The capital markets have a funny way of making the consensus forecasts look foolish. The most popular prediction headed into 2023 was that markets would suffer through a rough first half but rally by year’s end.

After six consecutive calendar years of US large-cap stocks outperforming US small-cap stocks, many investors thought this might be the year for small caps to outshine large caps. Most market observers expected value stocks to beat growth stocks again this year. US stocks were predicted to continue their decade-long dominance over international stocks. Everyone knew that with higher interest rates and still stubborn inflation, bonds were toast — especially below investment-grade securities. And investor enthusiasm for gold had rarely been lower.

But the exact opposite of almost everything that investors anticipated has happened, at least through the first four months of the year.

The Economy Is Not the Market

The economy appears to be on some preset course, hurtling towards recession in the next 12-18 months. S&P 500 companies have experienced two consecutive quarters of negative year-over-year earnings-per-share (EPS) growth. And small cracks are starting to appear in the labor market data. Yet stocks and bonds are admirably climbing the proverbial wall of worry.

For the past three quarters, I have constantly reminded investors that the economy is not the market and vice versa. Now, as markets inch closer to the second half of the year, the economy is slowing, earnings are falling, and the labor market is weakening.

5 Risks Facing Investors Now

Naturally, investors are on edge and eager to protect their unexpected gains. But one or more of the following five risks could finally produce capital market turmoil in the second half of 2023.

- Looming credit crunch

- Overtightening by the Federal Reserve (Fed)

- Increased competition for capital

- Declining earnings

- Debt ceiling debate

Here’s my take on these five risks as the second half of the year gets underway.

Credit Crunch Could Cool an Already Slowing Economy

Easy access to credit is the lifeblood of the US economy. And rising interest rates and tighter financial conditions have made credit considerably more difficult to get this year.

For example, the Fed’s quarterly Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices released February 6 revealed tighter lending standards and weaker demand for both consumer and business loans. In addition, the Fed survey reported banks’ expectations for lending standards to tighten, demand to weaken, and loan quality to deteriorate across all loan types for the remainder of the year.

Incredibly, that was before the recent failures of Silicon Valley Bank, Signature Bank, and First Republic Bank. Now, in the aftermath of those failures and amid the ongoing regional banking crisis, there’s a bigger package of data that indicates access to credit has become increasingly more difficult. In the Fed’s latest quarterly SLOOS report from May 8, banks reported tighter lending standards and weaker demand for both consumer and business loans across all categories.

Unsurprisingly, given the regional banking crisis, the Fed focused its special set of survey questions on banks’ expectations for changes in commercial real estate loans. And banks cited an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values; a reduction in risk tolerance; and concerns about bank funding costs, bank liquidity, and deposit outflows as reasons to expect tighter commercial real estate lending standards over the rest of this year.

