TLDR:

Yesterday was an eventful day in the market, marked by the release of the Producer Price Index, the year-end FOMC meeting, the unveiling of a new dot plot, and commentary from Chairman Powell.

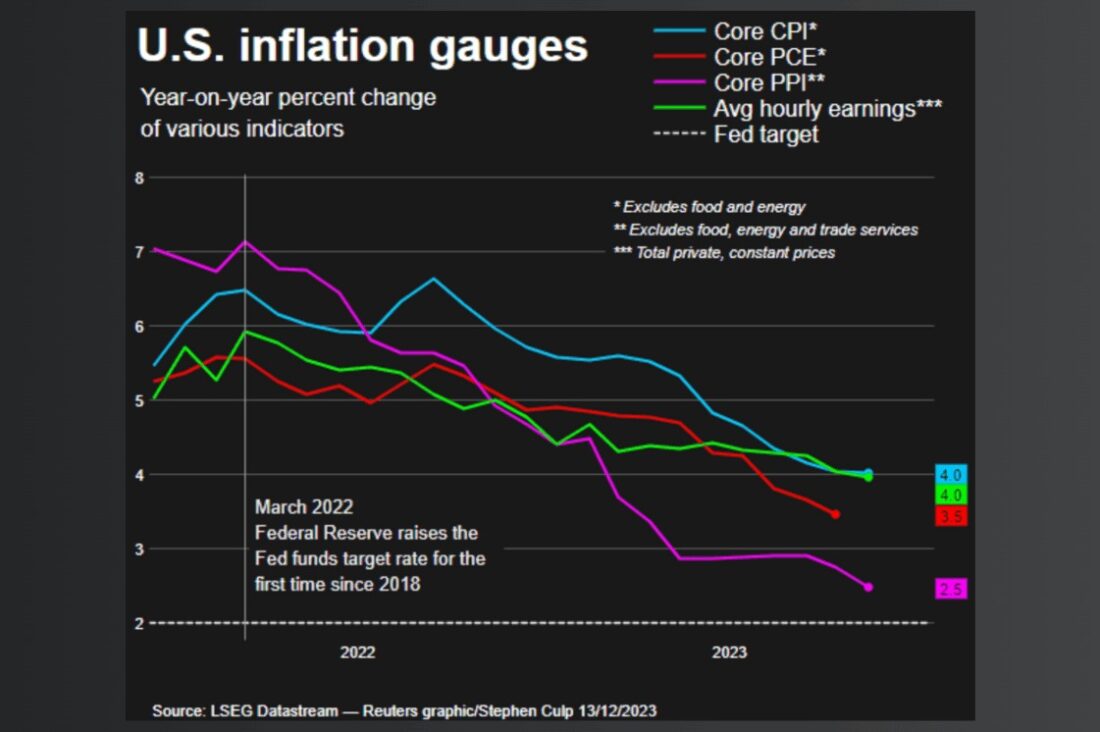

The provided diagram illustrates a decrease in producer prices, mirroring the general trend of declining inflation indicators. This drop was largely due to reduced energy costs, although there was a noticeable increase in food prices, particularly eggs and fresh fruits.

