Wednesday’s Federal Open March Committee (FOMC) meeting featured a 25-basis-point rate hike, which was widely expected. However, the post-meeting statement removed previous language that had anticipated additional firming of their monetary policy. This was seen as a signal that that the Fed would “pause” its rate hikes starting at the June meeting. This could hold benchmark interest rates at current levels or even allow them to move lower over later this year.

Source: Bureau of Economic Advisors

Although there are several factors in play, including the flare-up in US regional bank concerns and the threat of a US government debt default, the Fed is expected to keep its eye on employment and inflation. Friday’s April unemployment reading of 3.4% matched a 59 ½-year low, indicating a strong jobs market. However, there has also been a notable decline in year-over-year inflation readings since mid-2022, particularly core Personal Consumption Expenditures and the Consumer Price Index.

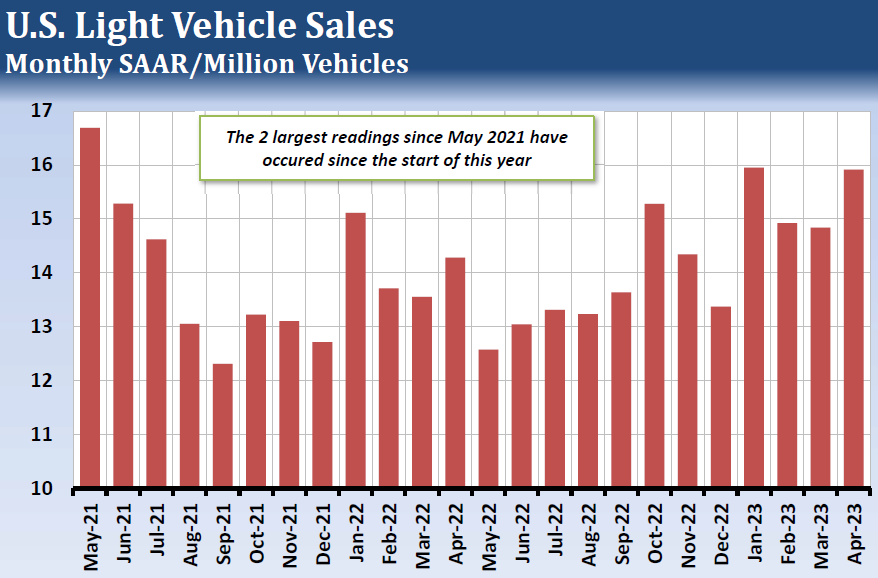

One area that could receive a boost from a paused Fed would be US vehicle sales. Last month, US light vehicle sales came in at a 15.914 million annualized rate. This was just behind January’s 15.951 million reading and was the second highest since May 2021. Vehicle inventories have been on the rise, with March’s 126,200 reading the highest since August 2021. Stronger vehicle sales should provide support to palladium, platinum, copper, and the energy markets.

Another industry pressured by rising US rates has been housing, with potential home buyers reluctant to get mortgages with interest rates running much than they were a year prior. If the Fed stays on hold, this could encourage homebuilders to undertake new projects, which would provide a demand boost for copper and lumber.

—

Originally Published May 5, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.