Since 2022, China’s growth rate has slowed to the 3%–4% range due to the combined effects of the Covid Zero policy and the country’s long-term structural debt issues. Despite calls for fiscal or monetary stimulus from both domestic and foreign media, China has shown a consistent reluctance to resort to stimulus-induced growth. This article aims to provide a comprehensive understanding of China’s stance on this issue.

1. China’s Current Policy Approach: Small Steps to Prevent Major Setbacks

The Chinese government is taking incremental measures to prevent severe economic downturns. For instance, restrictions on house purchases are expected to be fully lifted within the next year, and mortgage rates for both new and existing purchases are being reduced. The central government is also increasing transfers to local governments to ensure basic services are maintained.

These measures are designed to prevent worst-case scenarios while waiting for private entrepreneurs to invest in various sectors. Currently, investment is primarily seen in sectors like biotech, new energy and electric vehicles. However, as returns on safe assets become minimal, it is expected that private entrepreneurs and Chinese households will venture into riskier private investments in the future.

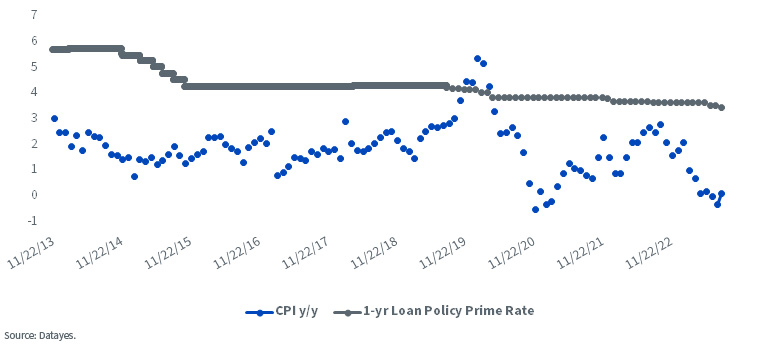

Monetary Policy Room for Maneuver: China Policy 1-year Loan Rate Still Significantly Higher than Year-over-Year Inflation Rate

2. “High Quality Growth”: A Shift Away from Debt-Driven Growth

The Chinese state media has consistently used the term “high-quality growth” since the deterioration of U.S.-China relations post-Covid. This implies a focus on slower growth and heavy investment in climbing the technology value chain. Given the U.S.-lead tech sanctions, this is a top priority for both the government and Chinese companies. Chinese media communication on macroeconomic policies are quite open and public.

3. Local Governments’ Financial Constraints Post-Covid Zero

Many wonder why China didn’t implement major stimulus measures like during the 2008/9 financial crisis. First, even during that crisis, Chinese stimulus was heavily supply-side and investment-driven rather than direct cash transfers to citizens.

Second, with China’s debt-to-GDP ratio now close or slightly higher than that of the U.S., large-scale policies require substantial funds which local governments lack due to decreased land revenue following Covid Zero and the peak of the real estate sector.

4. Upcoming Policies: A Focus on Supply-Side Reforms

China continues to manage growth through supply-side reforms for two main reasons. First, it believes that tech competition with the U.S. requires government funding for research institutions and tech firms. Second, while monetary stimulus is standard practice in the U.S., experiences in Europe and Japan have shown that this approach may not be universally as effective as in the U.S. Chinese leadership does not appear to be convinced the U.S. approach works well in China.

In summary, the Chinese economy is still weathering the impact of the real estate downturn, but it is not in a state of collapse, and there are enough government policy tools to avoid the worst.

—

Originally Posted September 28, 2023 – China’s Reluctance Toward Stimulus-Driven Growth

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.