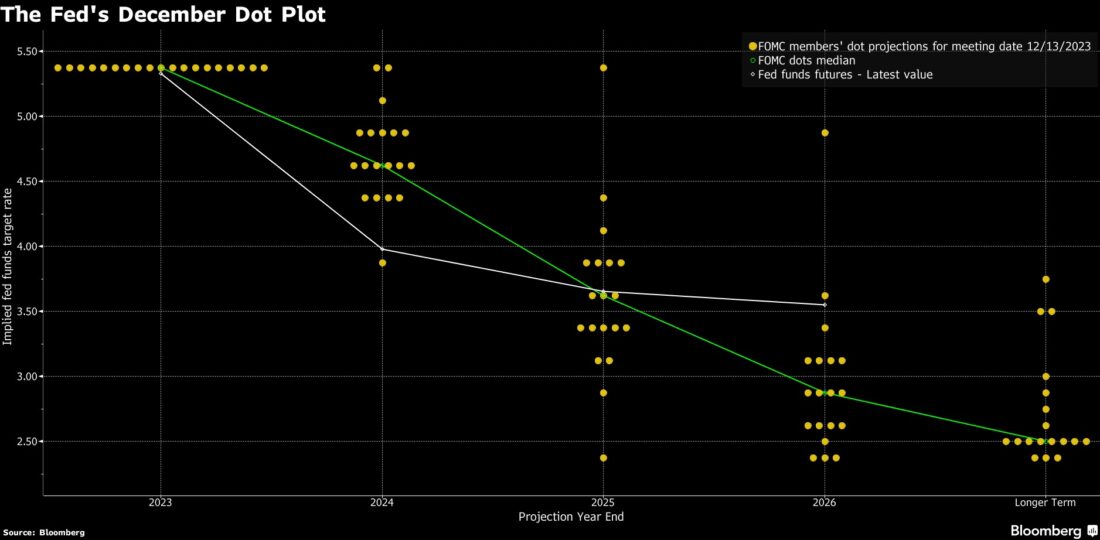

As a result, the Federal Reserve decided to maintain the interest rate between 5.25% and 5.5%, marking the first time since 2021 that it hasn’t projected any additional rate hikes.

The Fed also revised its future expectations, now forecasting the median funds rate at 4.6% by 2024, a decrease from the previous estimate of 5.1%. The projection for 2026, however, remains set at 2.9%.

The markets responded positively to these developments, with the S&P 500 surpassing 4700 for the first time since January 2022, 10-year yields dropping to around 4.0%, and most traders now anticipating a rate cut by March 2024.

Chairman Powell reiterated that policymakers are not ruling out further interest rate increases, but he acknowledged that the meeting included discussions on the timing for potential rate cuts.

Overall, Chairman Powell was “pleased with the progress” but “needs to see further progress getting back to 2%” before he can conclude the fight against inflation is over.

What’s happening in the markets?

This section is powered by Open AI connected to TOGGLE AI

Adobe Inc. presented a modest sales forecast for 2024, falling short of investor expectations that the introduction of new generative artificial intelligence tools would rapidly enhance the company’s performance. Following this announcement, Adobe’s shares declined by 6% in after-hours trading.

Despite the lukewarm outlook, Adobe surpassed financial projections: its revenues increased by 12% compared to the previous year, and net income rose by 26%.

Investors and analysts anticipate Adobe to be among the early major software companies to capitalize on the burgeoning generative AI technology, which generates original text or images based on given prompts.

In line with its strategic goals, Adobe is also focused on finalizing the significant $20 billion acquisition of Figma, a move seen as integral to its expansion in this area.

Earnings Update: Costco reports tonight

Over the past three quarters, Costco has reported double-digit earnings growth and in expectation of a repeat, the stock is pushing to record highs ahead of the retailer’s earnings.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

