After yesterday’s breathtaking equity rally, share prices are trading modestly higher this morning due to freshly released economic data and disappointing corporate earnings. On the economic front, this morning’s Personal Income & Outlays and Employment Cost Index (ECI) reports weren’t conducive to the Federal Reserve’s (Fed) inflation confrontation. The reports depicted persistent price increases, flaming wage growth and contracting consumer spending in March. Yesterday afternoon’s news of a revenue slowdown at Amazon Web Services, Amazon’s pivotal cloud unit, also hurt investor sentiment, which was riding high on the back of Meta’s earnings results.

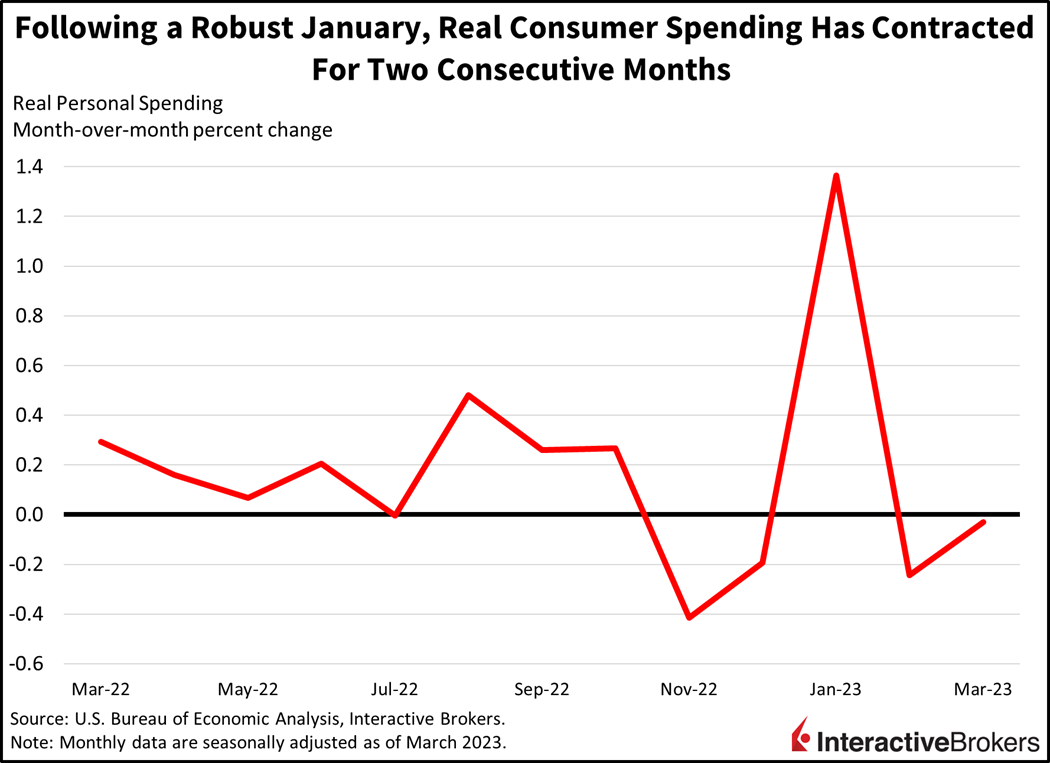

Today’s Personal Income and Outlays report for March, which contains the Fed’s preferred inflation gauge among other data points, reflected tenacious price pressures. The Core Personal Consumption Expenditures (PCE) Price Index came in at 0.3% month-over-month (m/m) and 4.6% year-over-year (y/y), the former metric coming in as expected by the consensus while the latter came in a tenth of a percent higher than expectations. This compares to 0.3% and 4.7% during the month of February while the Fed’s target is 2% as the disinflationary process appears to move at snail’s pace. Personal spending came in negative on a real basis, with nominal spending flat during the month of March. While yesterday’s first quarter Gross Domestic Product (GDP) data release depicted robust first-quarter consumer spending, most of the spending occurred during the first month of the year, a result of Social Security cost-of-living adjustments and a warmer than usual winter season.

According to the Bureau of Economic Analysis’s report, personal spending was flat in March, losing momentum from the 0.1% gain achieved in February. The 3.7% consumption gain occurring in yesterday’s first-quarter GDP report was driven by fierce activity in January as February and March personal spending numbers reflect a severely weakened consumer. In fact, January was the only month in which the rate of consumer spending growth exceeded the rate of inflation. On balance, the consumer lost momentum further in March and is likely to continue losing momentum as we progress through the year. The report also showed that personal incomes came in stronger than expected, up 0.3% m/m versus the expectation for 0.2% and an unchanged pace from the previous month. The boost in income alongside the drop in spending resulted in the personal savings rate increasing 30 basis points (bps), or from 4.8% to 5.1%.

This morning’s Employment Cost Index points to compensation costs that continue to pose a problem for the Fed. Employment costs rose 1.2% on a quarter-over-quarter basis during the first quarter, accelerating from the previous quarter’s 1.1% gain. On a y/y basis, employment costs declined modestly from 5.1% in the fourth quarter of 2022 to 4.9% in first quarter of 2023. Again, progress is occurring, but at a speed that requires an abundance of patience.

