As we began another month, on a “binary number” day (1101), we had much to look forward to. We could expect key announcements from the Treasury and Federal Reserve, along with a host of economic reports. As I write this, all except the FOMC meeting are behind us. On balance, they have been market-friendly, particularly the Treasury’s refunding announcement.

The first number of the morning was the ADP Employment Change at 8:15 (all times EDT). It came in lighter than expected at 113,000, well below the consensus 150k estimate but above last month’s 89k. This gave a lift to bond prices and stock futures, but only a modest one. Traders know that the ADP report is an unreliable predictor of the employment report that follows two days later. Last month’s ADP came in at 89k, well below that months 150k consensus, yet last month’s Nonfarm Payrolls showed a staggering increase of 336k, well above its 170k estimate.

Fifteen minutes later, the bond market’s key catalyst arrived. Bond traders were thrilled that the quarterly refunding announcement was biased more heavily toward shorter-term notes than long-term bonds. That bias is helpful for two reasons: first, because the concerns about excess supply had been weighing more on the long end; and second, because the long end is more volatile than the short end, good news has a bigger impact. We saw a huge relief rally in bonds, with 10-year yields falling a quick 10 basis points. That said, it is also reasonable to think that fixed income markets are thinner than normal ahead of today’s FOMC announcement, so good news might be getting rewarded a bit more than normal. We’ll see about that later.

The bond rally got another leg when JOLTS and ISM statistics were released. September JOLTS job openings were 9.553 million, well above the 9.4 million estimate, but August was revised lower from 9.61 million to 9.497 million. Simultaneously, markets focused on a series of weaker than expected ISM readings: 46.7 reading on ISM Manufacturing, well below the 49.0 consensus; 46.8 vs. 50.6 exp. on ISM employment; and 45.5 vs. 49.8 on New Orders. That combination pushed 10-year yields to a drop of as much as 15 basis points.

Yet all that data are just appetizers for the 2pm main courses of the FOMC announcement and the 2:30pm press conference from Chairman Powell. There are nearly unanimous expectations for a “hawkish pause,” meaning that there will be no change in rates (Fed Funds futures show a 0.5% chance of a hike – essentially zero) while rhetoric will offer reminders of potential hikes and little hope for potential cuts. This fits with the stances offered by numerous Fed talking heads. They don’t see the need to raise rates immediately, allowing the economy to further digest the recent hiking cycle, but assiduously remind investors that they remain committed to not cutting rates until their 2% inflation target is sustainably reached – or unless economic circumstances warrant.

There is always a risk when markets are too convinced that a particular result will occur. We are forced instead to focus on secondary factors, or in this case, the nuances of Powell’s responses. He has frequently played the role of “Goldilocks in a Suit” – think about trader’s enthusiastic reactions to terms like “disinflation” in February, and “neutral” in August 2022 – but a series of sober, unenthusiastic responses can put traders in a funk.

