expensive to store, move, and insure, and can be very perishable. This is why most commodities investments are made through derivatives called futures contracts, that is, contracts in which a buyer and seller agree to exchange commodities at a given price at a specified time in the future (the futures contract maturity).

Futures contracts can be purchased for a set of different expiries. It is possible, for example, to buy crude oil for delivery next month, for delivery in 6 months, for delivery in a year and so on. The collection of futures contract prices for available Futures contracts of different expiries is called the Futures curve.

A commodity is said to be in contango when the price of a distant Futures contract is higher than the price of a nearer future, and it is said to be in backwardation when the price of a distant Futures contract is lower than the price of a nearer future. The performance of an investment in a given commodity is dependent on the shape of the curve as investors would need to ‘roll’ from one contract, when it is about to expire, to one with a maturity in the future, if they want to remain invested. The overall return is a combination of:

+ Spot return: movement of the spot price of the physical commodity.

+ Roll return: generated yield due to the rolling of one futures contract to the next designated contract by ensuring a continual exposure to futures prices and avoiding physical delivery and contract expiry. The roll return is mainly impacted by the shape of the futures curve and the way it changes over time. A curve in contango will create a negative drag to the performance, while a curve in backwardation will create a positive drag.

Unfortunately for investors, most commodities tend to remain in contango most of the time and, therefore, broad commodities indices (such as the Bloomberg Commodity Index) tend to suffer from average negative roll yield creating a drag to the performance.

How to improve the performance of broad commodities benchmarks

Commodities benchmarks are known to be sub-optimal because they invest in front-month future contracts (futures with low maturities) and therefore fail to consider the term structure of each future curve and suffer from high negative roll yield.

There are two main ways to improve on those basic benchmarks.

1. Investing in physical commodities whenever possible

One of the easiest ways to avoid roll yield drag is simply to not invest in commodity futures contracts. Of course, as discussed earlier, most commodities are too difficult to invest in physically, but not all. Precious metals, like gold or silver, are durable, they carry a high price tag per weight, and, therefore, can be stored very cheaply in bank vaults. Replacing precious metals futures contracts with physical bars of precious metals is a simple and straightforward way to reduce the contango drag and improve performance over the long term.

2. Investing in other parts of the future curve to minimise the negative roll yield

Each futures contract on a given future curve has its own roll yield depending on how steep the curve is for that maturity. Quite logically, the front end of the curve is not always the flattest part of the curve, that is, the part of the curve where the roll yield is the smallest. In fact, most of the time it is the steepest, that is, the most detrimental to long-term returns. In other words, broad commodity benchmarks are built in a pretty inefficient way. Long-term performance of broad commodity strategies could be improved over the long term by selecting on a regular basis the futures contract on each commodity curve with the lowest roll yield, minimising the drag suffered by investors.

—

Originally Posted April 13, 2023 – Two ways to supercharge the diversification powers of broad commodities

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.