Investors Favor Cyclical Stocks Today

Markets are modestly higher today, with cyclicals leading and tech lagging on disappointing earnings. The S&P 500 Index is up 0.4% while the tech-heavy Nasdaq Index is up 0.2%. Bond yields are down, led by the long end as recession fears heighten while Fed tightening expectations remain strong. Hawkish Fed expectations are propelling the Dollar Index, it’s up 0.3% to 101.81. WTI Crude oil is up modestly, rising 0.4% to $75.04 a barrel, as a weakening demand outlook led to a sharp price correction this month.

Consumers Back Away From Purchasing Goods

The following quarterly results for Amazon and Columbia Sportswear Company illustrate how consumers are backing away from spending on goods.

- Amazon posted $3.2 billion in quarterly profits or $0.31 earnings per share (EPS) for the first quarter compared to the net loss of $3.8 billion or $0.38 for the year-ago quarter. Earnings easily exceeded the analyst consensus expected EPS of $0.21. Amazon’s revenue of $127.4 billion increased 9.4% from the year-ago quarter and exceeded the consensus expectation of $124.5 billion. Revenue growth was driven primarily by advertising and cloud services because the company’s Amazon website sales were virtually flat y/y, signaling consumers are tapped out on buying goods. Amazon expects its current-quarter net sales to increase to between $127 billion and $133 billion, a 5% to 10% y/y increase.

- Columbia Sportswear generated $46.2 million in earnings, or EPS of $0.74, a significant decline from the $66.8 million in earnings or $1.04 a share for the year-ago quarter. Analysts expected EPS of $0.88. However, revenue of $820.6 million climbed 7.8% y/y. Rather than being driven by strong activity at cash registers, Columbia’s sales growth was driven, in part, by supply chain improvements allowing the company to ship spring inventory in the first quarter, unlike in 2022, when supply chain problems caused a delay in orders. Earnings were hurt by the company resuming more normal levels of promotions compared to the year-ago quarter that had exceptionally low promotions. Selling, general, and administrative expenses (SG&A) also increased because of higher supply chain costs associated with elevated inventory levels. Columbia also occurred costs associated with a transition in third-party logistics and it also increased its investments in its direct-to-consumer channel.

Sticker Shock May Be Kicking In

Consumers continue to flock to out-of-home dining but appear to be more price conscientious. In addition to dining out and enjoying other forms of entertainment, consumers are still splurging on travel, with the following examples illustrating these trends:

- McDonald’s Corporation posted net income of $1.8 billion or $2.45 per share for the first quarter, up from the net income of $1.1 billion or $1.48 a share for the year-ago quarter. McDonald’s first-quarter revenue was $5.89 billion compared to $5.66 billion for the year-ago quarter. It exceeded the analyst consensus expectation of $5.59 billion. Impressively, McDonald’s same-store sales grew 12.6% y/y, with U.S. restaurants benefiting from higher prices and increased traffic, but McDonald’s CEO Chris Kempczinski said consumers appear to be curtailing their spending and pushing back against price increases, in part by ordering fewer items per meal.

- BJ’s Restaurants reported first-quarter net income of $3.48 million or $0.15 a share compared to $1.46 million or $0.06 a share for the year-ago quarter. Analysts expected $0.04 of net income per share. The company’s first-quarter 2023 revenues of $341.28 million exceeded the consensus expectation by 2.74% and was up 14.2% from the $298.73 million in revenues from the year-ago quarter. Like McDonalds, BJ restaurants experienced strong restaurant traffic with comparable restaurant sales increasing 9% y/y.

- American Airlines reported net income of $10 million in the first quarter and adjusted EPS of $0.05. The EPS matched analysts’ expectations. In the year ago quarter, American Airlines reported a negative net income of $1.63 billion, or $2.52 per share. Its recent quarter revenue of $12.19 billion fell short of the expected $12.20 billion but was up 37% y/y as air traffic demand has increased substantially. The company is optimistic about growing demand for air traffic but says its future growth may be limited by delays in receiving new aircraft.

Investors Look to Next Week’s Fed Meeting

With a 25-bp hike expected at next week’s meeting and 28% odds of another 25-bp hike in June, the market will be looking to Chairman Powell’s comments next week. As the Chairman approaches the mound, market players will be focused on how much more tightening is needed to subdue inflationary pressures.

Collectively, the Fed’s 475 bps of rate hikes and $400 billion of quantitative tightening alongside a contracting consumer during two of the last three months have failed to suppress price pressures to levels more consistent with the central bank’s 2% target. With a 25-bp hike expected at next week’s meeting and 28% odds of another 25-bp hike in June, the market will be looking to Chairman Powell’s comments next week. As the Chairman approaches the mound, market players will be focused on how much more tightening is needed to subdue inflationary pressures. With risks tilted towards not doing enough, I expect Powell to deliver a message of higher-for-longer as he leaves the door open for more rate hikes. With yesterday’s GDP reflecting a sharp deceleration from 2.6% to 1.1% on a q/q basis, alongside a slowing consumer and persistent Fed in the present, odds of a recession during the second half of this year are high.

Visit Traders’ Academy to Learn More about Gross Domestic Product, Personal Income and Outlays and other Economic Indicators.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

well written . Thank you.