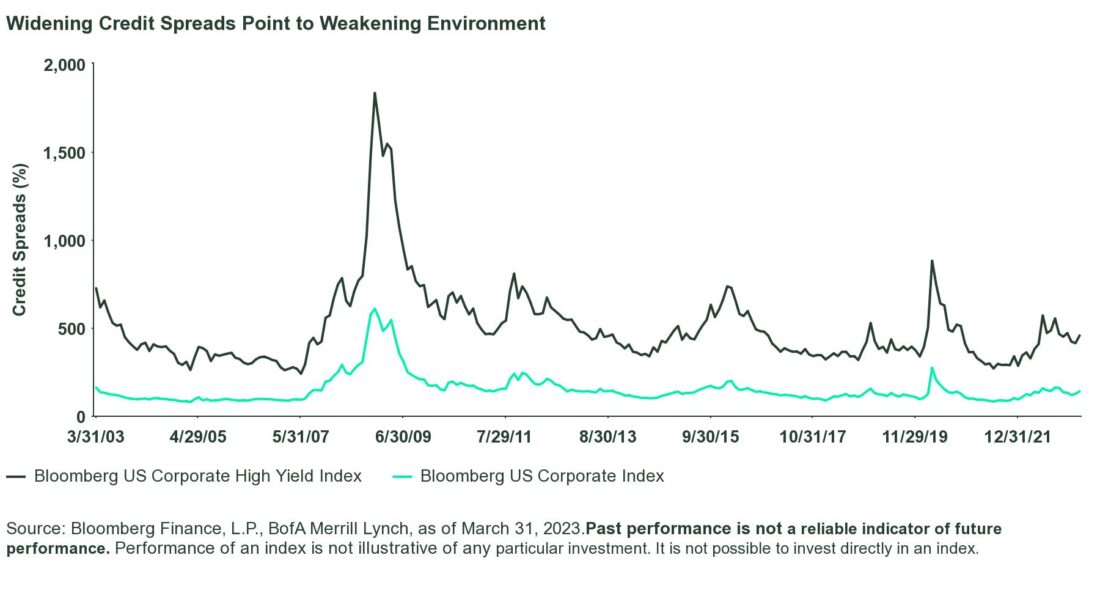

The SLOOS data also underscores that credit conditions are deteriorating for commercial and industrial, commercial real estate, residential real estate, home equity lines of credit, auto, credit cards, and other consumer loans. But that’s not all. The latest Federal Reserve Bank of Dallas Banking Conditions Survey and the American Bankers Association’s Credit Conditions Index also point to a weakening credit environment

Widening Credit Spreads Point to Weakening Environment

This raises the risk of a credit crunch, with many market observers identifying commercial real estate as the likely culprit. At the very least, tightening credit conditions will cool an already slowing economy.

Perhaps the silver lining is that inflation will continue to fall, allowing the Fed to end its tightening cycle. But a growing chorus of market participants think the Fed may have already overdone it. Let’s examine risk #2 to find out.

Overtightening, Rate Cuts Typically Mean Decline in Risk Assets

On May 3, the Fed raised rates for the 10th time since last March, bringing the target fed funds rate to 5-5 ¼ percent, its highest level since August 2007. Despite ongoing challenges in the US banking system and fresh signs that the economy may be slowing, robust job gains and elevated inflation persuaded Fed policymakers to keep tightening in early May. However, subtle but important changes to the FOMC statement language combined with Chairman Powell’s post-meeting press conference remarks hinted that the Fed’s tightening cycle may soon be coming to an end.

Yet bond market yields suggest the Fed may have already tightened too much.

The target fed funds rate of 5-5¼ percent is notably higher than the yields across every maturity on the curve. For example, the target fed funds rate is more than 1% higher than the US 2-year Treasury yield and 1.5% greater than the US 10-year Treasury yield. Concerned that the Fed has overtightened, bond market participants are anticipating a recession, capital market meltdown, or possibly both in the second half of the year. As a result, investors are aggressively pricing in Fed rate cuts by year’s end. Wildly, some investors expect rate cuts as early as July.

Fed Rate Cuts? Careful What You Wish For

Investors should be careful what they wish for when it comes to Fed rate cuts. Historically, during the monetary policy transition period from the last rate hike to the first rate cut, risk assets perform reasonably well. In fact, that may reflect the current investment environment. But when the Fed begins to cut rates, risk assets typically decline. Afterall, the Fed is lowering rates for a reason — usually in response to a recession or capital market breakdown.

The monetary policy risks to the market’s year-to-date rally share a strange connection. On the one hand, if investors are right and the Fed has already tightened too much, when it begins cutting rates, risk assets are likely to fall. On the other hand, with inflation still well above the Fed’s target and a tight labor market, policymakers just might unexpectedly raise rates for an 11th time on June 14.

Neither outcome — rate cuts or a hike — seems particularly good for the short-term outlook for risk assets, especially now that there’s greater competition for investors’ capital from more conservative money market instruments.

Competition for Capital Dampens Enthusiasm for Risk Assets

In the ultra-low interest rate environment of the past 15 years, there was very little competition for capital. Investors had no choice but to invest in riskier financial assets, spawning the acronym TINA — There Is No Alternative to risky assets. Low rates bolstered the relative attractiveness and valuations of essentially all risky financial assets — stocks, bonds, private equity, real estate, IPOs, SPACs, NFTs, and cryptocurrencies.

