By J.C. Parets & All Star Charts

Tuesday, 2nd May, 2023

1/ Banks Break Lower

2/ Energy Is on the Brink

3/ Communicating a Change in Trend

4/ The Bigger the Base…

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Banks Break Lower

Late last week, First Republic Bank (FRC) was placed under FDIC receivership, and subsequently sold to JPMorgan Chase (JPM) early on Monday. Just when it seemed the volatility in the financial sector might be behind us, another regional bank has collapsed.

And not surprisingly, we’re seeing a material reaction from the entire industry group. Here is a daily candlestick chart of the SPDR Regional Banking ETF (KRE) dating back to early 2020:

After the first bank failures in March, KRE resolved lower from a massive distribution pattern, or a head and shoulders top. The ETF followed through aggressively to the downside, before finding its footing and coiling in a bearish continuation pattern.

Continuation patterns are called as such because they tend to continue in the direction of the underlying trend. That’s exactly what we’re seeing today as KRE is down more than 6%, marking a decisive resolution from the short-term bearish pattern.

With the index now losing half its value since its highs from last year, the question is how low banks can go.

2/ Energy Is on the Brink

Last week, we mentioned that the strength of individual energy stocks has been deteriorating for some time now.

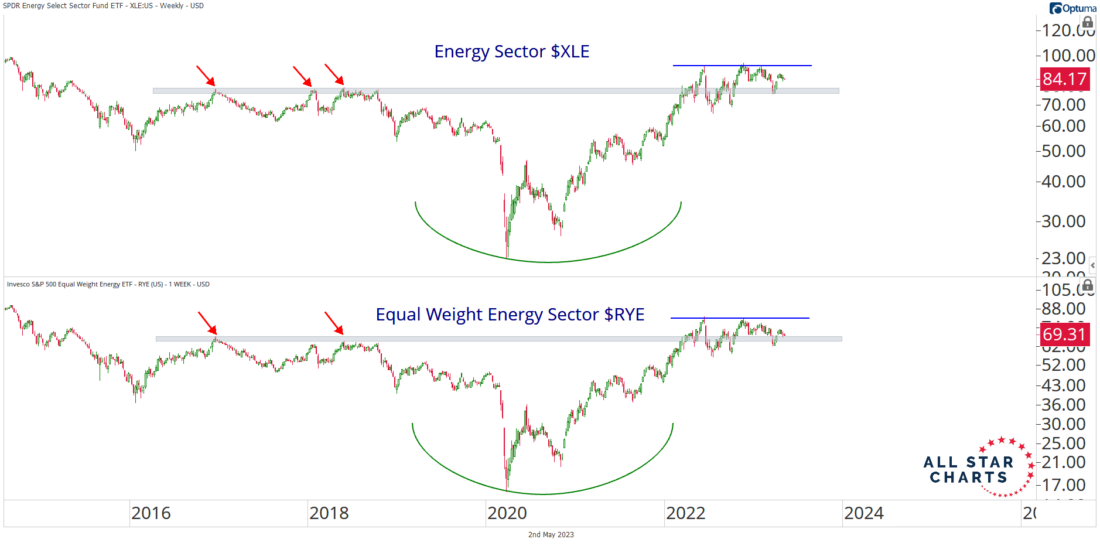

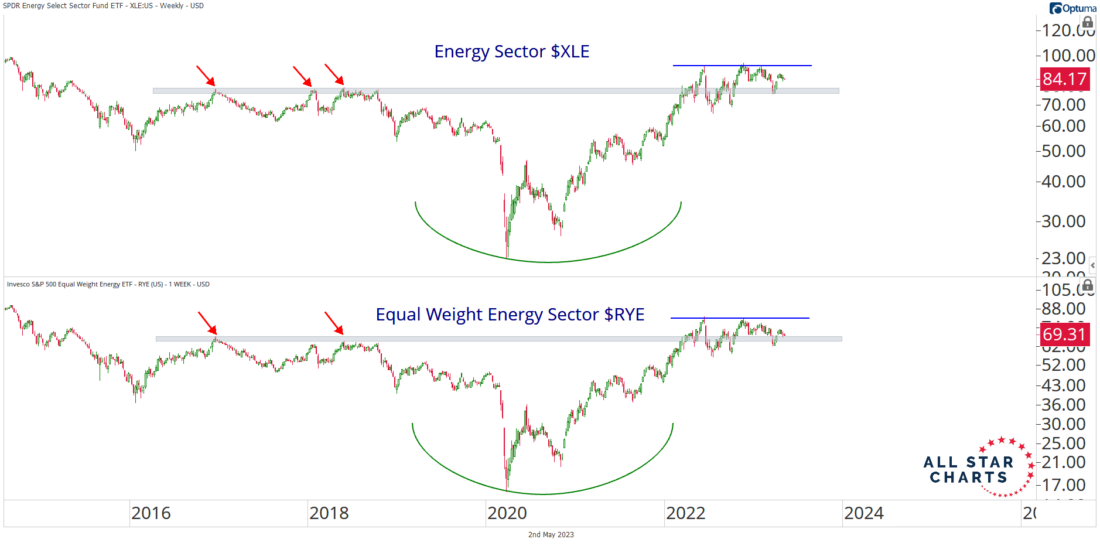

However, when it comes to the energy sector indexes, the shelf of former highs from 2018 and 2016 could be our line in the sand:

The chart above shows the Energy Sector SPDR (XLE) and the Equal Weight Energy ETF (RYE) coiling just above a critical polarity zone.

If prices hold, these structural uptrends could remain intact. On the other hand, if bears take control at current levels, we could expect selling pressure to grip the entire energy complex. This is likely to happen in an environment where crude oil and its derivative contracts are also violating their prior-cycle highs.

3/ Communicating a Change in Trend

Trends don’t usually shift from up to down, or vice versa, in rapid fashion. More often than not, there is a prolonged period of sideways, or trendless price action between the uptrend and downtrend phase.

We call this process basing. Here’s what it looks like, using the SPDR Communications ETF (XLC) as an example:

Notice how price bottomed out late last year and rallied back to the August highs before correcting back to the 200-day moving average (MA). At this time, momentum hit overbought conditions and shifted back into a bullish regime.

However, the 200-day MA was still flat or even downward-sloping at the time, suggesting more basing was likely in store for XLC. It has since tested those pivot highs twice: once in April, and again this week. While buyers have yet to force an upside resolution, more of the overhead supply at this key level is absorbed with each test. It could only be a matter of time until XLC resolves higher from this reversal pattern, setting the stage for a new uptrend.

4/ The Bigger the Base…

When it comes to big basing formations in the currency markets, it’s difficult to beat the Swiss franc (CHF):

The Swiss franc is forming a decade-long base, challenging the neckline of a potential inverted head and shoulders pattern. The path of least resistance could transition higher on a decisive breakout of this bottoming formation.

On the other hand, it could be an uncertain market until then. The U.S. dollar is likely to strengthen in an environment where the Swiss franc rolls over, producing stiff headwinds for stocks and commodities.

If and when the Swiss franc resolves higher from this long-term base, it could mark the start of a sustained uptrend that would run into the latter half of the decade.

—

Originally posted 2nd May 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.