By: Damanick Dantes and Michelle Cluver

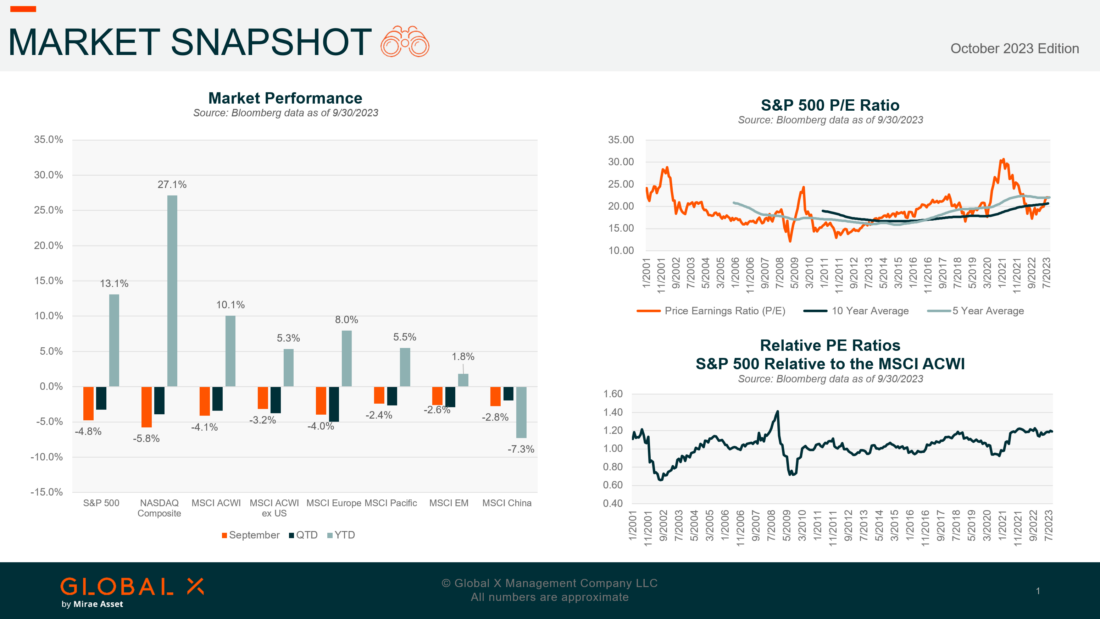

In September, U.S. stocks declined as the Federal Reserve (Fed) signaled that interest rates could remain higher for longer. The rise in the August Consumer Price Index (CPI), boosted by higher energy prices, further supported the Fed’s message on interest rates needing to remain at restrictive levels for an extended period. Reduced expectations of future rate cuts weighed on equity markets, with the S&P 500 and Nasdaq Composite down -4.8% and -5.8%, respectively in September, ending the quarter negative while still holding year-to-date gains. Small-cap stocks underperformed in both September and Q3, while higher yields weighed on growth stocks, especially small cap growth. Cyclical and interest rate sensitive sectors generally underperformed the S&P 500 while the Energy sector benefitted from rising oil prices.

Despite a stronger U.S. dollar, international equities performed relatively better in September. The MSCI ACWI ex-US index declined by -3.2%, while the MSCI Emerging Market (EM) index fell by -2.6% during the same period. The stabilization of Chinese equities played a role in the relatively better performance of emerging markets, as investors were encouraged by recent stimulus measures.

Footnotes

All data sourced from Bloomberg as of September 30, 2023.

—

Originally Posted October 4, 2023 – Market Snapshot – October 2023

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.