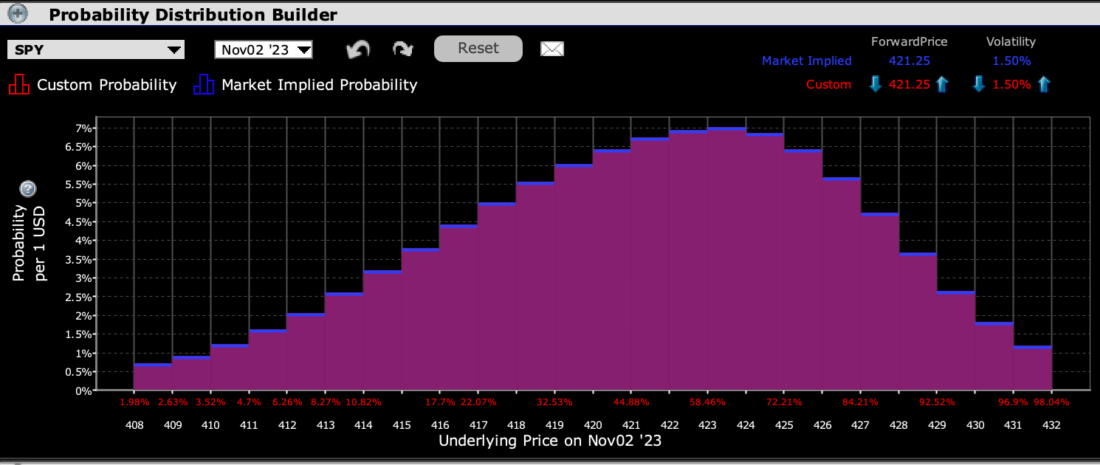

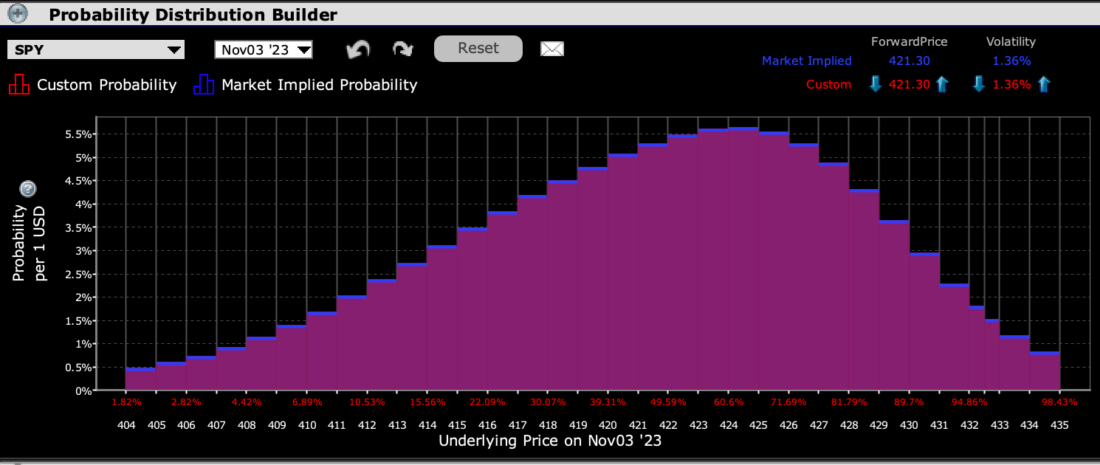

When we look at how options markets are setting up for the FOMC meeting, traders are tending towards the bullish side, though with respect for risk. The IBKR Probability Lab shows that SPY options expiring today, tomorrow, and Friday all show peaks slightly above the current level:

IBKR Probability Lab for SPY Options Expiring Today

Source: Interactive Brokers

IBKR Probability Lab for SPY Options Expiring Tomorrow

Source: Interactive Brokers

IBKR Probability Lab for SPY Options Expiring Friday

Source: Interactive Brokers

Meanwhile, we see a fair amount of volatility priced in for near-term options, even as we saw VIX declining today:

SPY Volatility Term Structure

Source: Interactive Brokers

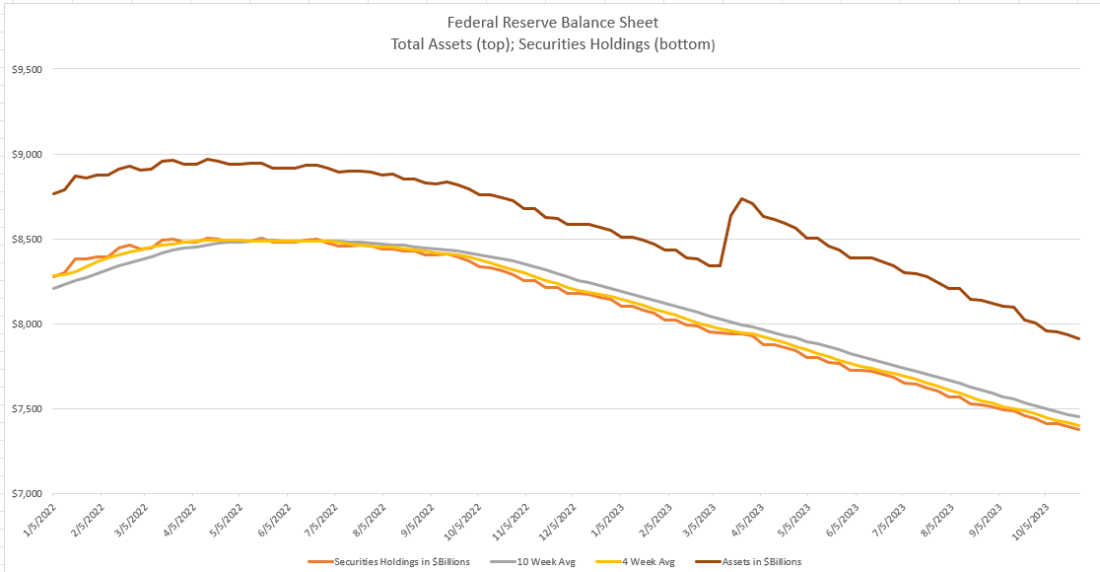

It will be interesting to see if the FOMC or Powell comment about the pace of quantitative tightening (QT). They have been largely quiet about the topic, even as the Fed consistently shrinks its securities holdings, and hence the size of its balance sheet. The balance sheet jumped higher in March when the Fed offered $300 billion in liquidity to banks during that month’s crisis, but that bump has been long-since erased:

Source: Interactive Brokers, Federal Reserve H.4.1 Reports

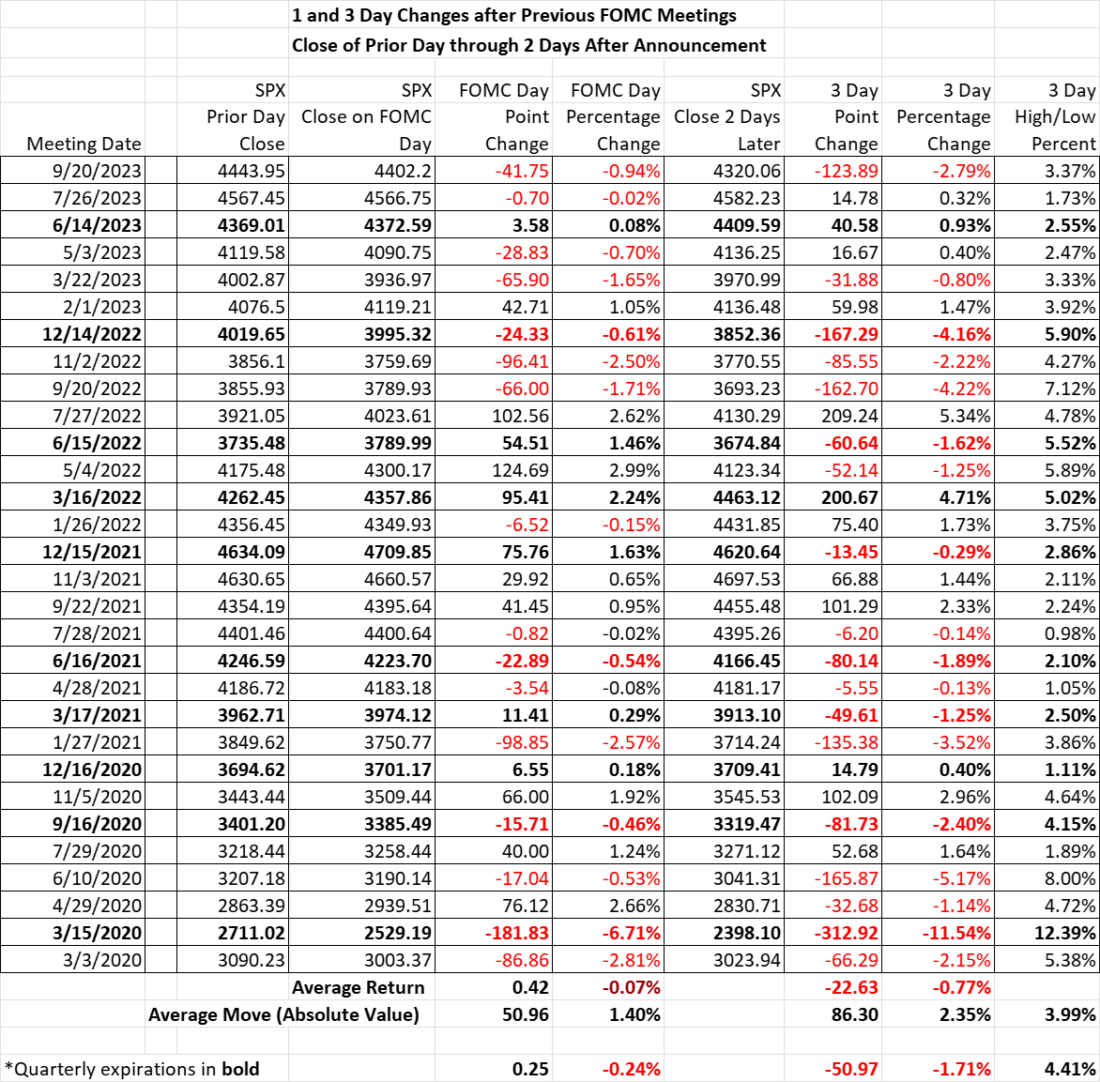

We will leave you with our consistent reminders that typically apply to trading around an FOMC meeting:

- The first move is often the wrong move. Markets can be very thin from 2pm through the end of the press conference. Market makers don’t want to be blindsided by random comments. As a result, we often see a big initial reaction that can fade quickly or even be reversed.

- Traders react while investors consider. The former group hangs on every utterance from the Chair; the latter spends the afternoon, evening, and following morning, thinking about the full ramifications of all the FOMC-related events. The truer reaction is seen on the following day. Note the potential for reversals that are shown in the table below.

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.