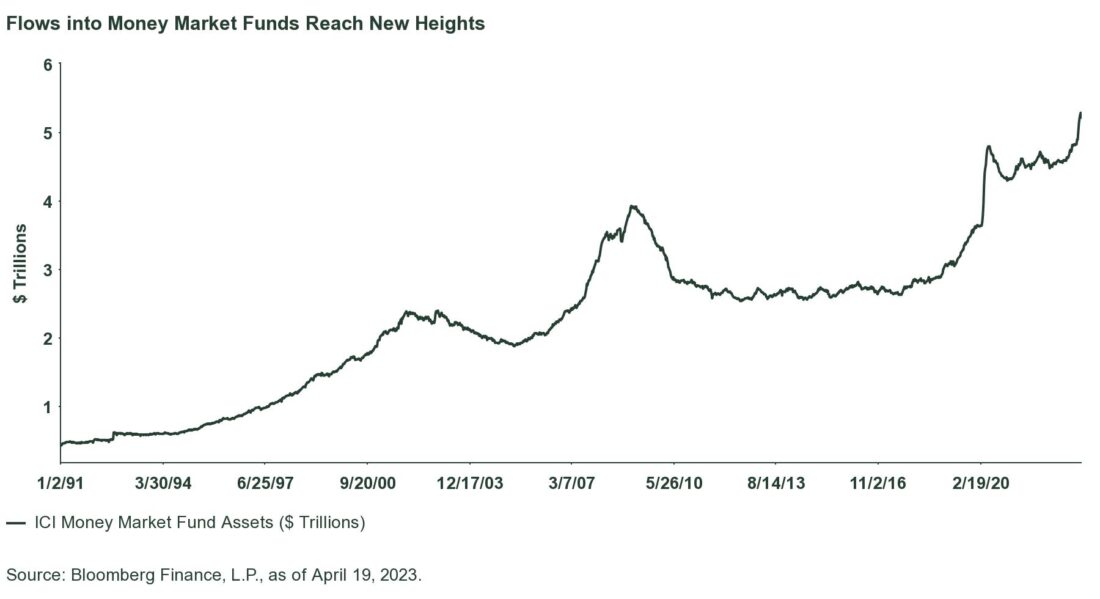

Allocating capital to low-yielding money market instruments became an afterthought for investors. That is, until the Fed started aggressively raising interest rates 14 months ago.

Today, certificates of deposit (CDs), money market funds, Treasury Bills, and short term (1-3 years) Treasurys offer yields of 4-5%, more or less. Last year there were precious few places to hide as practically all investments declined and volatility surged. Most investors are expecting a recession, falling earnings, and mounting job losses in the next 12-18 months.

Capital on the Sidelines Waiting for a Better Opportunity

Given last year’s losses and the bleak economic outlook, the perceived safety and stability of money market instruments has become more appealing to investors. Flows into CDs, money market funds, Treasury Bills, and short term Treasurys have soared in the past 12 months. On May 4, the Investment Company Institute (ICI) reported that money market fund assets hit a new record, surpassing $5.3 trillion.

This renewed competition for investor capital has some messy consequences. Significant capital flows into money market instruments saps investor demand for riskier financial assets, putting downward pressure on their valuations. In addition, bank demand deposits continue to yield very little. As a result, depositors are withdrawing their money from savings accounts and placing it in higher-yielding money market funds and Treasury Bills.

According to Strategas Research Partners, commercial bank deposits have fallen by roughly $1 trillion while money market mutual funds have taken in $751 billion since the hiking cycle started.1 A massive decline in demand deposits could exacerbate banking industry challenges by lowering earnings and reducing loan growth. It will be difficult for the economy to gain traction without a healthy banking environment.

For the glass half full crowd, there’s a tremendous amount of capital on the sidelines just waiting for a better opportunity to come back into riskier financial assets. Perhaps once the anticipated recession begins, investors’ appetite for risk assets will return. Until then, investors lie in wait, comfortably collecting stable, reliable income from CDs, money market funds, Treasury Bills, and short-term Treasurys.

Click here to read the full article

Footnotes

1 “Headwinds To Persist For Financials,” The Daily Macro, Strategas Research, May 9, 2023.

2 “Debt Ceiling Negotiation Have Started, Now Comes the Hard Part,” Strategas Research Partners, May 10, 2023.

—

Originally Posted May 16, 2023 – 5 Risks Could Derail the Market’s Hot Start

Disclosure

ssga.com/etf

Important Risk Information

Marketing Communication

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

The views expressed in this material are the views of Michael Arone through the period ended May 11, 2023 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements.

Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investing involves risk including the risk of loss of principal.

Past performance is not a reliable indicator of future performance.

All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holding LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.