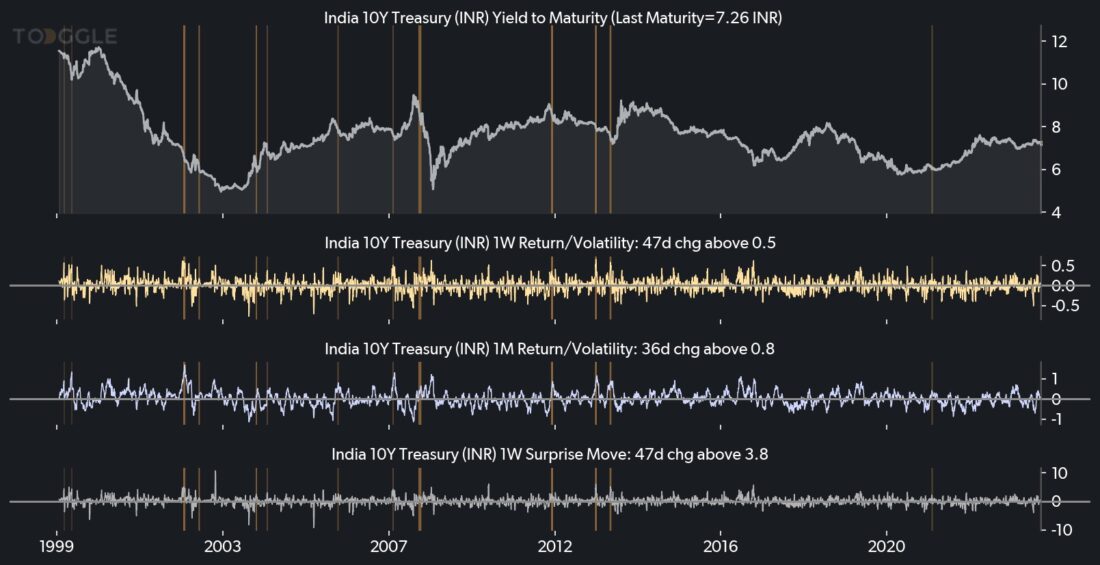

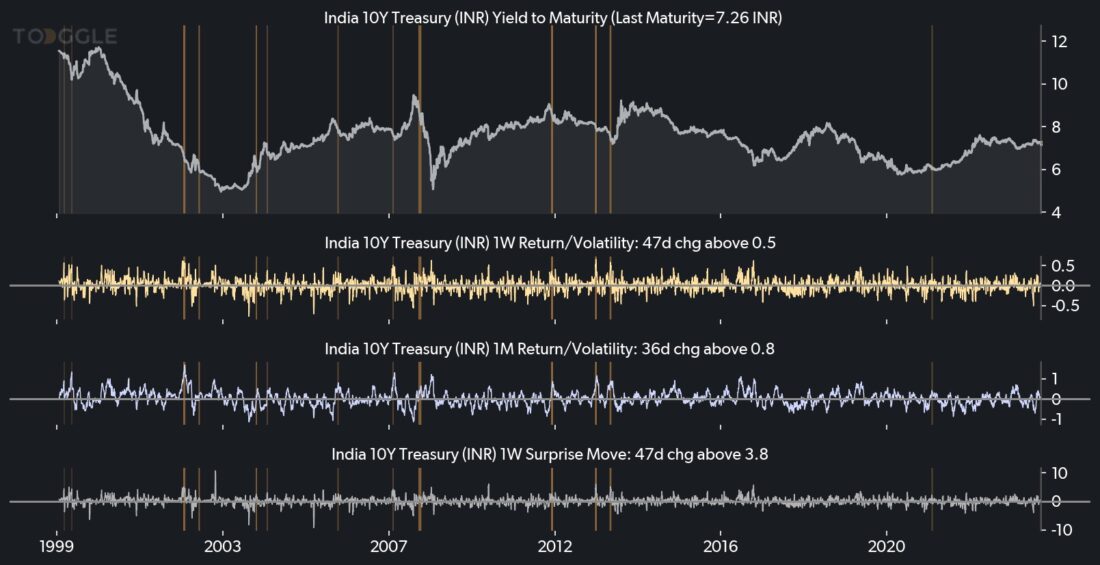

Asset Spotlight: India 10Y Treasury

The Indian 10Y Treasury has jumped, a move which historically has been followed by median downside in yield over the following 1 week, based on Toggle AI’s analysis of 14 similar occasions in the past.

General Interest: 2 million vehicles recalled

Tesla announced a recall yesterday for 2 million vehicles in the United States to rectify an issue with Autopilot, its innovative yet contentious advanced driver-assistance system.

The recall involves a software update from Tesla, which aims to enhance the frequency of warnings and alerts for drivers who are not adequately attentive.

—

Originally Posted December 14, 2023 – Reading between the dots

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.